No, Michael Saylor Doesn’t Control Bitcoin

I have to call BS on this claim that Michael Saylor is now Bitcoin’s overlord and can single-handedly decide its fate. That’s just ridiculous.

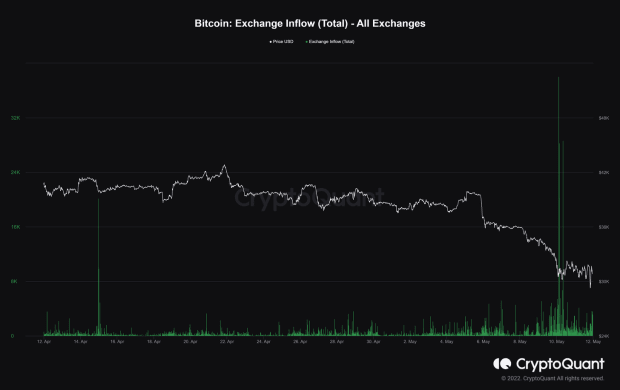

During some drama about whether MicroStrategy’s valuation makes sense, Vinny Lingham declared Saylor is the second most powerful person in Bitcoin after Satoshi Nakamoto. He argued Saylor can dictate terms by threatening to dump MicroStrategy’s giant bitcoin stash if he doesn’t get his way.

While questioning MicroStrategy is fair game, the notion Saylor controls Bitcoin’s destiny is intellectually dishonest drama-baiting. Vinny knows better.

Bitcoin is decentralized, permissionless, and based on consensus. No single entity, not even the largest holder, can dictate terms.

If influence correlated to Bitcoin holdings, the asset would have failed long ago. Governments could easily acquire 10% of supply with their printing presses and control Bitcoin — but that’s not how it works.

Saylor can’t force protocol changes on Bitcoin. Even if he demands certain features, node operators hold the real power by enforcing consensus rules. If Saylor forks Bitcoin to make unilateral changes, the main chain persists while his fork dies, assuming that would be a shittier version.

We’ve already seen this play out when early influencers like Roger Ver disagreed with the community. Bitcoin kept on trucking while Ver’s alternative chain became irrelevant.

Bitcoin’s entire value stems from no one party controlling it. If whales could centralise decision-making by buying large portions, the whole experiment would fail. Thankfully, that’s impossible by design.

So, while Saylor provides a valuable perspective, his influence has limits. He cannot compel developers or miners or nodes to follow his preferred roadmap. His Bitcoin stack buys him a voice at the table, not absolute authority.

No matter how many satoshis Saylor accumulates, he cannot unilaterally impose changes on a decentralized, leaderless network. Bitcoin derives resilience precisely from preventing such dominance.

So enough with this bogus narrative that Michael Saylor is now Bitcoin’s dictator. He’s an influential figure, sure — but he doesn’t control Bitcoin’s fate any more than you or I do. That power remains dispersed.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.