Next CME Bitcoin Futures Settle on December 28: Upcoming Price Action?

Next week will see another round of Bitcoin futures expire and settle on the Chicago Mercantile Exchange (CME). Even though the CME Bitcoin futures are cash-settled, they could impact Bitcoin’s actual spot price.

CME Futures Expiration and Their Effect On Bitcoin

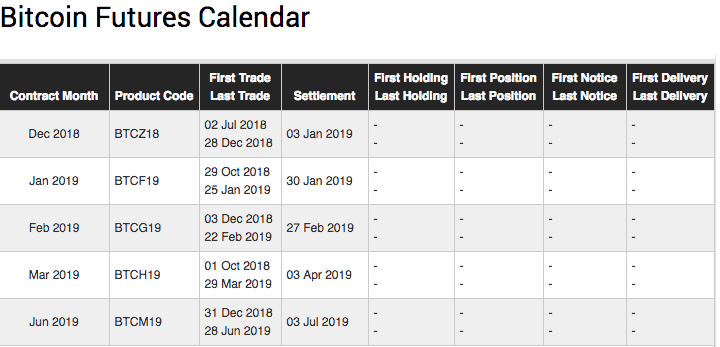

CME’s next round of six-month Bitcoin futures ends on December 28, 2018, with settlement on January 3, 2019. These futures contracts started trading back on July 2 of this year.

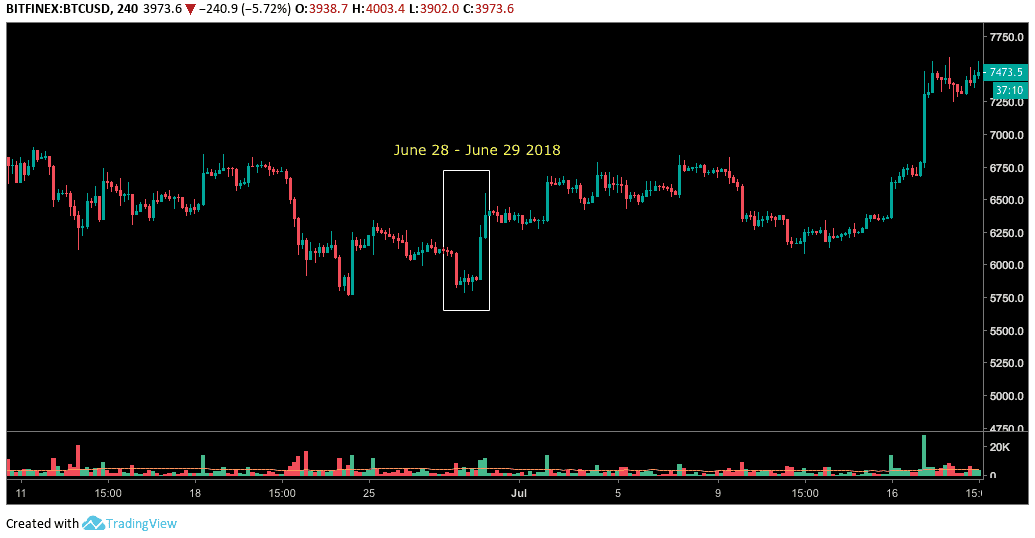

According to data CryptoPotato had received from CME Group, a previous round of six-month Bitcoin futures contracts started on January 2, 2018, and ended on June 29. The chart below shows slight price action for Bitcoin, correlating with the June 29 expiration date. However, such effect could very well be attributed to other crypto market factors.

Another round of six-month CME Bitcoin futures ran from April until the end of September. But the charts showed little action coinciding with their expiration in September.

Bitcoin is currently priced at a significantly lower level than when the current six-month contracts began. Bitcoin’s price fluctuated around the mid $6,000 range back on July 2. As of the time of this writing, Bitcoin is valued around $4,000.

Cause and Effect

The CME and Chicago Board Options Exchange (CBOE) Bitcoin futures are cash-settled, unlike exchanges such as Bitmex, meaning no spot Bitcoin is moved, bought, or sold in the process. However, these mainstream futures contracts seem to be a hot topic in the crypto space, even though Bitcoin’s price is not directly impacted with each futures position taken.

CME and CBOE futures’ impact on Bitcoin’s spot price could be a self-fulfilling prophecy. Speculators in the crypto space may think these CME or CBOE Bitcoin futures expirations and settlements will move the market one way or the other.

They might then make trading decisions based on those speculations, buying or selling spot Bitcoin. If enough people engage in such speculation, it would likely move Bitcoin’s spot price.

Another possibility could see traders hedging their CME or CBOE futures positions, buying spot Bitcoin while shorting Bitcoin futures on the CME or CBOE for example.

Only time will tell if December 28, 2018, or January 3, 2019, will have any impact on Bitcoin’s spot price.

The post Next CME Bitcoin Futures Settle on December 28: Upcoming Price Action? appeared first on CryptoPotato.