New Zealand Retirement Fund Invests In Bitcoin

The KiwiSaver Growth Strategy fund, part of New Zealand’s retirement savings program, has allocated 5 percent of its money to bitcoin.

The KiwiSaver Growth Strategy fund, which is part of New Zealand’s national KiwiSaver program, has reportedly invested 5 percent of its funds into bitcoin.

The program is meant to be used as a retirement savings vehicle for New Zealand’s citizens, with tax incentives and age requirements similar to a 401(k) account in the U.S. The KiwiSaver Growth Strategy fund has about $244 million ($350 million New Zealand dollars) in total investments, according to local news outlet Stuff. It’s managed by wealth firm NZ Funds Management.

“Our KiwiSaver is majority built up through traditional asset classes that compound over time to give people the best retirement they can get,” the fund’s chief investment officer James Grigor told Stuff. “If you are happy to invest in gold, you can’t really discount bitcoin.”

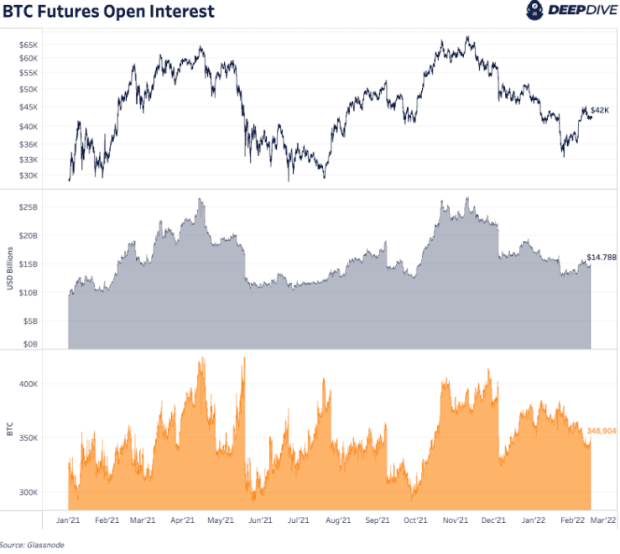

The announcement is a notable indicator of how bitcoin has become derisked as an asset in recent months. As large corporate institutions continue to divert their treasury assets to bitcoin and traditional financial firms look to offer bitcoin exposure to clients, it’s becoming clear that the asset has a place in nearly any portfolio.

“Bitcoin’s price has risen sharply as overseas institutional investors had begun buying positions for their clients in a process Grigor called the ‘legitimisation’ of bitcoin,” per Stuff. “The likes of pension funds were now able to invest in bitcoin funds, like those from United States company Galaxy Digital, in which NZ Funds had invested KiwiSaver money, he said.”