New York Fed’s ‘Bitcoin Is Just Another Fiat’ Claim Sparks Controversy

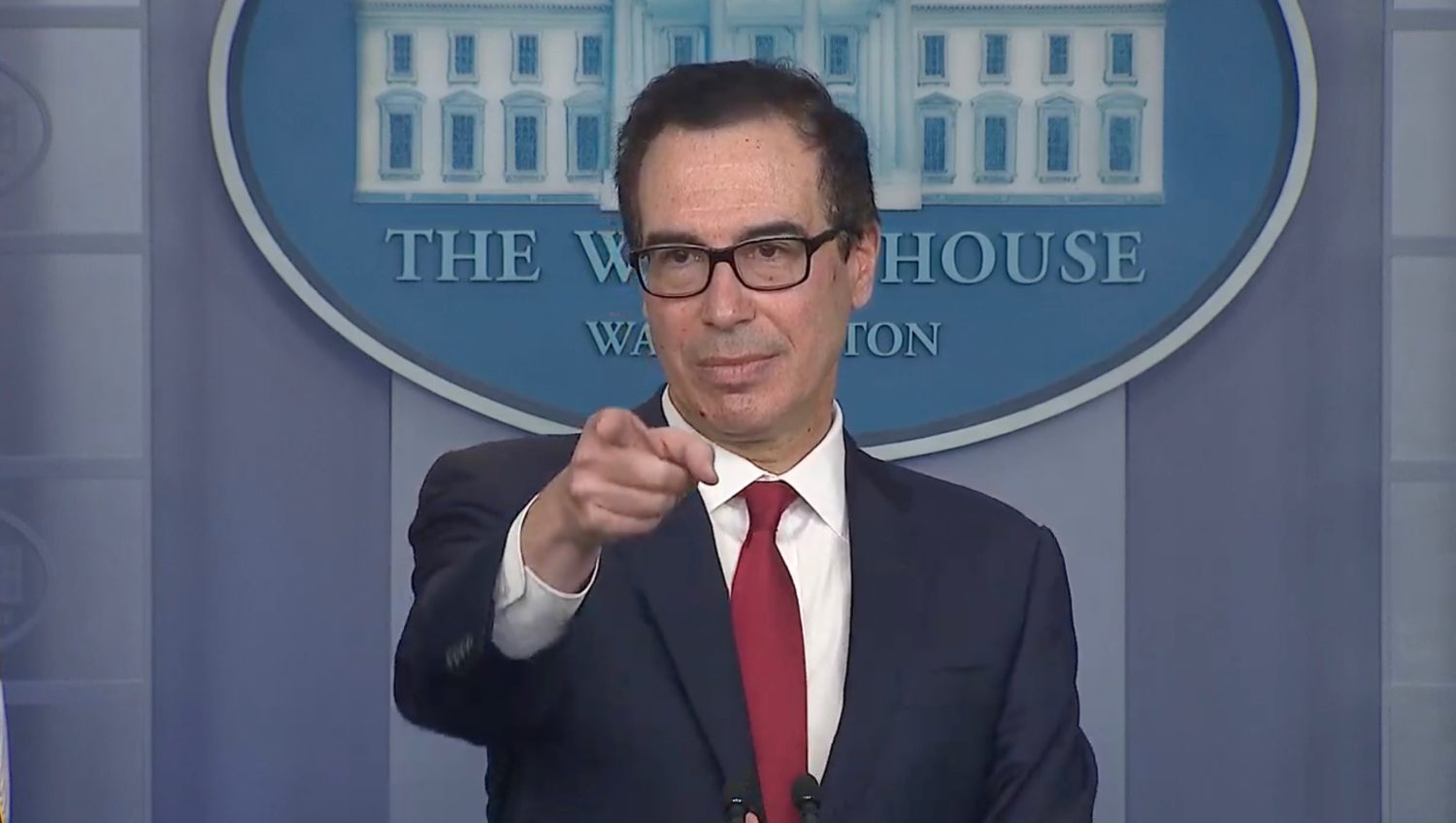

“I don’t know if their intent is to denigrate Bitcoin but it comes off that way,” said Nic Carter. (Northfoto/Shutterstock)

New York Fed’s ‘Bitcoin Is Just Another Fiat’ Claim Sparks Controversy

Economists with the New York Federal Reserve do not think that bitcoin is a new kind of money.

Bitcoin, the decentralized, permissionless, trustless digital value system that an anonymous programmer ginned up over a decade ago is “just another example of fiat money,” said Michael Lee and Antoine Martin in a Thursday blog post.

“Bitcoin may be money, but it is not a new type of money,” they said. Dollar bills are fiat, gigantic limestone wheels were once fiat and bitcoin is fiat as well, they said.

Their argument appeared to employ a definition of fiat money as being an intrinsically worthless object whose sole value derives from the bearer’s belief he or she can use it for goods.

But such a definition misclassifies the nature of Bitcoin by botching the very meaning of fiat, said Nic Carter, a partner at the blockchain-focused Castle Island Ventures and frequent crypto commentator (including with CoinDesk).

Carter said that the latin root of fiat – decree – invokes in fiat money a sense of value by authoritative mandate: this dollar bill has value because the issuing authority (which, he pointed out, has the monopoly on violence and taxes too) said so. But that is not at all the case with Bitcoin, he said.

“I don’t know if their intent is to denigrate Bitcoin but it comes off that way,” Carter said.

In a tweet he called the Fed’s argument “insane.”

What is Bitcoin?

Martin and Lee posit that Bitcoin’s true newness lies in the novel “exchange mechanism” it spawned. “The ability to make electronic exchanges without a trusted party – a defining characteristic of Bitcoin – is radically new,” they said.

Simply put, there had never been a true means to conduct “electronic transfers without a third party” before Bitcoin came around, they said. Yes, central banks and commercial banks and an ecosystem of financial products all allowed money to flow electronically before. But those all worked because a third party said so. They said that’s not the case with bitcoin.

Bitcoin’s innovation permits an ensuing wave of similarly trustless monies to foster and grow: stablecoins, initial coin offerings as well as unexpected assets, like CryptoKitties, they point out. But they also argue that none of those are new forms of money either.

“It is more accurate to think of Bitcoin as a new type of exchange mechanism that can support the transfer of monies as well as other things,” they said.

Carter agreed that Bitcoin gave the world a new way to move money, challenged the author’s assertion that the Bitcoin blockchain should harbor other assets and said that it was impossible to divorce Bitcoin’s monied nature from the mechanism it exists upon.

“The monetary qualities are also essential. That was clear in the way Satoshi described” its limited supply, he said.

The authors ultimately said that it’s important to define what is actually new about bitcoin for historical reasons.

“History provides lessons about what makes a good money as well as what makes a good transfer mechanism,” they said. “These lessons could help cryptocurrencies evolve in a way that makes them more useful.”

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.