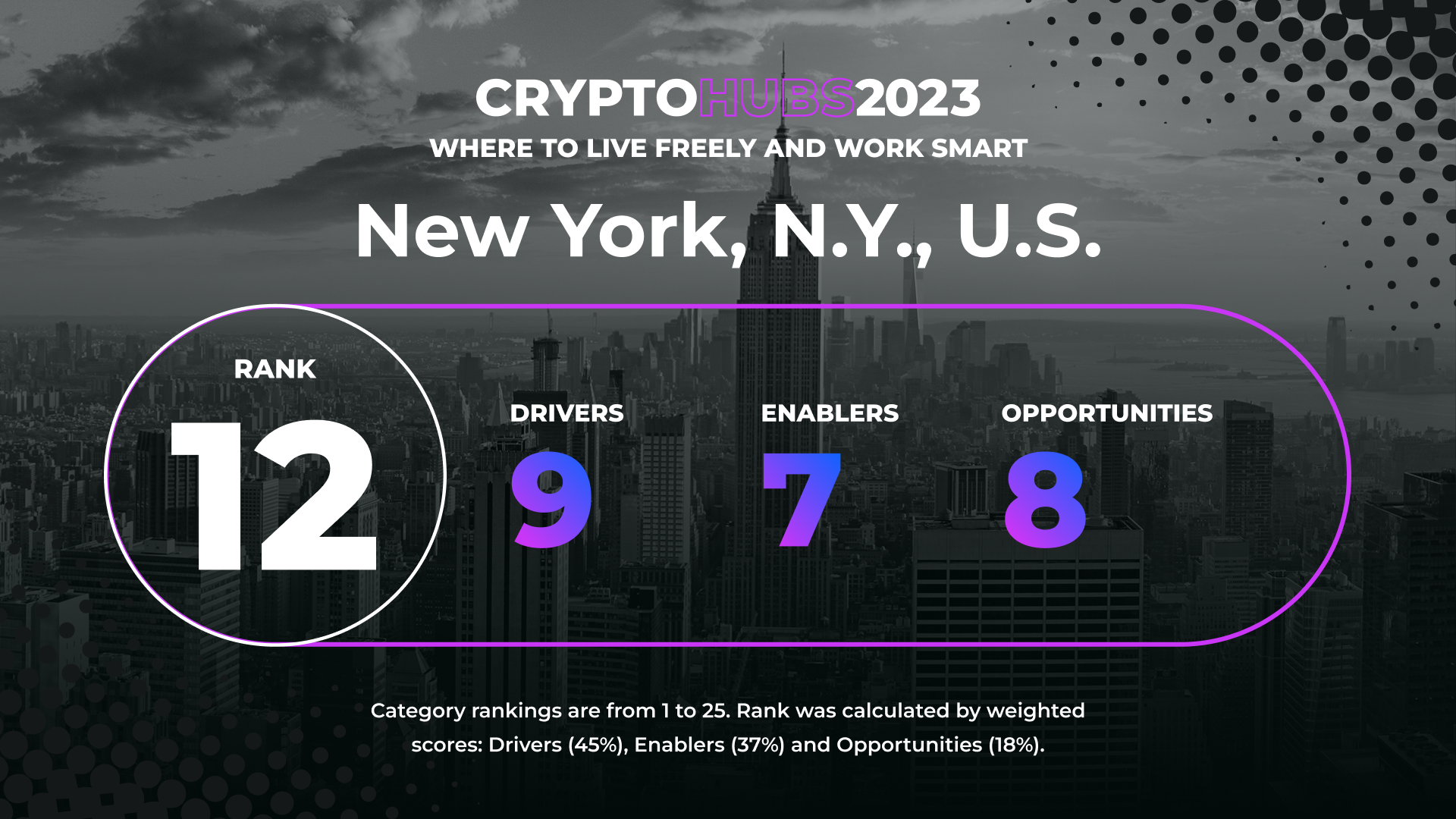

New York City: A Crypto Sandbox in a Big Business Playground

At 12th place globally, New York City came in fifth among the U.S. hubs in CoinDesk’s Crypto Hubs 2023. Many of the Crypto Hubs’ criteria were measured on a national basis, so all the U.S. hubs were hampered by a middling crypto regulatory score – part of the drivers category and the single-most heavily weighted factor overall at 35%. There were seven U.S. hubs in the initial 25-hub sample. All of them scored well in the enabler category for digital infrastructure (12%) and ease of doing business (10%) and opportunity measures including per-capita crypto jobs, companies and events (6% each). But New York’s high cost of living and congested traffic dragged it down, giving it a low quality-of-life score, which at 15% of the weighting was the second-most important criteria in our rubric.

New Yorkers pride themselves on being the best at many things: building skyscrapers, jaywalking and making money. (And, the list, any New Yorker will tell you, could certainly go on.)

So, it should come as no surprise that the Big Apple has big ambitions when it comes to fashioning itself into a first-in-class crypto capital.

“New York is the center of the world, and we want it to be the center of cryptocurrency and other financial innovations,” Mayor Eric Adams told his supporters after clinching the city’s chief executive role in late 2021.

Read Crypto Hubs 2023: Where to Live Freely and Work Smart

And, while New York City is admittedly a hub for hubris, it’s not so bizarre to imagine the city as a center for crypto too. This was true before the crypto market crash last year and will likely continue amid a period of regulatory uncertainty. New York was one of the first jurisdictions to think seriously about crypto regulation, putting the so-called BitLicense into effect in 2015. Some firms, like Kraken, found the rules onerous and pulled out of the financial hub, but, for many, any amount of clarity was appreciated.

New York City Hall signaled its commitment to crypto, encouraging municipal employees to convert their paychecks to tokens using U.S.-based crypto exchange Coinbase in early 2022 (before the chilling effects of Crypto Winter). Adams even boasted about converting his own cash for coins when he took office in January last year, taking his first three paychecks into bitcoin (and swallowing a $1,000 loss).

Even before he took office, Adams floated the idea of spinning up a New York-inspired cryptocurrency a la Miami Coin. And while the plans for NYC Coin never panned out, the project encapsulated the momentum behind Adams’s digital money mission.

Beyond the hallowed halls of City Hall, amid the hustle and bustle of Wall Street, the cryptocurrency industry has garnered its fair share of supporters – and, more importantly, some much-needed capital. As the financial epicenter of the U.S., New York is THE place to court banks and money management mammoths, some of which are already dipping their toes in the industry.

Between 2021 and 2022, Goldman Sachs poured nearly $700 million into crypto analysis firms like CertiK and Coin Metrics. Meanwhile, BNY funneled hundreds of millions of dollars into Fireblocks, a crypto infrastructure company.

Gotham remains a crypto magnet, despite the concrete jungle’s comparatively high operating costs. There are 96 crypto companies based in New York as of publication time, more than twice the number of those in London, Miami and Austin combined, according to crypto data provider The Tie’s database. Those firms include heavyweights like crypto exchange Gemini, stablecoin issuer Paxos and data intelligence provider Chainalysis.

“So, you’ve heard of Silicon Valley, right,” The Tie CEO Joshua Frank told CoinDesk. “Well, I call [Manhattan’s] Nomad district ‘shill-a-coin alley’ because every crypto company is within a four or five block radius.”

In such a crowded city, it’s easy to draw out the crypto crowd.

Frank’s company throws regular in-office networking events, bringing in more than 100 attendees at a time.

“In what other city would we have been able to just throw a little happy hour in our office and have 150 people show up?” Frank asked.

Aa a crypto company executive, that access to clients and investors makes New York an easy choice for a place to live and work, even if the living itself – ridiculous rents, overburdened transport systems and terrible traffic – is infamously awful.

“I don’t think anybody wants to be here,” Frank said. “But, I think you have to be here.”

Edited by Jeanhee Kim and Daniel Kuhn.