New UK Rules Cause Consternation for Bitcoiners

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

New regulations from the British Financial Conduct Authority (FCA) have taken effect over UK businesses that deal with Bitcoin and other cryptoassets, leading to immediate public disapproval.

These new regulations, quietly imposed in mid-February, came as a surprise to many of the users impacted. The FCA has already impacted several payment processors like PayPal and Luno, which have ceased all ability for users to purchase Bitcoin. The main thrust of these new regulations, however, has been in developing what the FCA calls “positive frictions.” Piggybacking on previous decisions in 2023 to combat the rise of “finfluencers,” such as banning refer-a-friend bonuses and other incentives from non-crypto investment sites, the FCA has aimed its new regulations at countering “social and emotional pressures to invest”. In the main, this initiative amounted to one most controversial rule: quizzes and other competency tests on all major exchanges, preventing users from accessing their own funds.

The background for new regulations of this scale are, unsurprisingly, quite complicated. For starters, the FCA is a financial regulator that exists at the behest of the British government, but is not directly controlled by it. Although the Treasury does make appointments to this board, its daily functions are nevertheless independent of direct oversight. For example, the FCA’s predecessor agency, the Financial Services Authority (FSA), was founded in part to curtail the practice of industry self-regulation in the finance sector, which is a legally recognized type of trade association. In fact, CryptoUK, the self-regulating trade association in Britain’s digital asset sphere, directly spoke against these new regulations.

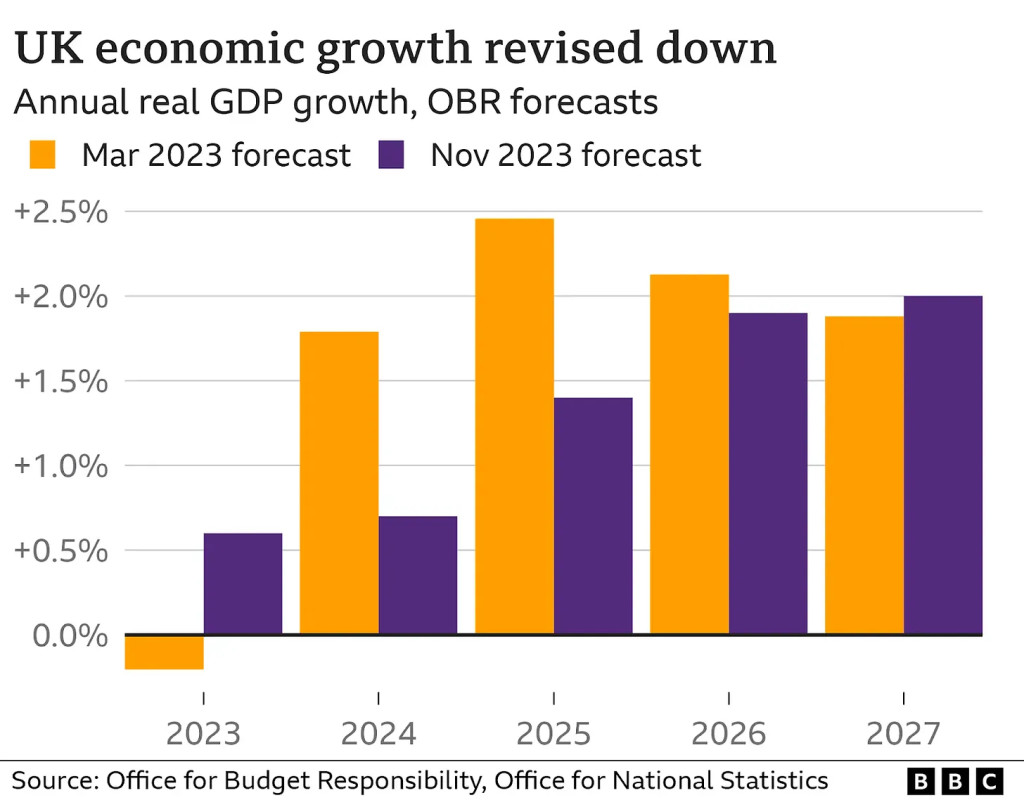

All this is to say, it’s little wonder that the FCA feels empowered to act this unilaterally, especially when it might contradict some of Parliament’s long term economic goals. British Prime Minister Rishi Sunak has made an ambitious policy out of trying to promote growth in the crypto sphere. Sunak wishes to make the country a “crypto hub”, attracting international capital and facilitating industry development through friendly regulation. It’s little wonder that Sunak has identified Bitcoin as an area of major growth: A substantial percentage of Britain’s existing economy is powered by similar longstanding international relationships in the world of banking and finance, and expectations for the economy as it stands have been lagging.

So, if the same sources of income have been failing to meet expectations, why not look towards a rapidly growing industry that could doubtlessly benefit from these existing ties? Sunak claimed that the first item on his pro-Bitcoin agenda has been to pass clear legislation around a stablecoin, but new FCA regulations have also been very high up his priorities list. There’s just one question, then. Why has an agenda intended to place exchanges under the “same legal framework that covers investment banking and insurance” led to such an overreach?

For starters, the FCA has been marked for a notorious hostility to Bitcoin in the last several months. Although the United States has made worldwide headlines with its approval of a Bitcoin spot ETF, the futures ETF with more indirect ties to bitcoin’s actual valuation has been legal well before that. The FCA, however, established a complete shutdown of Bitcoin-related derivatives in 2021, and has not given any indication that they wish to change this stance. This backwards attitude puts the UK not only behind the US, but also most of its other largest trading partners; both prominent members of the English-speaking world like Canada and Australia as well as the European Union have all begun embracing this multibillion dollar derivatives market. Even Hong Kong, with longstanding economic ties to Britain, has shown far greater receptiveness on this front.

The FCA’s conservative attitude towards such a massive and growing industry has hardly gone unnoticed, needless to say. Lisa Cameron, MP and Chair of the Crypto and Digital Assets All-Party Parliamentary Group (APPG), has made public statements alongside very similar lines as the reports published by APPG, claiming that the world of Bitcoin is of vital economic importance. Although “The APPG has been clear in its recent inquiry report that..we must ensure that the U.K. has robust standards in terms of regulation and consumer protection,” said Cameron. “The APPG is aware that the new financial promotions regime has caused complications for some crypto and digital firms, and of reports that a number of operators have paused crypto purchases while they adapt to the new regime.” She went on to add that “While consumer protection must remain a top priority, government and regulators must also take care to ensure that we do not inadvertently deter responsible and regulated operators from choosing to invest in the U.K.”

So, if nothing else, the concern about these regulations is shared by actual legislators and not only the community. Cameron’s criticism seems particularly noteworthy in that she has only been part of Sunak’s party since October 2023, having previously won 3 elections under an SNP ticket. Additionally, Coinbase has also made headlines with its January hiring of George Osborne, former Chancellor of the Exchequer, in an advisory role. Considering that Coinbase is one of the exchanges most directly impacted by these new rules, a man who was in charge of the Treasury for 6 years is bound to have useful advice.

In other words, there are possible sources for opposition from several different sectors, as both government figures and industry leaders have voiced their objection, alongside the consumers as a whole. As for a timeline on the FCA changing their policies, however, it’s anyone’s guess. Meanwhile, there have been several other prominent interactions between the British legal system and the world of Bitcoin. Craig Wright, the so-called “Fake Satoshi,” is currently involved in a court case over his continued claims that he is the true inventor of Bitcoin. If the court rules against him, it may prove the end for a recurring episode in Bitcoin’s subculture. Similarly, although the United States is known for making the most prominent mass-scale seizures of Bitcoin, British law enforcement did manage to seize more than £1.4 billion in bitcoin in late January.

It’s likely that the FCA’s rules will eventually be loosened one way or another, as the British government has put such a priority on making these new regulations friendly to the industry. If pushback is loud and varied enough, it’ll be clear that a new course is necessary. Bitcoin’s economic star has been going up and up over the past few years, and it’s way too powerful for unelected regulators to put up a high degree of stubbornness. If we can see it in the US’ fight for a Bitcoin ETF, we can see it in the pushback to the FCA: nobody is strong enough to challenge Bitcoin’s crown.