New Opportunities Through 4Bulls NFT Staking

[Sponsored Content]

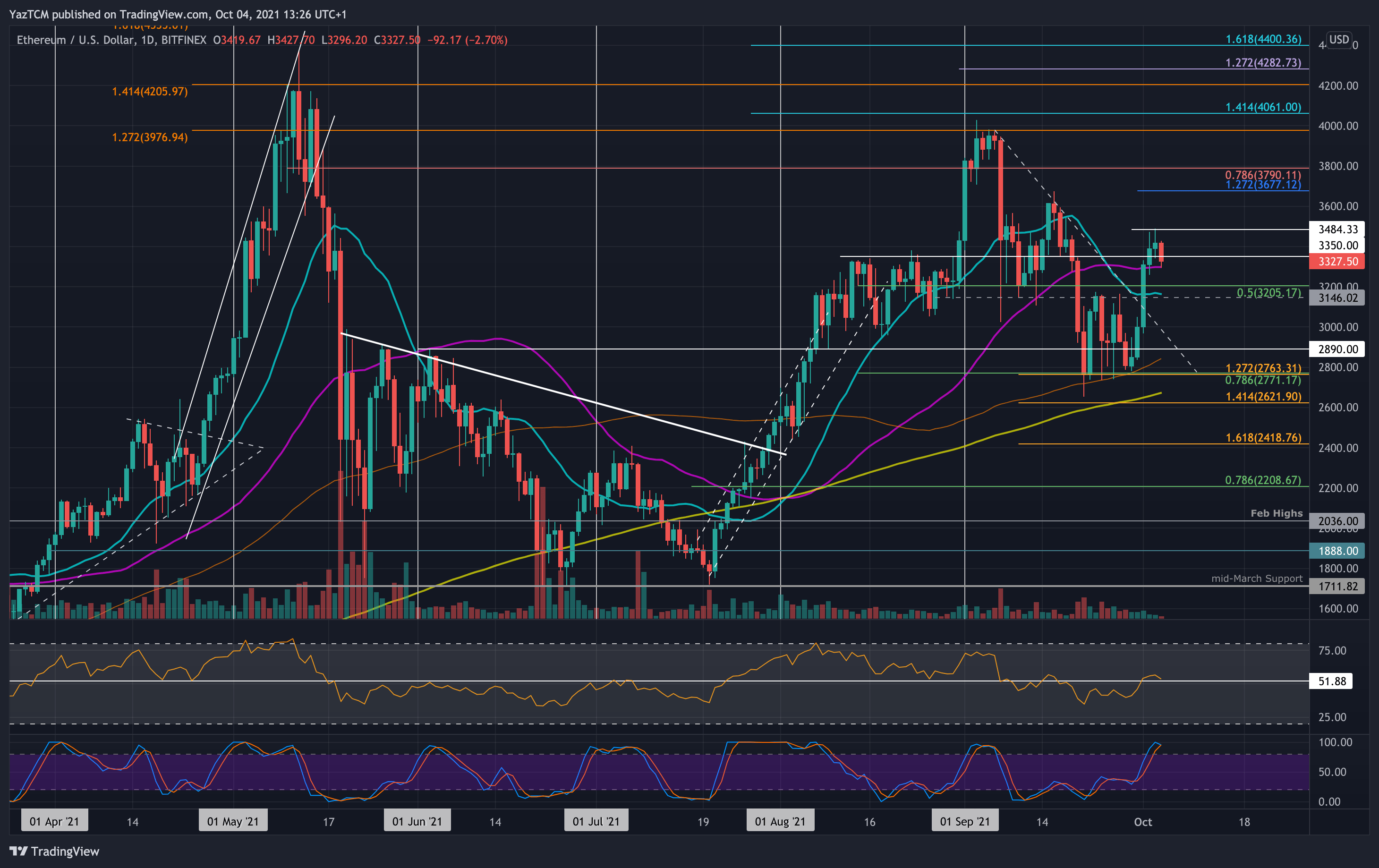

It goes without saying that the cryptocurrency market has been particularly volatile throughout the past few weeks.

It all started when Elon Musk revealed that Tesla will no longer be accepting bitcoin for its products while bashing the primary cryptocurrency for its inefficient mining process.

In all fairness, all of this was rather expected, and many cryptocurrency proponents were left baffling as to how Musk and Tesla failed to see this earlier. Then came a long line of well-known FUD from China as the country reiterated, once again, that BTC mining and trading is banned in the country.

This saw the market plummeting as bitcoin touched a low of $30,000. Most of the coins have since recovered, but most of them are nowhere near their former highs.

And while this creates an opportunity for traders, those without sufficient experience are left wondering how they can take advantage.

Savings and Fiat

Having savings is undoubtedly an important thing to consider, but keeping them as is leads to inflation, eating their value away. This is especially true for the past year as many governments across the world, and perhaps the US Government the most, printed excessive amounts of money to keep their economies afloat.

While it might have a temporary positive effect on the economy, this money printing essentially devalues the existing fiat currencies and increases inflation.

This is where decentralized finance (DeFi) steps into the picture – offering much higher yields to investors compared to legacy financial markets.

Introducing NFT Staking and 4Bulls

4Bulls.Game – an NFT game created by 4Bulls, has recently launched a unique staking program where cryptocurrency holders are able to lock NFT artworks for a period of time and, in return, receive 4Bulls tokens for holding non-fungible tokens.

Naturally, this allows 4Bulls NFT holders to earn measurable returns for staking their tokens. The fundamental difference between traditional crypto staking and NFT staking is that the latter offers relatively higher returns.

Users will get 4B tokens, but these can be exchanged through Uniswap.

There are different types of NFTs, and different types of NFT locks. In terms of the tokens, they come in three rarity levels: Common, Rare, and Epic.

Common non-fungible tokens are featured for sale in the official gallery of 4BULLS.GAME. On the other hand, Rare and Epic NFTs can only be won when participating in fantasy battles on 4BULLS.GAME. Gamers are incentivized to engage in battles to win Rare and Epic NFTs because such “rarer” NFTs offer significantly higher APYs when staking.

The locks on NFT staking are as follows:

- No Lock

- 3-Month Lock

- 6-Month Lock

The longer the lockup period is, the higher the APY. The same goes for rarity.

4Bulls Ecosystem

Apart from compelling staking rewards, the 4Bulls ecosystem represents a DAO model, meaning that each product in it belongs to the community, staying true to the cause of decentralization.

With this said, the remunerations that are made from the sales of digital artwork and the fees collected during the fantasy battles get reinvested into the community through the 4B utility token as the revenues are redistributed proportionally throughout the referrers and stakers.

This means that the revenue collected by the protocol is designed to go to the protocol’s users. This also suggests that as the protocol grows and develops, stakers will be able to participate in voting to perhaps adjust fees, APY rates, as well as other important metrics that are related to the operations of the protocol.