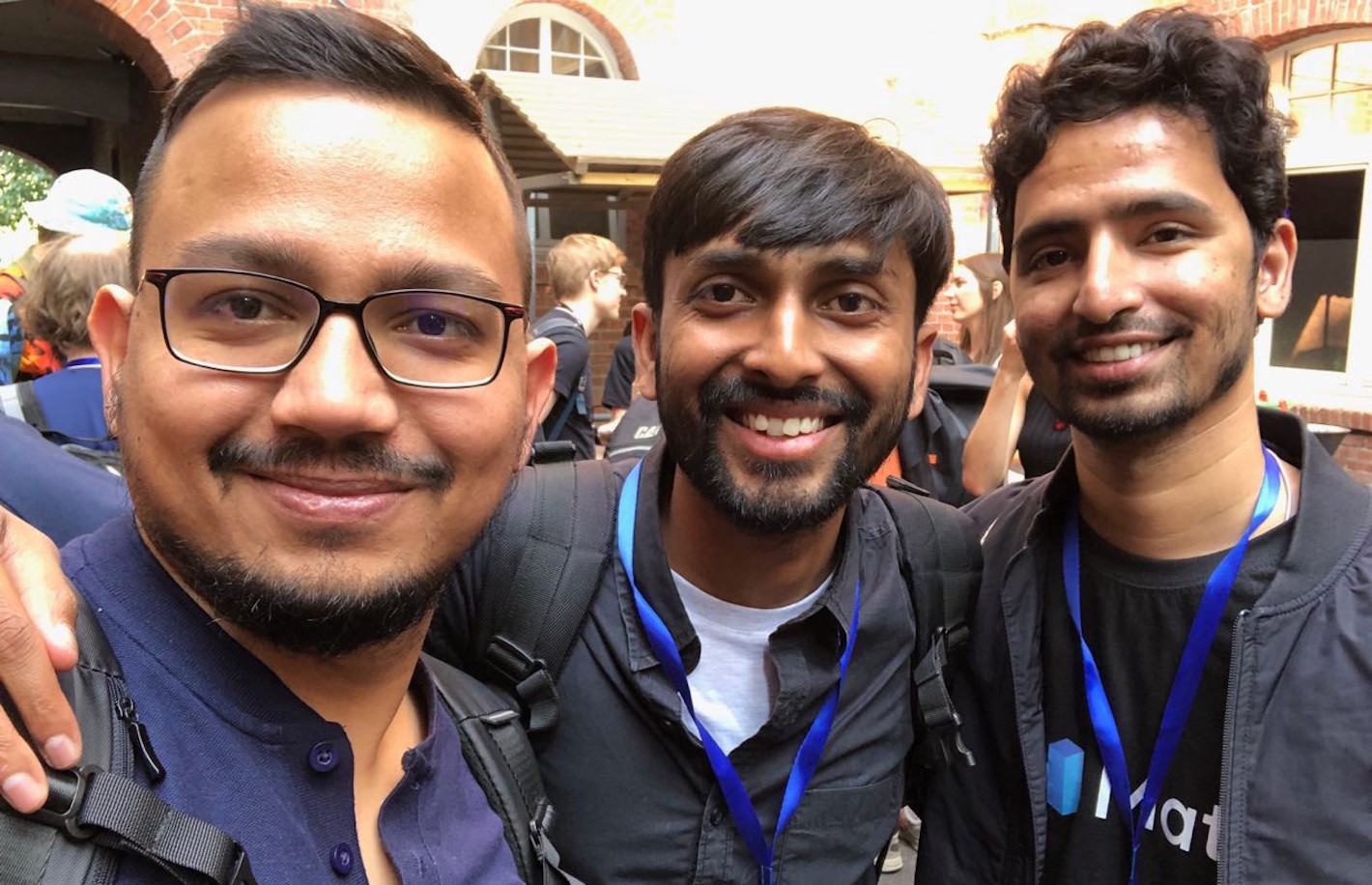

New deBridge Feature Lets Solana Users Easily Access Any Ethereum-Based Blockchain

A new feature by cross-chain bridge deBridge will let Solana users access applications on other blockchains – and vice-versa – easily at low fees, Alex Smirnov, CEO and co-founder of deBridge, shared with CoinDesk.

Smirnov said the feature was the first time a Solana user could access Ethereum Virtual Machine (EVM)-based blockchains, such as Arbitrum, without relying on derivative tokens or wrapped tokens, which present a security risk.

“Wormhole used to be the only interoperability solution available for the Solana ecosystem, but the problem here is that interoperability was not seamless,” Smirnov explained.

“Users and projects that needed to transfer liquidity to Solana have always faced limitations due to the lack of liquidity in Wormhole pools and high slippage during the exchange of the wrapped assets, which often made developers have to deal with non-liquid Wormhole assets,” Smirnov added.

deBridge said its new feature works by enabling any EVM smart contract to prepare on-chain instructions that are directly executed on Solana, while Solana programs can also prepare messages to be sent to any smart contracts on EVM chains.

This is possible thanks to a link-up with the DLN Trade, a cross-chain exchange product by deBridge that uses a decentralized order book to allow any asset on one chain to be traded directly to any asset on another without the bottlenecks and risks of liquidity pools.

Liquidity pools refer to a basket of tokens locked on decentralized exchanges that are used to facilitate trading for those tokens in the open market. DLN uses peer-to-peer liquidity to conduct trades, instead of relying on a liquidity pool.