Nassim Taleb Explains Why He Thinks Bitcoin Fails As Money And Store of Value

Nassim Nicolas Taleb was called Wall Street’s principal dissident by renowned journalist Malcolm Gladwell. Yet, he may well be dubbed Bitcoin’s principal dissident by whoever has enough academic authority to do so.

Once a vocal Bitcoin user and advocate, Black Swan author Nassim Taleb, recently became a harsh critic of cryptocurrencies, and published a paper this weekend explaining the reasons why he thinks Bitcoin fails as money, store of value, and even as a novel technology.

For Nassim Taleb Bitcoin Is Not Money… It Serves Little Purpose

Taleb began by questioning the possibility of Bitcoin turning into a global store of value any time soon:

It is also a reasoning error to claim that an innovation, bitcoin, can become the “new gold” ab ovo, when gold wasn’t decided to be so by fiat thanks to a white paper; it organically became the reserve ex-post, throughout centuries of competitive selection against other modes of storage, payment, and collectibles.

As a social science, economics explains that the conception of money depends fundamentally on a collective agreement. It can happen by force (as in the case of fiat money) or by the evolution of social interactions (as in gold). However, it takes a long time for society to change at a cultural level for both scenarios. To expect bitcoin to acomplish in decades what gold achieved in thousands of years seems improbable for the social sciences.

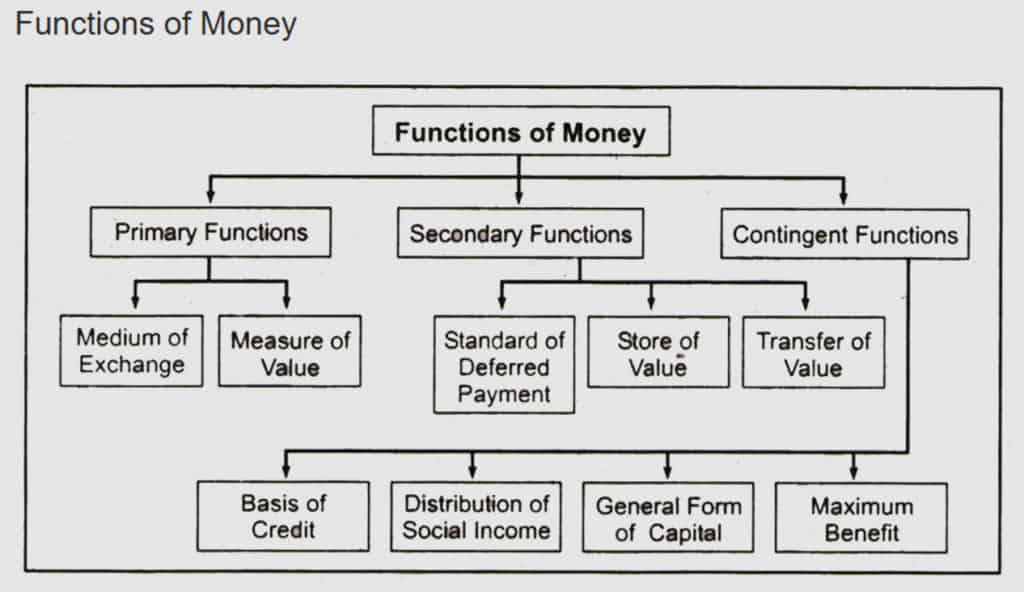

Similarly, Nassim Taleb questioned the role of bitcoin as money. One of the main functions of money is that it must be stable enough to serve as a unit of account, something that bitcoin at the moment cannot satisfy

Nassim Taleb explain that it would be hard to express economic interactions in terms of pure Bitcoin prices:

To be able to regularly buy goods denominated in bitcoin (that is, fixed in bitcoin, floating in U.S.$ or some other fiat currency), one must have an income that is fixed in bitcoin. Such an income must come from somewhere, say, an employer. For an employer to pay a salary fixed in bitcoin, she or he must be getting revenues fixed in bitcoin. Furthermore, for the vendor to offer a can of beer in fixed bitcoins, she or he must be paying for the raw material and have the overhead fixed in bitcoin. The same with a mismatch of assets and obligations on a balance sheet. All this requires a bitcoin-USD parity of low enough volatility to be tolerable and for variations to remain inconsequential.

In other words, when buying goods with Bitcoin, the parties are actually exchanging goods using the dollar as the underlying money. It is difficult to establish fixed prices in Bitcoin because the market does not have a global agreement on what its value is. This extreme volatility can ultimately lead to Bitcoin’s failure.

The Fallacies of Bitcoin

Nassim Taleb ends by explaining how some arguments of maximalists and theorists are nothing but fallacies.

First, he explains that it is false that Bitcoin is a product of libertarian design:

“The belief that bitcoin is an offshoot of libertarian and Austrian economics has not a shade of backing…

Libertarianism is fundamentally about the rule of law in place of the rule of regulation. It is not about the rule of rules -mechanistic, automated rules with irreversible outcomes …

Nor is libertarianism about total distrust.”

Secondly, he assures that it is false that Bitcoin is a safe haven. He confirms that instead of maintaining its value over time, “Bitcoin appears to respond to liquidity, exactly like other bubble items.”

In third place, he denies that BTC serves as a protection against oppressive regimes:

In the cyber world, connections are with people one has never met in real life; infiltration by government agents is extremely easy. By comparison, the mafia required a Sicilianlineage for “friends of ours” so they could do their own security clearance type of check. One never knows the degree of governmental surveillance and real capabilities.

The slogan “Escape government tyranny hence bitcoin” is similar to adverts extolling the health benefits of cigarette

The transparency of the blockchain, the reliance on the fiat system to access money, and the need to establish human connections aid governments in exercising oversight of bitcoin transactions.

And finally, he addressed what he calls the Fallacy of the Agency problem: Instead of relying on Central Banks and governments to be able to use money, a society utterly dependent on Bitcoin would be relatively dystopian and dependent in turn on large corporations and individuals who took advantage to acquire BTC in its early days:

One would have the illusion that, by being distributed, Bitcoin would be democratic and reduce the agency problem perceived to be present among civil servants and banks.

Unfortunately, there appears to be a worse agency problem: a collection of insiders holding on to what they think will be the world currency, so others would have to go to them later on for supply. They would be cumulatively earning trillions, with many billionaire “Hodlers”; compare with civil servants making lower middle-class wages. It is a wealth transfer to the cartel of early bitcoin adopters.

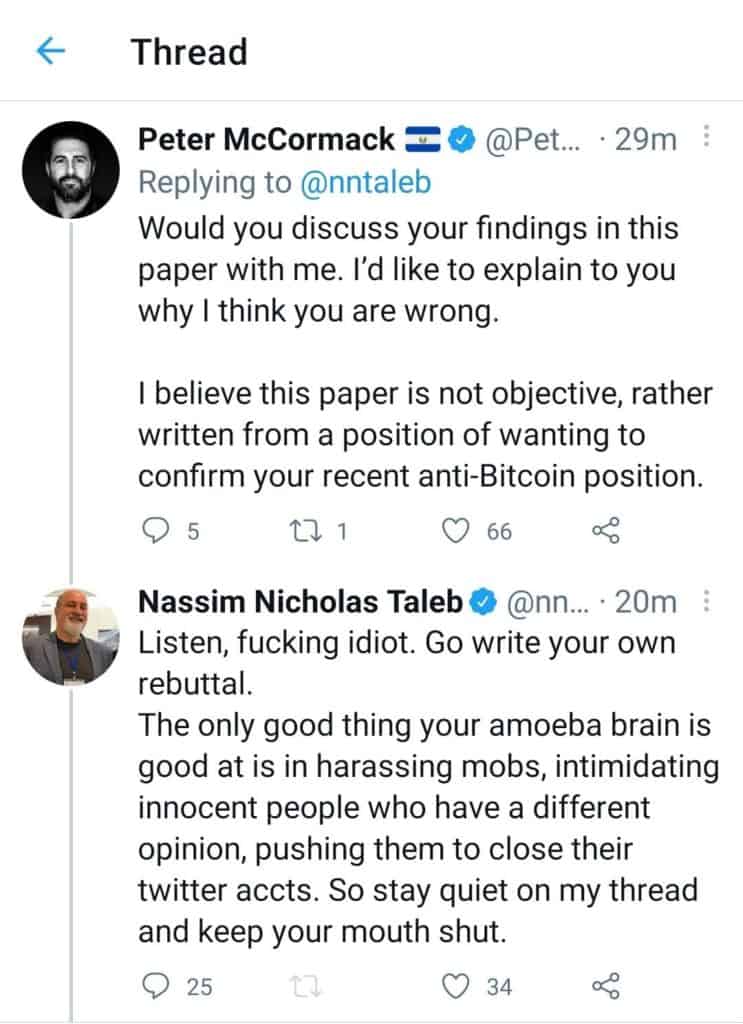

Twitter Arguments? Nah

Taleb ends the paper by saying that “great technology” doesn’t mean useful and argues that society is still “close to nothing with the blockchain.”

Such arguments are harsh for many BTC maximalists, and some could even try to prove them wrong. But beware! If you are among those adventurous bitcoiners always looking to debate, you better do it in the academic field! Mr. Taleb is not really a fan of Twitter drama: