Multicoin Leads $4M Strategic Round for Web3 Co-Ownership Platform Lore

Yat Siu

Co-Founder and Executive Chairman

Animoca Brands

Where is Web3 headed? Take a look to the future with this pioneering investor in the metaverse and NFTs.

Yat Siu

Co-Founder and Executive Chairman

Animoca Brands

Where is Web3 headed? Take a look to the future with this pioneering investor in the metaverse and NFTs.

:format(jpg)/www.coindesk.com/resizer/hUv1U9cMP77z__1hmpusCl6kqtA=/arc-photo-coindesk/arc2-prod/public/5WF4AJAWOJA7FDQBEIWAKGTGYA.jpg)

Brandy covers crypto-related venture capital deals for CoinDesk.

Yat Siu

Co-Founder and Executive Chairman

Animoca Brands

Where is Web3 headed? Take a look to the future with this pioneering investor in the metaverse and NFTs.

Yat Siu

Co-Founder and Executive Chairman

Animoca Brands

Where is Web3 headed? Take a look to the future with this pioneering investor in the metaverse and NFTs.

San Francisco-based Lore, a co-ownership platform for Web3 collectives, has raised $4 million in a strategic funding round led by Multicoin Capital. The capital will enable new use cases and expansion to additional blockchains beyond Ethereum, starting with Polygon and Solana.

Lore, now in public beta, is a platform and protocol that makes it easier for Web3 creator communities and game guilds to co-own non-fungible tokens (NFT), opening up new ownership and utility options. Co-owner collectives can pool resources, issue ownership stakes to members, and distribute funds with automated administration settings. Collectives can easily access mints, stake assets or play NFT-based games. Lore also serves as a social network of sorts, making it easier for new members to connect with collectives.

“The internet bundled us into communities based on shared interests and goals, but collaboration largely stopped there,” said Lore co-founder and CEO Thomas Scaria in a press release draft shared with CoinDesk. “Lore gives communities of all sizes a new way to take action, and to ultimately achieve the goals that bind them together,” he continued. “Lore turns niche communities into hubs for cultural curation, wealth creation, and commerce. As more opportunities emerge in virtual worlds, Lore will be there to help strangers and friends from all over the world to pool resources to seize opportunities.”

Lore emerged from stealth last summer and previously required NFT ownership to join the platform. The public beta has now opened up the experience to any interested user. Web3 communities already using the platform include Proof, Friends With Benefits, Seed Club, Memeland and Azuki.

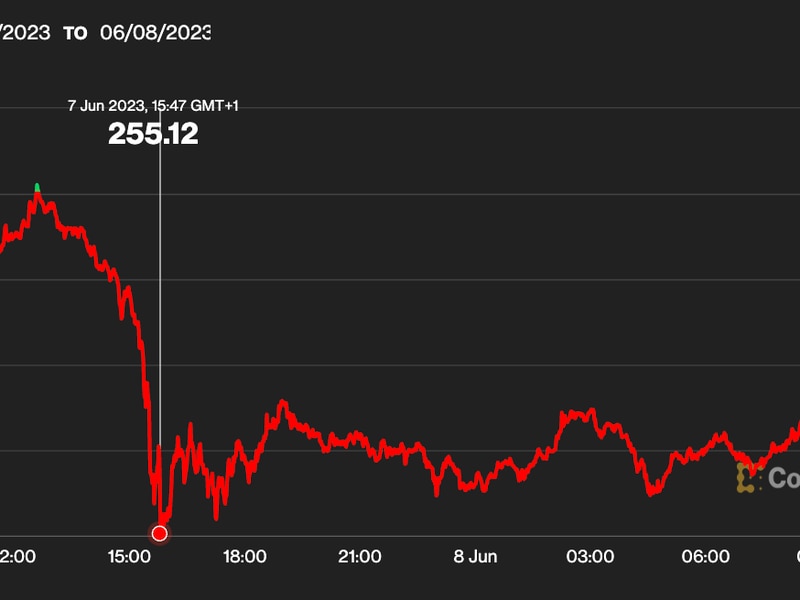

The round comes as investments in crypto startups gradually gain steam after nearly stalling due to the crypto bear market and a number of headline-grabbing scandals.

Other investors in the round included Seed Club Ventures, North Island Ventures, Balaji Srinivasan, Zeneca, Mischief Ventures, Sfermion, CMT Digital, Patricio Worthalter, Spice Capital and Sublime Venture, among others. Lore has now raised $7.15 million to date.

Edited by Stephen Alpher.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/hUv1U9cMP77z__1hmpusCl6kqtA=/arc-photo-coindesk/arc2-prod/public/5WF4AJAWOJA7FDQBEIWAKGTGYA.jpg)

Brandy covers crypto-related venture capital deals for CoinDesk.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/hUv1U9cMP77z__1hmpusCl6kqtA=/arc-photo-coindesk/arc2-prod/public/5WF4AJAWOJA7FDQBEIWAKGTGYA.jpg)

Brandy covers crypto-related venture capital deals for CoinDesk.