Multicoin Capital Partners Explain How They Invest in Crypto Startups

Multicoin Capital partners reveal their investment process.

415 Total views

35 Total shares

According to Coinopsy.com, over 1,500 cryptocurrencies have collapsed in the past eight years. With so many failures, what is the best way to determine which projects are worth investing in, and how can these projects be found?

CEO of Civic, Vinny Lingham, and co-founder of Multicoin Capital, Kyle Samani, joined the latest episode of Cointelegraph’s crypto markets show to explain how they search for and assess crypto investment opportunities. They also discuss how COVID-19 is shaping the role of crypto in the global economy and why Asia may or may not become the DeFi hub of the world. Watch the full discussion in the video above!

The Search for Crypto Startups

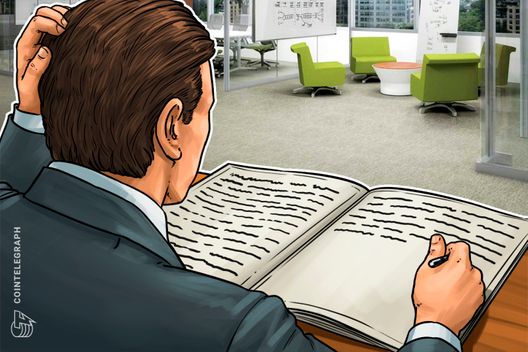

At the beginning of every decision to invest is the search for the right investment. The crypto space is notoriously riddled with scams and fraudulent projects. Finding a legitimate startup can often feel like a daunting task. For Samani, forethought and research are the driving forces behind a successful search. He said:

“We were reading and thinking and learning all the time. And occasionally we got to have a conversation internally where we’re like, hey, like, this is a big opportunity. Let’s go find a team. And when that happens, then we will start usually systematically, just like calling everyone we know, looking at all the companies tangentially, you know, in that space and trying to kind of try and find the right company to really express that view.”

Evaluating the Worthiness of a Project

Once a group of companies are identified, what is the best way to evaluate them? Lingham starts from the roots:

“My personal one is I look at the founder, the team and what they’ve done before.”

They must display passion as well as expertise. He continues:

“So it’s always about the team. Can they stick together? Will they weather through the — will they keep fighting for survival? And then once that’s — once it’s clear that hurdle, okay, what problem is this team trying to solve? And do I believe they have the background and the technical expertise to go and do it? And often I find that they have the passion, but not the technical expertise.”

While Lingham looks closely at the core team, Samani analyzes the market. He states:

“We are very, very focused on the market and really understanding the size of the market, the existing players, wedges to kind of build a footing in them, how can you build a footing, and what’s kind of your asymmetric insight about that.”

But Samani also understands the importance of finding the right combination of market conditions and passion driven team. He concludes:

“The more time I spend investing, the more time I really value the importance of founder-market fit because being a founder is really hard. And, like, if you don’t have the right story and context for why you’re doing what you’re doing, you’re going to give up eventually.

If you enjoyed this latest crypto markets update, hit the Like button and subscribe to our YouTube channel for more weekly crypto content!