Multicoin Capital Leads $1.15M Seed Round for DeFi Protocol Swivel Finance

Multicoin Capital Leads $1.15M Seed Round for DeFi Protocol Swivel Finance

Swivel Finance – a decentralized protocol for fixed-rate lending and interest-rate derivatives – has raised $1.15 million in a seed round led by investment firm Multicoin Capital.

- According to a blog post on Thursday, other participants in the funding included Electric Capital, CMS Holdings, Divergence Ventures and DeFiance Capital.

- Several angel investors also invested, including Huobi adviser Alex Pack, Aave CEO Stani Kulechov, and DeFi Alliance’s Imran Khan and Qiao Wang.

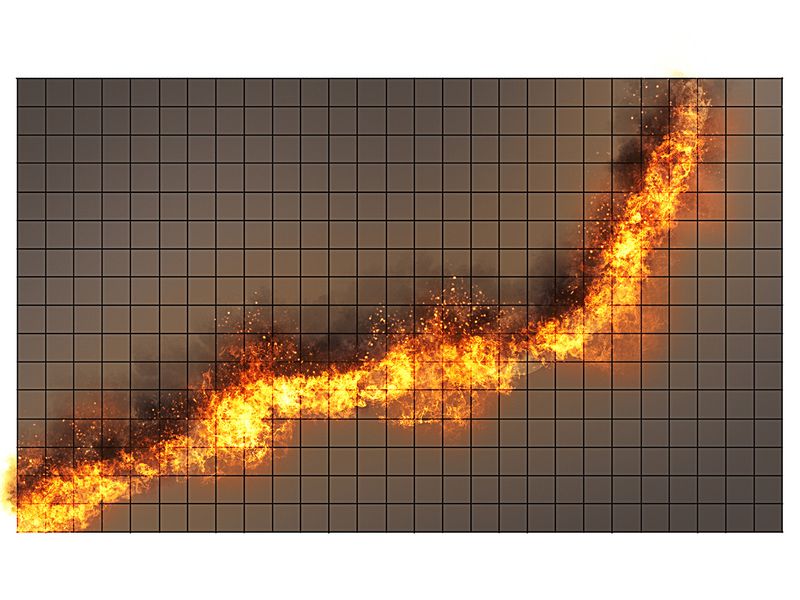

- Swivel said it initially aims to facilitate “trustless” interest-rate swaps, allowing “cautious lenders to lock in a guaranteed yield.” Investors will also be able to speculate by leveraging their rate exposure.

- Formerly known as DeFiHedge, the firm said its interest rate offerings will place it in a “unique spot” in the decentralized finance market and could help grow the nascent DeFi industry.

- Multicoin Capital said in its post on the funding that interest-rate derivatives are the “most liquid financial product on the planet,” trading over $6.5 trillion per day. “Swivel unlocks this market and brings these concepts to crypto.”

- The seed investment will be used to ramp up development as the currently two-man team moves the project towards its version 1 mainnet launch.