Much Ado About =Nil;

Blockchain companies are adopting zero-knowledge (ZK) technology for everything from scaling to security – making the rapidly-advancing field of cryptography the biggest buzzword in crypto. As companies race to introduce ZK-based products to the market, however, they may encounter challenges stemming from the high expense and expertise needed to build and operate ZK systems. As ZK becomes more mainstream, new infrastructure will be needed to onboard developers and bootstrap newer projects.

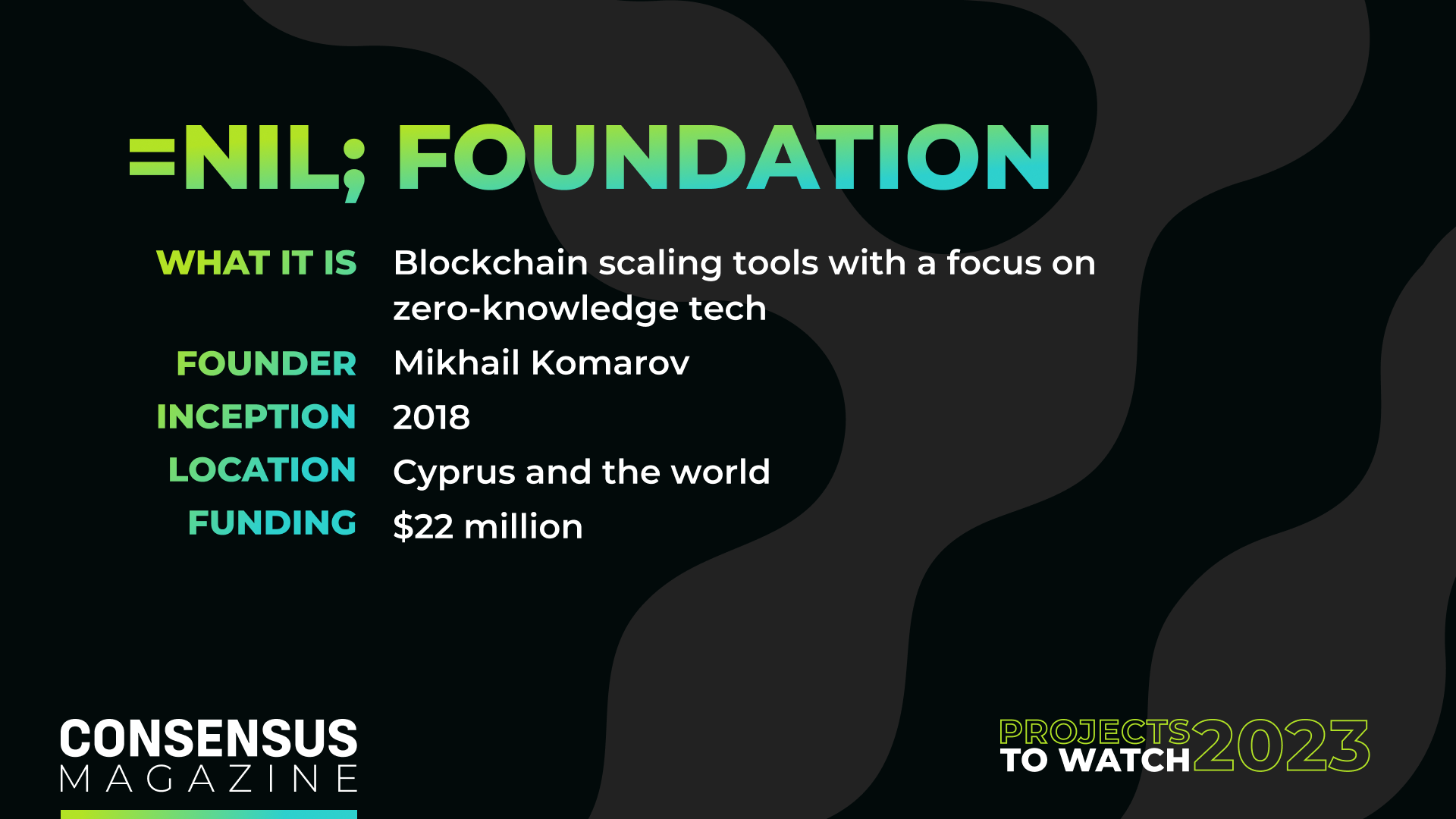

=NIL; Foundation

If “Seinfeld” was “a show about nothing,” the =nil; Foundation is a cryptically captioned crypto company borne of the same ethos. Like the irreverent 1990s sitcom, =nil;’s unassuming exterior hides ideas that demand attention. You may find those ideas difficult to decipher, however.

For starters, there’s that name: “=nil;” Foundation. Stylized to look like computer code, “=nil;” literally translates as programmer-speak for “nothing.” Not so revealing, in other words, and a syntactical nightmare for a journalist tasked with writing a story about something (and an even bigger headache for his website’s SEO team, he’s told).

And then there’s the fact that the =nil; Foundation is not really a “foundation” – at least not in the traditional sense. Venture capitalists, take note: This foundation is for-profit, and its founders say they plan to formally drop the “foundation” label sometime soon. (=nil; started as a nonprofit in 2018 but raised a conspicuous $22 million from investors this year.)

On its website =nil; describes itself as providing “trustless data accessibility” – a tagline impenetrable for all but the crypto native, but decidedly not nothing. According to the site, =nil; was established to “facilitate and support research and development in database management systems and applied cryptography.” For those equipped to parse the jargon, this is where things may begin to make sense: =nil; aims to help manage databases (read: blockchains) through its expertise in advanced cryptography.

Still confused? That might be the point. In an interview with CoinDesk, =nil; co-founder Mikhail Komarov seemed to take pleasure in his company’s elusiveness. “Everything I give a name to is about ‘nothing,’ ‘nobody,’ ‘no one’, like ‘f**k off’ and all that stuff,” said Komarov, who added that his childhood nickname was “Nobody the Nobody.” Komarov isn’t worried that =nil;’s nonstandard naming will push it below the radar, however. The tech can do the talking.

Komarov, a wispy-haired Russian transplant based in Cyprus, is what some in crypto would call an OG. With a penchant for black clothes and a wry smile seemingly glued permanently to his face, Komarov has the coy, knowing disposition of a hacker’s hacker – an only-in-crypto character that may well have been plucked off the set of “Mr. Robot.”.

Komarov studied Algebraic Topology at Moscow University, and says =nil; kicked off as a rag-tag group of programmers eager to consult and deploy their skills on projects across the crypto-verse.

Komarov’s driving thesis is that blockchains are just glorified databases, and he describes the =nil; of the early days as a nonprofit “think tank” driven by a single question: “What if this industry was not invented by a cryptographer, but by someone who does database management systems?”

From the once-hyped EOS blockchain to the Ethereum staking juggernaut Lido (which Komarov co-founded), the team’s digital fingerprints can be found on some of the buzziest crypto projects of the past few years.

“In the beginning, it was actually a foundation. It was just trying to prove that this thing is worth something, that it can be done,” explained Komarov. “It was not really known whether it was possible to merge these industries,” database management and cryptography.

Komarov began tinkering with blockchains in 2013, but he says his interest in database management stemmed from challenges he faced in 2017 as the chief technology officer of Golos, a Russian-language spin-off of the blockchain-based social network Steemit. Komarov describes Golos as a “decentralized” Reddit – a kind of forum site with its own built-in token. As the platform became more popular – including in Ukraine where, Komarov says, people used it to spread anti-Russian political articles – it began to outgrow its underlying blockchain.

“The amount of data that got put inside this thing got too large,” Komarov recalled. “It became a big pile of problems. It was so big that exchanges were not willing to list the GLS token because they knew that they wouldn’t be able to support and maintain the deposits and withdrawals.”

Frustrated from his Golos experience and aware that blockchain scaling issues were by no means unique to him, Komarov’s first big product push with =nil; was to build out a database management system – a tool like mySQL that aimed to help blockchain projects conveniently store, view and edit their data.

Because it has grown to 40 employees around the world, however, =nil; has gradually shifted its geographically distributed sights onto zero-knowledge (ZK) cryptography – a burgeoning field of cryptography that has wide applications to blockchain scaling.

So what is ZK? It’s a kind of technology that allows one to prove a statement is true without showing the statement itself. Without getting into the mechanics of how this all works (the Ethereum Foundation has a useful explainer), the key unlock of ZK tech is in allowing two parties to pass data back and forth in compressed form, and with certain privacy-preserving features.

The usefulness of ZK may be difficult to grasp in the abstract, but the tech has been looked to as a key solution for blockchain scaling – enabling Ethereum, mainly, but theoretically any blockchain to offload traffic to ZK-based chains that can securely and cheaply process data on their behalf. (ZK can help solve, in other words, some of the main problems that Komarov faced when building the data-heavy Golos.)

=nil; is wooing investors with plans to launch two flagship ZK products, each aimed at helping zero-knowledge development teams build out their tech.

The first new product, =nil;’s “zkLLVM,” is oriented towards helping developers build ZK crypto apps more quickly. It does this through a suite of compiler tools – software libraries that will help programmers write complex ZK applications using familiar programming languages (rather than arcane, ZK-specific languages.)

The next product, a “proof market,” addresses one of the biggest bottlenecks for getting ZK apps up and running once they go live: the high computation costs of ZK systems.

ZK crypto apps are built around trustlessness, the idea that a far-flung network of people – rather than one central company – should be able to pitch in to keep a given system alive and accountable. But organically building up a network of people to operate a ZK service is difficult. This difficulty stems partly from the complexity of generating ZK-proofs – the computation-hungry math problems that power ZK systems.

ZK-proofs are best generated by specialized machines. Due to the large requirements for generating proofs, many ZK apps are forced to generate proofs entirely in-house rather than outsource the work to a community. While convenient, this sort of vertical integration is hardly “trustless” and could become infeasible should a given ZK system scale up and demand more resources than a single firm can provide.

=nil;’s proof market aims to give ZK upstarts easier access to companies and individuals with ZK-proof-generating goods – building up a platform that connects capable ZK-proof generators with projects needing proofs.

Should =nil; succeed, it could reach the kind of status of something like Flashbots – the Ethereum software builder whose “MEV-boost” middleware (a block marketplace) is now used by virtually every validator that operates the network. It’s no coincidence that =nil; counts Hasu, Flashbots’ head of strategy, as a lead investor.

=nil;’s success is not guaranteed, however. The ZK-proof market will struggle to take off unless it manages to attract an acceptably large, trustworthy community of proof-generators. This may prove difficult: It remains to be seen whether the ZK community can bake in the incentive systems/economic model required to support =nil’s marketplace.

There are also potential weaknesses with =nil;’s zkLLVM compiler. Most obviously, =nil; will need to build up trust before developer teams readily use its code to create applications that secure millions of dollars in crypto.

Despite the big questions, =nil;’s big swing at ZK tech is well-timed. The field of ZK cryptography is now to the blockchain industry what artificial intelligence (AI) is to the rest of the technology industry: ubiquitous, buzzy, and probably important for the long haul. If =nil; succeeds, it’s hard to imagine it will stay stealthy for too much longer.

Edited by Jeanhee Kim and Danny Nelson.