Mt. Gox Moves $3B Bitcoin to New Wallet, $130M to Bitstamp Exchange

-

Defunct crypto exchange Mt. Gox moved billions of dollars worth of bitcoin between wallets and sent $130 million to Bitstamp.

-

The cryptocurrency movements echo those of yesterday as Mt. Gox repays customers hit by a hack 10 years ago.

-

Payments started early this month and Mt. Gox still has more than $6 billion of BTC to distribute.

45:11

Bitcoin’s Price Is Way Up. And $48 Trillion in Wealth Just Got Access

08:42

Bitcoin Ecosystem Developments in 2023 as BTC Hits Fresh 2023 High

01:10

Bitcoin Extends Rally as $1B in BTC Withdrawals Suggests Bullish Mood

1:02:43

Why Financial Advisors Are So Excited About a Spot Bitcoin ETF

Defunct bitcoin {{BTC}} exchange Mt. Gox moved a fresh batch of the asset to new wallets on Wednesday, tempering chances of a price rally as sentiment remained dented.

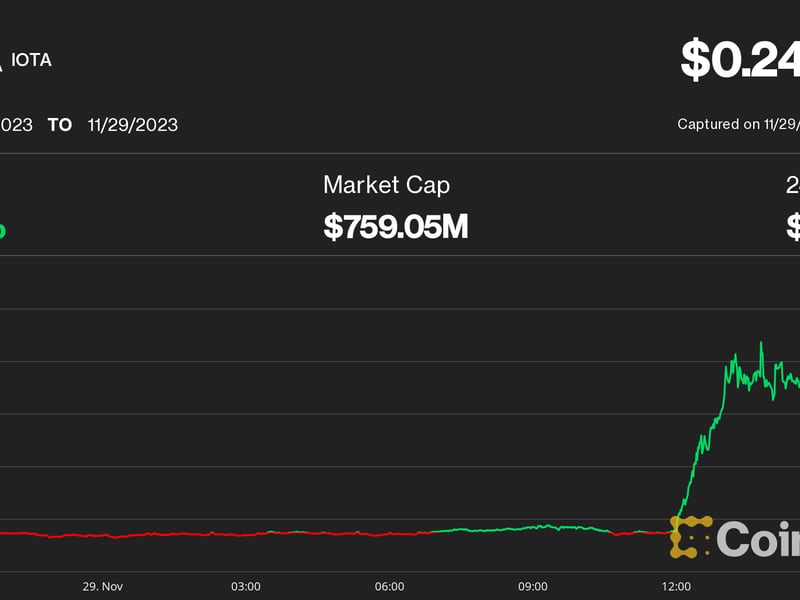

Arkham data shows Mt. Gox moved 37,400 BTC, worth $2.5 billion, from its main wallet to a new wallet “12Gws9E,” and another $300 million to an existing cold wallet. It then moved another $300 million to wallet “1MzhW,” of which $130 million was sent to crypto exchange Bitstamp. BTC prices remained steady.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JCLDZBXAI5GTZDWS2AZSRON5TI.png)

Mt. Gox is sitting on $6 billion worth of BTC, down from $9 billion on July 10. BTC has largely remained steady between $66,000 and $67,000 during the period.

These movements mirrored those of Tuesday, when Mt. Gox moved $130 million to Bitstamp and shuffled $2.5 billion between wallets. Several creditors on crypto exchange Kraken also reported receiving bitcoin repayments for the first time in their personal accounts in U.S. hours.

In early July, the defunct exchange began repaying creditors hit by a 2014 hack. Over $9 billion worth of BTC and $73 million of bitcoin cash {{BCH}} will be distributed to traders in the coming months.

Edited by Sheldon Reback.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Follow @shauryamalwa on Twitter