More People HODLing Bitcoin Hurts Case for Buying, Selling With It, Says Morgan Stanley

Addresses holding amounts of bitcoin worth more than $1 million are on the rise.

More People HODLing Bitcoin Hurts Case for Buying, Selling With It, Says Morgan Stanley

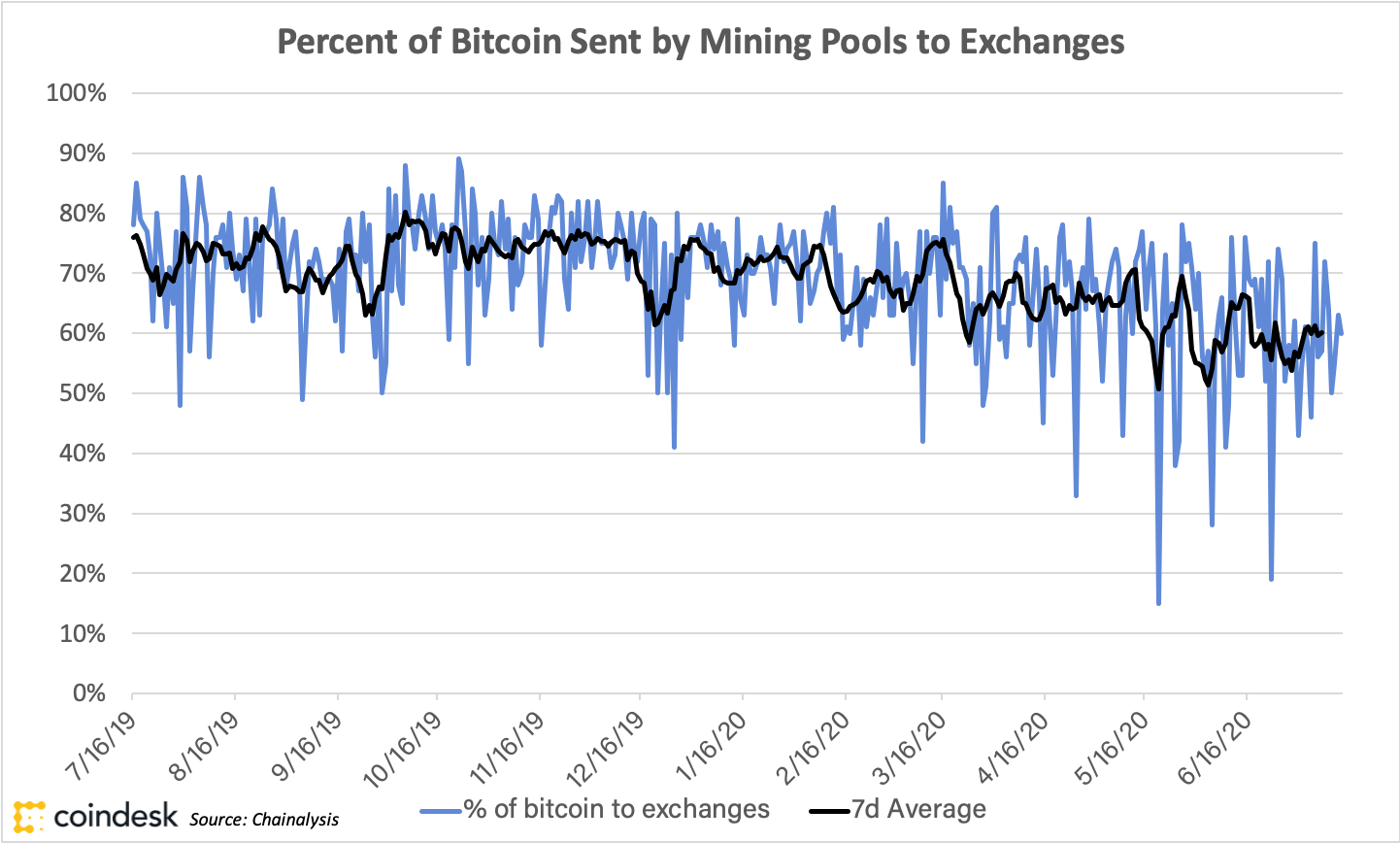

Bitcoin liquidity appears to be falling as the demand that has driven the recent bull market appears to be concentrated among a relatively small number of investors who are unwilling to sell, according to new research by Morgan Stanley. That lack of liquidity potentially hurts its use for transactions, the investment bank said.

Addresses holding amounts of bitcoin worth more than $1 million are on the rise, with wallets holding over 100 bitcoin owning over 60% of all coins issued. Almost 30% are held in wallets that hold between 1,000 and 10,000 coins.

In the report, Morgan Stanley said the case for bitcoin as a means of exchange “becomes harder to defend” if liquidity continues to fall, as it won’t be as attractive a vehicle for trading in goods and services.

This however could change with the evolution of products that enable a user-friendly experience for spending crypto assets.

Morgan Stanley highlights PayPal’s confirmation of its entry into the bitcoin market in October 2020 as an example of this even if its use proves modest. With 325 million potential customers on PayPal’s platform, companies should see significant opportunity in creating products and services that can facilitate the use crypto for buying and selling.

Ruchir Sharma, Morgan Stanley’s head of emerging markets and chief global strategist, echoed this view in a bullish new blog post, in which he is suggests bitcoin could replace the dollar as the world’s reserve currency.

He acknowledges that almost all bitcoins are held as investment rather than to transact, but believes this is changing thanks to developments such as PayPal adoption.