Money Reimagined: Memes Mean Money

Money Reimagined: Memes Mean Money

Before we get into this week’s column, an announcement, one I’m super excited about.

Today, we’re simultaneously launching a new podcast under the same name as this newsletter: CoinDesk’s Money Reimagined. Like the newsletter, it’s a conversation around the technological, political and social forces reshaping our financial system. For each show, I’ll be joined by the tremendous Sheila Warren, blockchain lead at the World Economic Forum, as we sit down with insightful guests from around the world.

Below you’ll find links to the first show which you can use to subscribe with your preferred podcast player. In it, we dive more deeply into the “culture of money” theme addressed in this week’s newsletter, including a four-way interview with multimedia artist Nicky Enright and University of Virginia Media Studies Professor Lana Swartz.

For free, early access to new episodes of Money Reimagined subscribe to CoinDesk Reports with Apple Podcasts, Spotify, Stitcher, CastBox or direct RSS for your favorite podcast player.

Those silly DeFi memes, they’re really important

Sushi, Hotdogs, Yams, Shrimp.

The whimsical, food-obsessed names of of the latest decentralized finance (DeFi) outfits are antithetical to the stodgy imagery of the mainstream financial system they seek to disrupt. Banks’ memes, by contrast, skew toward strength and durability. (Think of the lion statues and Roman columns guarding bank branches in old parts of London, New York or Paris.)

DeFi’s critics say the silly names show it’s merely a fad, a game – or worse – a scam. It’s all imaginary, they say. It’s not real.

The problem with that perspective is that all aspects of money, including the financial systems built on top of it, are imaginary.

And, in case you’re wondering, that’s a feature, not a bug.

Israeli historian Yuval Harari calls money “the most successful story ever told,” even more important to the evolution of society than religion, corporations and a host of other human-imagined institutions. Like those concepts, money’s power hinges on the collective adoption of a common belief system. It takes a set of mutually understood rules and gives them symbolic representation in a token we call a currency. In exchanging that token, we reach agreements that reflect those rules and so enable commerce, collaboration, value creation and, ultimately, civilization.

Storytelling and cultural creation have always been integral to how society fosters this belief system, how we’ve forged communities around currencies. It’s why representations of money and the conversations around it are rich with iconography, foundational myths and stirring language.

This process of collective imagination has become firmly tied to another powerful imaginary concept: the nation-state. This combination has been so effective that it has survived the introduction of new technologies and tokens over time. We’ve gone from shells to coins to banknotes to checks to credit cards to Venmo, and each time we’ve just accepted that a new transfer vehicle can convey the same rules and values we’ve always attached to our national currencies.

This is a useful lens to apply to the many new ideas for money bubbling up in the crypto world. Whether it’s bitcoin’s bid to become a digital gold-like currency or the fight between Uniswap and SushiSwap to dominate liquidity in DeFi’s lending markets, the semiotic process for creating memes and stories is vital to the establishment of a new system. We need to reimagine money.

Imagined communities

If you have a $100 bill in your wallet, take a good look at it.

On one side, there’s Ben Franklin’s balding head and torso, behind which are a quill, an inkwell with the Liberty Bell superimposed onto it, and an extract from the Declaration of Independence. There are also the seals of the U.S. Treasury and the Federal Reserve, the signatures of the Secretary of the Treasury and the Treasurer, a serial number and other identifying numerals.

On the other, we see Independence Hall in Philadelphia, where Franklin and other Founding Fathers signed the declaration, along with the words “In God We Trust.” On both sides, the number 100 appears numerous times in and around a highly ornate border.

Combined with cotton threads and watermarks, the baroque design helps make the note difficult to counterfeit. But more importantly, the imagery appeals directly to patriotism. It’s all associated with the nation-state to which the dollar, we are encouraged to believe, is indelibly linked.

Now think about the actual value of the note, by which I mean the physical piece of paper. You could use it as a bookmark, maybe, make a paper plane out of it, or write a very small amount of information in very small print on it. But none of those uses add up to $100 in utility.

A banknote’s value comes almost entirely from our shared imagination, a commonality of beliefs fed by centuries of cultural production that forges a type of community. It’s only because the payer and the payee share those beliefs that this piece of paper can function as an instrument for clearing that community’s debts.

Each tribe of cryptocurrency advocates is endeavoring to create the same sense of community and belief around its preferred token. How they attain that is a cultural challenge.

What’s real?

In November 2014, I created a video for The Wall Street Journal with Nicky Enright, a multimedia artist. We filmed him walking the streets of the Diamond District in New York’s Midtown as he wore an A-frame sandwich board and held a wad of “Globos,” his personal currency, in hand. The beautifully ornate notes were on sale for a $1, he told passersby, in a special two-for-one deal.

The interactions with people were fascinating. One of the most common questions was, “Is it real?” Enright’s answer was always something like, “Of course it’s real. You can see and hold it, right?” As a guest on this week’s inaugural Money Reimagined podcast, Enright reflected on those exchanges, noting that “people will question the Globo in a way that they rarely, if ever, question their own currency” and yet the very same questions about what is “real” could be applied to the purely symbolic value of the dollar.

The pertinent question for cryptocurrency advocates is: How do the purveyors and believers in a particular currency similarly get enough people to believe in it, to view it as “real?” And that’s again where the cultural conversation comes in.

It’s why Bitcoin’s culture is filled with ideas, phrases and iconography that help build community. Think of the word “HODL,” or the concept that Bitcoin is “The Honey Badger of Money,” or the almost religious devotion to the mysterious founding father, Satoshi. (By the way, it’s irrelevant that these ideas, like DeFi’s, seem frivolous to traditionalists. They are appropriately in line with the meme culture of the digital age, and consistent with the liberal conventions that internet culture unleashed, as names like Yahoo and Google became corporate mainstays.)

Meme governance

University of Virginia media studies professor Lana Swartz, author of the newly published New Money: How Payment Became Social Media, has some thoughts on all this.

As the second guest on this week’s podcast, she reflected on the very early research that she and two colleagues did into Bitcoin’s culture in 2013. At that time, she said, “there was a real fixation on the idea that Bitcoin would be free from human institutions, free from human foibles and free from the need for human governance. … But then all these early Bitcoin people ever really did was to talk and create community, and create ways to govern themselves, and create ways to think about this project.”

It’s a great insight. Money is inseparable from community, and community is about values, the expression of which involves governance. (Not government per se, but governance.)

This brings us full circle to DeFi, where tribes conduct meme warfare on Twitter and elsewhere to promote their tokens. Each of those tokens is tied to a protocol, which offers a different form of governance.

The difference with traditional money is that the enforcement of each token’s particular governance model comes via a decentralized network rather than the centralized institutions of a nation-state.

That shift is what makes it so promising. But it’s also why the cultural creation process is so challenging, as it must compete with the giant mindshare that traditional finance occupies. It’s why the meme-ing must continue.

The end of wall street as we know it?

Hats off to Bloomberg’s Joe Weisenthal for coming up with a killer graph. (Sadly, I’m using that descriptive literally.) The chart, which appeared Tuesday in Bloomberg’s daily “Five Things to Start your Day” newsletter, maps the reservations at New York restaurants recorded by OpenTable and subway turnstile receipts from the Metropolitan Transportation Authority, against the price of shares in SL Green, a real estate investment trust focused on Manhattan office space. COVID-19 has done a number on all three.

I include this here, because when thinking about the future of Manhattan real estate, it’s hard not to think about the future of Wall Street. Banks, brokerages and other financial institutions are giant contributors to the city’s commercial rents, occupying large open-plan trading areas on multiple floors of some of NYC’s prime real estate. But in the COVID-19 era, banks have learned that, with the help of new low-latency connectivity packages, their traders can work pretty well from home, offering the prospect that the firms can save millions in rents if they pare back their footprint in the city.

An exodus from New York by bankers, traders and brokers would mark an end to an era. Hollywood’s movies about testosterone-fueled trading floors will become period pieces. The bigger question is what it means for the idea of Wall Street as a New York institution and, by extension, for the city’s outsized role in the regulation of the global financial system.

There are plenty of reasons for banks to maintain a legal residence in New York. Most important, the Federal Reserve Bank of New York (FRBNY) has a unique role within the Fed’s monetary system, as it conducts the open-market operations by which the central bank implements monetary policy. To act as a counterparty with FRBNY in those trades and gain access to that vital flow of monetary liquidity, banks need, at the very least, a capital markets subsidiary domiciled in New York. Their presence for that purpose in turn gives local regulators such as the New York Department of Financial Services a critical role in world finance.

But it’s not hard to imagine that a physical downgrading of banks’ physical presence in New York could, over time, degrade the city’s dominance. Will the rest of the U.S. continue to grant NYC its gatekeeping role? And as central banks, potentially armed with digital currencies, move to expand the range of counter parties they deal with to include non-banks such as large companies and municipalities, New York’s centrality in the process could be further diminished. It’s yet another way in which the seismic events of 2020 could prove a turning point for the world of finance.

The global town hall

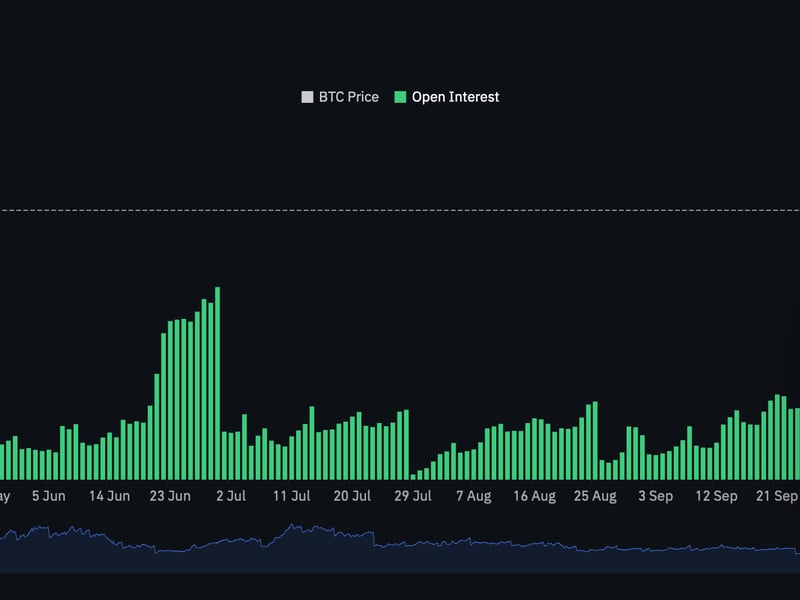

CRYPTO-DERIVATIVES BOOM. According to a comprehensive report by CoinDesk Research Hub contributor Blockchain Valley Ventures (BCC), “future contracts volume on cryptocurrencies has surged by close to 300% between H1 2019 and H2 2020,” mostly driven by institutional players using platforms such as Bakkt and the Chicago Mercantile Exchange. Other interesting takeaways:

- Asia accounted for 95% of all futures trading in the second quarter of 2020.

- DeFi appears to be increasing the demand crypto derivatives as its smart-contract-based model has the potential to mitigate counter party risks and other dangers of trading in derivatives.

- BVV is predicting this boom will inspire mergers and acquisitions in the crypto exchange space as the derivatives market has the potential to grow to 10 times the size of the spot market.

Pro-bitcoin market professionals have long encouraged the development of derivatives markets, as they are supposed to bring two-sided liquidity to the overall market. That, in turn, should reduce volatility, protect investors from excessive losses, build efficiency and contribute to the overall development of crypto as an asset class. But it’s worth contemplating how that process plays out, because it’s not yet translating into immediate payouts to investors in crypto spot markets. Consider, for example, the fact that despite the boom in derivatives, bitcoin’s price can’t seem to get sustainably above $11,000, even as it also tends to find strong support at $10,000 or just below it.

In other words, the idea that market sophistication will translate into a higher bitcoin price isn’t yet playing out.

Despite talk of a bull market and signs of buy-in by mainstream players such as MicroStrategy’s Michael Saylor and former Prudential Securities chief George Ball, bitcoin remains well below its 2019 high of $13,789. At this stage of development, the two-sided liquidity of derivatives markets seems to be doing a reasonable job of containing excesses in the spot market. But it will take time for that improved efficiency to breed confidence among institutional and other, more cautious investors, to take actual long-term bets on bitcoin itself.

DEFI’S WHITEHAT SAVIORS. Some students of the 2008 financial crisis look at the highly complex world of DeFi protocols, tokens and lending markets and see parallels. An opaque, hard-to-understand market in which interrelated credit risks are poorly understood seems ripe for the kind of cascading failures that the similarly complex world of credit default swaps and collateralized debt obligations delivered 12 years ago.

They’re right to be concerned, but I think the core risks come in a very different form. Algorithmic, decentralized collateral delivery should, in theory, reduce the kind of counterparty risks markets faced in 2008, when fears that debtors did not have the assets they’d pledged created a downward spiral of selling, fear and self-fulfilling collateral demands. What it doesn’t solve for is software risk. The big danger for DeFi is that bugs in multiple smart contracts will be exploited to steal funds in a synchronized manner, triggering a mass panic from which hackers can profit.

So, it was a bit alarming to read this gripping account by a prolific “whitehat” coder who goes by the handle @SamCzSun about a recent all-nighter he pulled to rescue $9.6 million worth of ether. The funds were sitting in a smart contract associated with Lien Finance, an Ethereum-based protocol for decentralized options and stablecoins, and were vulnerable to a bug that he’d discovered. Being the honest player that he is, he felt compelled to place the funds into a safe environment before someone could dishonestly claim them. The security researcher talks about the challenge he faced in reaching out to someone from the Lien Finance team, since its leadership is all anonymous. Who could he trust? And when he did find someone to help, they faced the challenge of ensuring that their rescue operation wouldn’t tip off others and create a front-running opportunity for them.

The whole thing demonstrates the downside of decentralized finance. The absence of a middleman and the use of decentralized governance might well create special opportunities for financial creativity and access to finance. But, when things go wrong, the under-regulated structure of DeFi makes it extremely difficult for people to appeal to the one thing they often need in a crisis: someone to trust. It also reminded me of the vital role played by white hackers like @SamCzSun, who could have easily grabbed the $9.6 million for himself. Not only do they keep people safe from bad guys, but, in finding flaws, they help developers fix and strengthen the system.

DATA, CLIMATE AND FINANCE. In last week’s column, we discussed how important it is that blockchain and cryptocurrency technologies be calibrated to the challenge of mitigating climate change. But it’s not just this new form of finance that needs alignment with a healthier planet, it’s also old finance, whose investment priorities have for too long skewed in favor of fossil fuel-reliant industries, even though many economists now argue that those investments represent “stranded assets.” As this report from Refinitiv and OMFIF points out, to get financial services to invest more sustainably requires “clear and consistent Environmental, Social and Governance data.” The idea behind ESG is that if reliable data can be provided on environmental performance, more effective mechanisms for rewarding carbon-reducing investments can arise. But right now, both data and the regulations surrounding environmentally sound investments are inconsistent across the globe.

Interestingly, the report makes a clear case for central banks to play a role in setting consistent standards. But what if, as we’ve discussed in a few Money Reimagined newsletters, the whole function of central banks comes into question as technology, economic imperatives and geopolitical tensions move us to a more fragmented, multi-currency world? It’s my view that the world needs data sources that can be trusted across borders, regardless of where they are collected and regardless of the local regulator’s reputation and enforcement capability. It’s where there has to eventually be a place for decentralized systems that can both affirm the reliability of environment-measuring devices and immutably record their data in distributed ledgers that all can access.

Things get really interesting when there’s an intersection between decentralized environmental data and decentralized finance. (See Ian Allison’s piece on Ocean Protocol below.) That’s when carbon markets can be spun up by anyone anywhere so that any innovator with a climate change-fighting project can unlock the capital they need from anywhere else in the world.

Relevant reads

Digital Euro Would Provide Alternative to Cryptos, ECB President Lagarde Says. Europe’s goal to develop a central bank digital currency was given a boost when Christine Lagarde, president of the European Central Bank, gave a forceful speech in its favor. As the former head of the International Monetary Fund, Lagarde is something of an international finance rockstar. Her words matter. Dan Palmer reports.

The Currency Cold War: Four Scenarios. In the currency war of the future, who ends up on top? The U.S.? China? Bitcoin? Or some multi-currency world. Jeff Wilser surveys four futurists on what to expect as part of our Internet 2030 series.

Ocean Protocol and Balancer Want to Do for Data What Uniswap Did for Coins. DeFi for data markets. This is when things get really interesting. Ian Allison reports on Ocean Protocol’s use of a DeFi-inspired automated market maker (AMM) model for achieving something many have struggled to achieve.

How Small Business Can Achieve ‘Economies of Scale’ by 2030. In another contribution to our Internet 2030 series, EY’s Paul Brody foretells a future of “re-decentralization” in which smart contracts and seamless, digitized commercial systems create new opportunities for small businesses to work together and once again compete with the big monopolies that currently dominate our world.