Mission Critical: Orange-Pill The Orange Man

Why is it imperative that Bitcoiners explain the benefits of Bitcoin to Donald Trump?

Bitcoin capital does not care where it resides. It will go wherever it gets the best treatment. I want the United States of America to be the best place for Bitcoin capital and the Bitcoin industry. I want my home country to be a part of the future instead of the past. I cannot move away from the U.S. in the next ten years. My roots are too deep here in America. I know there are many just like me. We cannot avoid the decisions of our government. If they ban bitcoin, we will face deciding to go underground, flee our homes, or give up our bitcoin. I do not want to make that decision. I know many others who also don’t want to make that call. So I will do whatever it takes to ensure that the U.S. is the best place to buy, sell, trade, earn, mine, and HODL bitcoin. I want myself and my family to live in a nation that sees the potential of Bitcoin and works to adopt it in full. If you live in the U.S., I hope you will join me fighting for that future.

Two Windows Of Time

The following five-10 years will be critical in our direction as a country as nations worldwide grapple with the decision to adopt or fight bitcoin during its early stages. Unfortunately, we have members of Congress (MOC) who want to over-regulate or potentially ban bitcoin and all crypto in the U.S. If we do nothing and sit on our hands, there will likely be successful efforts to damage Bitcoin adoption in the U.S. and hurt our shot at being a big player in the inevitable Bitcoin future.

Realistically, we are playing with two windows. First, in these next five-10 years, we face a period where Bitcoin infrastructure and industry are vulnerable in the U.S. because they are not entrenched as power players in the American political process. The second time window is the long-tail event of “full Bitcoin adoption.” I want to prevent any dangerous policy from passing in the next five-10 years, AND I also want to cut in half the time it takes for the U.S. to adopt Bitcoin fully. I do not put a specific timeframe on the “full adoption window” because it is impossible to know how long it would take for adoption to occur if we did or didn’t actively pursue it. As I’ve stated in the past, I believe that adoption is unavoidable, but sooner is better for the U.S., which is better for you, your family, and your future if you plan to reside within America’s borders.

Although adoption is essential, I choose to focus on the here and now, ensuring that we do not enact any dangerous or harmful legislation in the next five-10 years. In 10 years or less, I predict the industry will be too entrenched to uproot. Here in the good ol U-S-of-A, there aren’t many more significant threats to our Bitcoin future than the Federal government’s ability to screw us over. They exercise incredible power via the presidential administration, Congress, and the Federal Reserve Board. Given historical precedence, more policies that attack Bitcoin are coming, so we need to be ready to fight back. If we don’t resist legislative attacks on Bitcoin, anti-Bitcoin bills from MOC like Representative Brad Sherman will make it to the floor of the House and pass because we sat on our hands.

One way you can fight back is by getting close to your elected officials and incentivizing them to protect Bitcoin adoption or educating them on Bitcoin to the point that they understand it and will fight for it of their own volition.

Bitcoin And The U.S.

The next President of the United States of America to have complete control over the federal government will likely face a historic decision. Do we adopt Bitcoin or fight this new technology because “it feels like” a threat to the dominant financial power that the U.S. has amassed? It is unlikely that the current administration has the political willpower or the desire to properly attack Bitcoin any further than the “crypto tax reporting” amendment, which already has at least three replacement bills in the works. Although Bitcoin policy is more critical to the future of our country, it does not get directly in the way of the Biden administration meeting (or not meeting) its legislative goals. In any case, Biden is focused on the “Build Back Better” agenda.

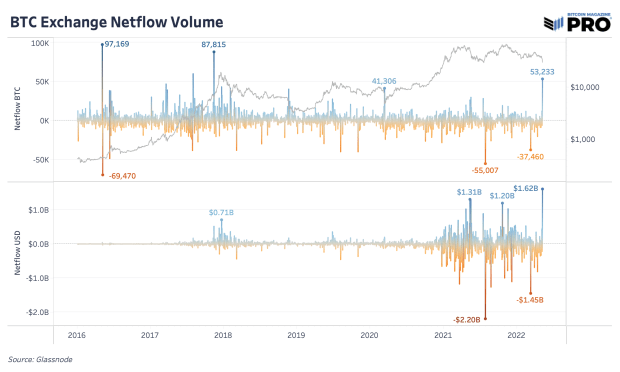

To clarify, I am not worried that the U.S. could harm Bitcoin. An attack by the U.S. would only aid Bitcoin toward its antifragile future. I worry, instead, that we will follow the same path as China and overregulate Bitcoin mining in this country or ban it outright. We may end up replicating the same policy blunder as the Chinese Communist Party (CCP), which kicked miners out of their borders in September 2021. That move by the CCP will likely go down in the history books as one of the worst policy blunders by a superpower in the last 100 years, if Bitcoin adoption goes the direction most of us believe it will. Unfortunately for the people of China, their leaders are known for making poor decisions that negatively impact their society and culture, lasting for generations, such as staying on the silver standard in the early 1900s,1 and burning their navy ships in the 1500s.2 These moves tend to occur during times of significant change where incumbent powers are tested. Still, times of transformation are where the U.S. shines best, likely in part due to our culture of seeking innovation encouraged via the decentralized nature of our states which compete for capital and residents. We have seen several states become dominant players in new and growing industries over the decades due to their ability to attract and out-compete their neighbors. Cars, oil, tech, and finance have all found a state to call home.

Today, several cities and states are becoming a hub for Bitcoin in the U.S. However, this time is different. Some may view Bitcoin as a direct threat to the United States federal government. They may see it as a challenge to U.S. economic power via its dollar hegemony. This “threat to the status quo” is not new for America. The U.S. has consistently allowed the powers that be to become the powers that were. Cars overtook horses, air travel surpassed railways, and cellphones displaced landlines. This time may seem no different, yet we face a significant hurdle in U.S. Bitcoin adoption. The U.S. has built considerable power around controlling the global financial system, and Bitcoin is poised to disrupt that control. Giving up power and letting Bitcoin thrive would be a massive move in the right direction for America. Still, ultimately it would upend the control by some of the most powerful entities in our society: the central banks. Unfortunately for the bankers, they don’t have a choice. Bitcoin is here to stay. Nations that jump on board now reap the benefits of early adoption, and I want the U.S. to be one of those nations. But at some point, all countries (with access to the internet) will adopt Bitcoin.

Suppose the U.S. decides to ban or over-regulate the Bitcoin industry so that miners and other industry partners move overseas. In that case, we will miss out on the next 100 (1,000?) years of growth as Bitcoin, and crypto-related capital flees for new shores.

Bye-Bye Biden

President Biden will face the first real test of his policies in the 2022 midterms. Presidents usually lose seats during their first mid-term regardless of their performance. In fact, since World War II, the sitting president’s party has lost an average of 26 seats in the House and four seats in the Senate,3 but analysts and politicos worldwide are bracing for a blood bath for Democrats in the coming midterm. There is a strong case that Biden will lose the House and the Senate. But even if he loses just one legislative body, it will hamstring his administration. A loss of either the House or Senate will keep Biden from making unilateral attacks on Bitcoin. So as we head towards 2024, Biden will be weakened, hamstrung, and void of a mandate (more on this). From there, it only takes a solid opponent to oust him in the 2024 presidential election.

The case for Biden’s removal from power? Let’s start with the midterms and move forward. Biden’s biggest problem in the midterms is plain and simple: Donald Trump is gone, so Democrats can’t effectively run against Trump in the midterms as they did in 2020. In politics, it’s always a losing strategy to campaign against someone who is no longer in office. So, it’s up to the Biden administration to convince voters they have done an exceptional job handling the pandemic and the recovery, or at least a good enough job to hold onto power. Voters arguably brought in Biden to deal with COVID-19 and the shutdown process as many voters lost faith in Trump to manage the country during the pandemic. Since Biden has been in office, fears over COVID-19 and the desire for sustained shutdowns have dropped dramatically. The new number one problem in voters’ minds is the economy, and the number one issue driving fears about the economy is inflation. Voters are growing unhappy with Biden’s direction as we move away from closures.4 Rising food, gas, and home prices have many concerned about the future. Inflation is at its highest in nearly 40 years. A rising cost of living is enough motivation to get voters to turn out for the opposition. Still, on top of that, ads will also target midterm voters with non-stop videos of U.S. military planes taking off from Afghanistan airports. Those videos will play blurry images of terrified Afghans plummeting to their death while trying to hold onto the outside of the aircraft as they attempt to flee the Taliban during the abrupt U.S. departure in August of 2021. After 20 years of managing Afghan defenses, the move to abandon the Afghans showed weakness to our adversaries. It will likely result in further aggression worldwide from those who wish to harm America. A dark shadow will blanket any excitement to turn out for Biden due to this embarrassment on the geopolitical stage. Governing is not easy, and mistakes happen, but this was a self-inflicted wound that will galvanize voters who worry about national security and foreign policy to vote a wave of Republicans into power. Biden’s only hope is to claim victory over the pandemic once the omicron variant has passed, which I assume he will attempt, but voters will still be left with a worrisome view of the future. Many believe inflation will persist well into the future.

Under this theory, Biden will be immobilized within 12 months from today, once he’s lost control over the federal government’s legislative branch, which only requires the loss of the House or the Senate. (Remember, he only has a one-vote lead in the Senate.) Once he has lost, Republicans will become a thorn in Biden’s side as they have for every Democrat president since the days of House Majority Leader Newt Gingrich. As a result, very little will happen in the way of any legislation – including aggressive anti-Bitcoin legislation – between 2022 and 2024 as both sides prepare to face off for the ultimate presidential showdown where I predict that Trump will return to run against Biden. This December, Biden declared that he would run for a second term. I expect Trump to wait till after the midterms to announce his third run. That move will minimize any ability of the Democrats to run against him during this cycle.

“Never interrupt your enemy when he is making a mistake.” – Napoleon Bonaparte

That patience will pay off for Trump. A sweeping victory in 2022 will bolster Trump’s odds of winning in 2024 as he can declare it as evidence for his “needed return” so he can run on his favorite issue, “saving the economy.” And if he is genuinely being patient, Trump will wait to declare his candidacy until after the Republicans have filled their new seats in D.C. in January. Waiting until January will avoid any incentive for Democrats to lay poison pills on their way out of power, which they will do anyway but they’ll have less leverage if Trump stays quiet.

Orange Man Returns

If (when) Trump declares his candidacy for president of the U.S., most Americans will be surprised as they realize he can return to the Oval Office. Many Americans are likely unaware of this possibility because we haven’t had a president with disjointed terms since Grover Cleveland ended his first term in 1889 and returned in 1893. Oddly enough, Grover left his first term in office under the same storyline of “voter fraud accusations.” Unlike Trump, Grover accepted defeat and even held an umbrella for his opponent, Benjamin Harrison, during Harrison’s inauguration. When Harrison was up for re-election, he lost to Grover for the same reasons I predict Biden will lose: mismanagement of the economy and labor unrest. History doesn’t always repeat, but it rhymes.

If the story plays out as it did in 1893, Trump will return for a second term where he will be joined by the most conservative Supreme Court in almost 100 years.5 If he is fortunate, he will return to power with a Republican-led House and Senate.

If it plays out this way, which is NOT a guarantee but more likely than many Democrats want to admit, Trump could potentially have excessive amounts of power during his second term in office. Trump accomplished an incredible amount for Republicans and Conservatives during his first term with less control over the federal government. That level of power is dangerous for Bitcoin in the U.S. because Trump is the type of president who would use his bully pulpit and the authority of the presidential pen to dismantle America’s chances of aligning with a Bitcoin future. Trump recently has made comments directed at crypto, saying that “it could be an explosion the likes of which we have never seen” and that “it’s a very dangerous thing.”

These statements show he is ready to take aggressive action to defend the entrenched powers in the financial system. Furthermore, it shows Trump sees the entire crypto space as a threat. I can’t blame him, and if we know anything about Trump, it’s that he loves America and would be the president to symbolically attack Bitcoin if he sees it as a threat to the U.S. dollar or U.S. power. Trump’s excessive power plus his propensity to attack any threat to America is why it is mission-critical to orange-pill Trump before he takes on a second term and becomes the 47th president. Orange-pilling Trump would mean (at minimum) he doesn’t view Bitcoin as a threat to the U.S. and that we have a lot to gain from adopting Bitcoin early. The hope is he can see the benefit of holding bitcoin as a reserve asset and that he sees Bitcoin mining as a productive new industry for America to compete in. If this threshold is met, Trump may use his powers the same way President Bukele of El Salvador used his: to make favorable decisions that will help push the U.S. towards an orange future.

Bitcoin, at its core, is one of the most American pieces of technology ever devised. It protects individual freedoms and minimizes the role of government without hurting the interests of the U.S. globally. In fact, with the advent of stablecoins and the inevitable decline of fiat currencies worldwide, the dollar may become more robust than ever as many individuals and entities worldwide seek a more stable currency (look up the Dollar Milkshake Theory). Orange-pilling Trump would be ideal, but we must also think pragmatically. The backup plan to keep a “worst-case scenario” from playing out would be to get enough Republican members of Congress to block any moves by Trump to attack Bitcoin. For this effort, I have been encouraged by the level of adoption by Republican members of Congress. On the Republican side of the aisle, Ted Cruz, Cynthia Lummis, and Pat Toomey defend Bitcoin in the Senate. Republicans also have incredible members of the House such as Warren Davidson, Ted Budd, Tom Emmer, Patrick McHenry, and Kevin Brady fighting back against the “attack on Bitcoin” that was slipped into the infrastructure bill by the U.S. Treasury. Biden’s White House supported that attack which is more evidence for why Biden is out of touch and will lose to Republicans moving forward.

In the event that Trump wins and turns against Bitcoin, these orange-pilled (bitcoin-sympathizing) members of Congress may be our last line of defense. They may be unwilling to toe the party line if Trump decides to go the wrong way, or they may even be the ones to sit him down to explain why Bitcoin is a positive for the U.S. I could see a similar series of events playing out identical to how Trump became a “born again” Christian during his first run.6 It’s possible Trump could “see the light” on Bitcoin if enough good Bitcoiners create inroads with him and share the “good word of Satoshi” during Trump’s third run for President.

It isn’t easy to orange-pill a specific target. Hopefully, the worst-case scenario is that enough Republicans in Congress will be pro-Bitcoin and in a position to block bad legislation. They may also apply social pressure on Trump to ensure no critical damage is done to America’s chances of maintaining their Bitcoin industry edge over the rest of the world. This is why it is vital to pressure your local elected officials to take a pro-Bitcoin stance and to place pro-Bitcoin politicians in Congress for the next two cycles. Then, they can act as a last line of defense to stop any anti-Bitcoin policy coming out of the White House from passing in Congress.

I believe it is mission critical to get to Trump because he will likely be the last president who can do severe damage to the future of the U.S. during the period when Bitcoin was created, to when it becomes fully adopted by this nation and others. If Trump were to ban mining or enforce legislation that would push industry players out of this country, it would not be Bitcoin that loses, but America. If you plan to live here for the foreseeable future and want America to thrive as a Bitcoin nation, I suggest you work to prevent this from happening in whichever way you can.

Trump could be an incredible ally to Bitcoin’s future in the U.S., or he could lead us down the same path as the CCP. Regardless of your politics, if Trump wins, it is better for you and your family if he doesn’t attack Bitcoin. There is a danger when power is centralized, but it can also be of benefit if those in power make the right decisions. For example, El Salvador’s president, Nayib Bukele, learned about Bitcoin in 2017, and now El Salvador has a legal tender law, volcano-powered Bitcoin mining, and a “Bitcoin City” in the works. He was able to do that because he has a lot of political power in El Salvador. It may seem unlikely now, but Trump could also lead us down the same path if the correct series of events occurs. If you want to see the U.S. go down the route of adopting Bitcoin, I will encourage you to join me and the many others fighting for this future.

If you want to become a part of a bottom-up effort to get into Trump’s ear if (when?) he returns to the most powerful office in the world, make it known to the candidates and elected officials running for office that you will vote on the issue of Bitcoin. No matter if your city and state are red, blue, or purple, show up to events, write letters, make phone calls, contribute to campaigns, and let D.C. know that you want the U.S. to be a part of the future and that you want your home to be the best place in the world for Bitcoiners. We all need to make our leaders know we will move our votes and capital to pro-Bitcoin candidates who work to defend and promote this incredible technology in the U.S. After the recent crypto tax reporting amendment fight, I promise you, they hear us. Still, as we head towards 2024, it’s going to be critical that American-bound Bitcoiners get louder than ever before.

1. https://www.livemint.com/Opinion/rCrmpVooFkYuoAznk8VCVI/How-the-silver-standard-wrecked-Chinas-economy.html

2. https://www.independent.co.uk/news/world/americas/500-years-ago-china-destroyed-its-worlddominating-navy-because-its-political-elite-was-afraid-of-free-trade-a7612276.html

3. https://en.wikipedia.org/wiki/United_States_midterm_election#:~:text=The%20party%20of%20the%20incumbent,four%20seats%20in%20the%20Senate.

4. https://morningconsult.com/2021/10/20/inflation-economy-biden-policies-poll/

5. https://www.cnn.com/2020/09/26/politics/supreme-court-conservative/index.html

6. https://www.theatlantic.com/politics/archive/2016/06/trump-born-again/489269/

This is a guest post by Dennis Porter. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

![Reshape Blockchain Security With BlockSafe Technologies – [BTC Media Sponsor]](https://www.lastcryptocurrency.com/wp-content/uploads/2018/10/6285/reshape-blockchain-security-with-blocksafe-technologies-btc-media-sponsor.png)