MicroStrategy’s Bitcoin Holdings And The Grayscale Bitcoin Trust Discount

Shares of GBTC are trading below prices seen during the 2017 bull run and markets are repricing the level of risk of holding MicroStrategy equity.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Bitcoin Investment Vehicles

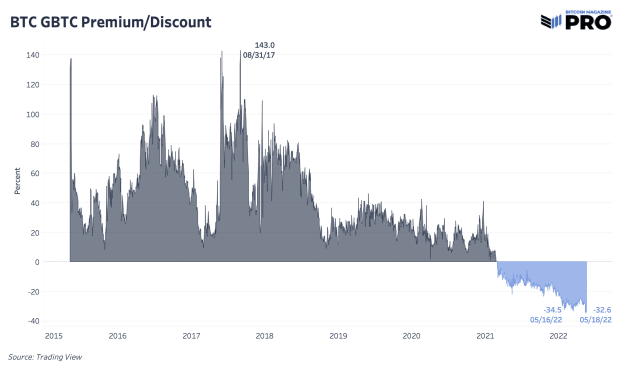

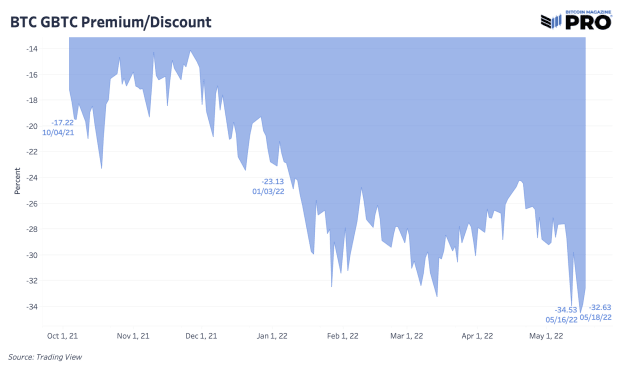

In our issue last month, GBTC Discount Shrinks, we highlighted the latest state of the Grayscale Bitcoin Trust, an overview of its spot ETF approval process and expected 2023 timeline. At that time, we were seeing a reversal in the GBTC discount trading at 23.15% up from its 30% low.

Since then, the discount has dropped further, reaching an all-time low of 34.5% this week. Likely this steepening discount is a result of more market sell-offs in risk appetite and the market’s reaction to the LUNA UST market blowup. Although the failure of LUNA can be thought of as strengthening the case for Bitcoin long-term (the best will survive), this example will certainly be used as firepower for increased government regulation, scrutiny and investor protection efforts across the entire industry.

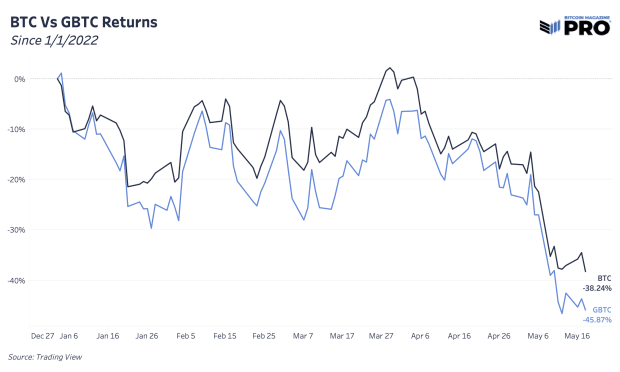

Regardless of the exact reasons for the lower GBTC discount, the lack of a bitcoin spot ETF in the United States continues to affect GBTC holders with performance down an additional 7.63% year-to-date relative to bitcoin.

For funds and individuals looking to dip their toe into some bitcoin exposure, GBTC looks to be a fantastic purchase, equivalent to buying bitcoin at approximately $21,000 with a 2% annualized management fee. While it is obvious that shares of GBTC that trade in secondary markets come with none of the self-sovereign properties of the native on-chain bitcoin, if/when the trust converts to an ETF, GBTC shares offer steep upside relative to bitcoin.

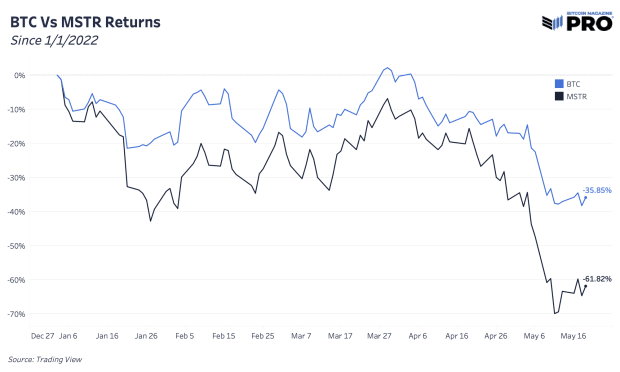

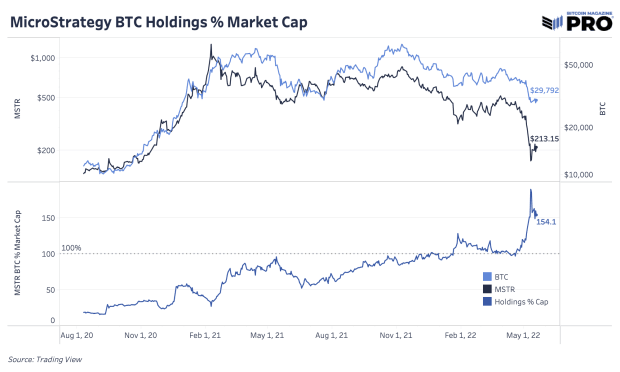

Lastly, we have one of the most prominent bitcoin exposure vehicles over the last two years, MicroStrategy. As per their earnings presentation earlier this month, the company owns 129,218 bitcoin with an average cost basis of $30,700. As a result of their leveraged debt position to purchase bitcoin and bitcoin’s 36% year-to-date drawdown, markets are repricing the level of risk of holding MicroStrategy debt and equity. MicroStrategy is down 61.82% year-to-date while MicroStrategy’s value of bitcoin holdings now makes up 154% of their entire market cap.

While buying MSTR today does imply strong future expected performance in the price of bitcoin, if one is right with that assumption, shares of MSTR would be one of the best bets to make over the medium/long term, given the company’s near un-liquidatable leverage bitcoin position, and access to public capital markets along with free cash flow and a growing public brand.