MicroStrategy’s Bitcoin Holding Doesn’t Necessarily Pose a Concentration Risk: Bernstein

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/downloads.coindesk.com/arc/failsafe/user/1x1.png)

Will Canny is CoinDesk’s finance reporter.

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

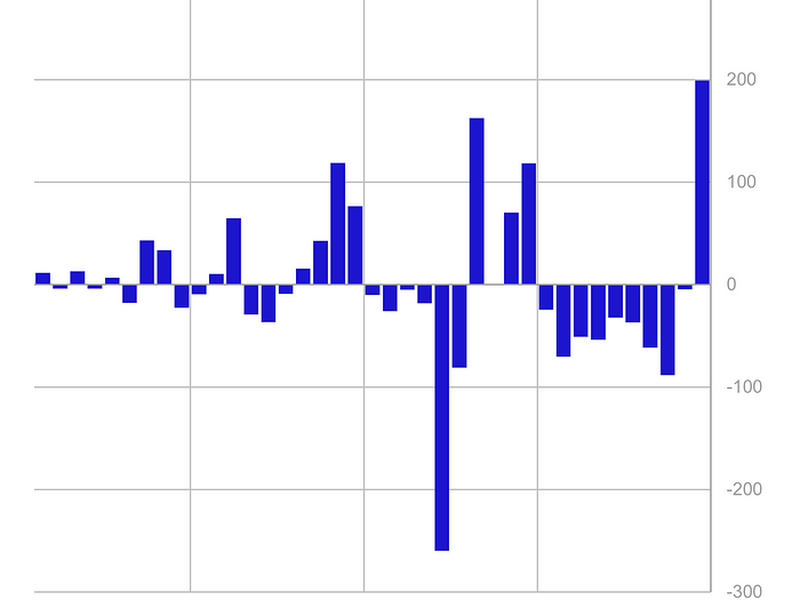

Whether MicroStrategy (MSTR) sells its bitcoin (BTC) tokens to pay down debt is closely tied to how the cryptocurrency performs. The position is not large enough to distort prices but it does present a sentiment risk in a down cycle, Bernstein said in a research report Wednesday.

The business analytics software company is the largest corporate holder of bitcoin as a balance sheet treasury asset, owning around 140,000 BTC at an average cost of $29,800. The stash is worth about $4 billion at current prices, the report said.

The company has about $2.2 billion in debt, with repayments due in 2025 and beyond. It has pledged 15,000 of its bitcoins, Bernstein said.

“High BTC prices mean a stronger balance sheet, higher stock prices and easier debt repayment without selling its BTC holdings,” analysts Gautam Chhugani and Manas Agrawal wrote.

MicroStrategy holds around 0.7% of total bitcoin in circulation, representing about 20% of daily average traded volume in spot markets, the note said.

At those levels, MicroStrategy does not “necessarily pose a concentration risk” even if trading volumes fell during a bear market, though it may affect market sentiment.

“The potential liquidation of MicroStrategy’s BTC during bear markets creates an overhang for BTC in a down cycle,” it said.

Edited by Sheldon Reback.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/downloads.coindesk.com/arc/failsafe/user/1x1.png)

Will Canny is CoinDesk’s finance reporter.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/downloads.coindesk.com/arc/failsafe/user/1x1.png)

Will Canny is CoinDesk’s finance reporter.