MicroStrategy Ups the Stake: Will Raise $900 Million to Buy Bitcoin

MicroStrategy has announced the pricing of its offering of $900 million aggregate principal amount of 0% convertible senior notes due 2027. As it happened the last time the company made such a move, it plans to allocate all funds into bitcoin after the offering closes on February 19th, 2021.

- CryptoPotato reported yesterday that the NASDAQ-listed business intelligence giant MicroStrategy said it would offer a $600 million convertible senior notes offering to qualified institutional investors. However, the firm has expanded its target by 50%.

- According to the latest statement, dated February 17th, Michael Saylor’s company will aim at raising $900 million. Despite the difference in the amount, MicroStrategy could again “redeem for cash all or a portion of the notes at a redemption price equal to 100% of the principal amount of the notes to be redeemed.”

- Interestingly, the company reaffirmed that it will use the net proceeds from the sale of the notes to acquire additional bitcoin.

- MicroStrategy already employed a similar strategy last year when it raised $650 million in such notes and bought BTC.

- Ultimately, the company has allocated more than $1 billion in the primary cryptocurrency over the course of several separate purchases.

- Additionally, MicroStrategy has led Bitcoin educational programs for corporations, and the company’s founder and CEO, Michael Saylor, has released such panels for retail investors as well.

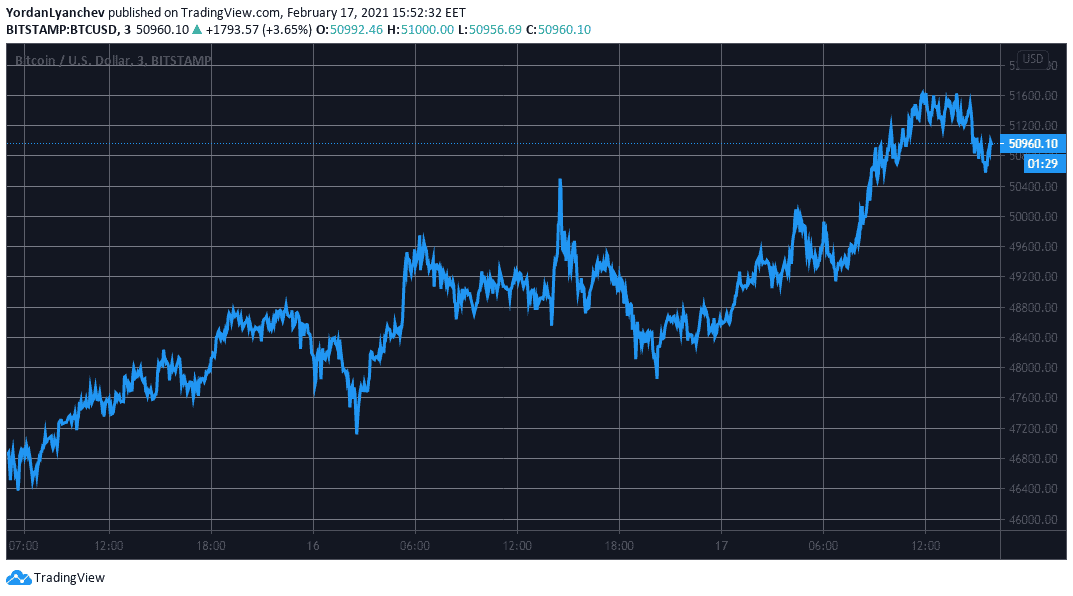

- The latest announcement came amid BTC’s newest all-time high. The primary cryptocurrency spiked to a new record of above $51,700 a few hours ago.