MicroStrategy Pledges to Add More Bitcoin to Corporate Balance Sheet

CEO Michael Saylor struck a defiant tone during a Q2 investor call, pledging to add more Bitcoin to its balance sheet while continuing to advocate for the cryptocurrency.

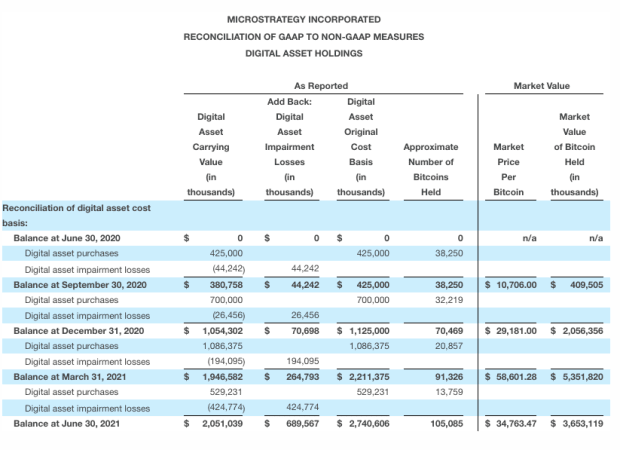

Publicly traded business intelligence firm MicroStrategy is pledging to add more Bitcoin to a corporate balance sheet that already includes 105,000 BTC worth roughly $4 billion.

In a statement issued before the conference, MicroStrategy CEO Michael Saylor noted: “We continue to be pleased by the results of the implementation of our digital asset strategy. Our latest capital raise allowed us to expand our digital holdings, which now exceed 105,000 bitcoins. Going forward, we intend to continue to deploy additional capital into our digital asset strategy.”

Speaking during a live video call with investors Thursday, CEO Michael Saylor and CFO Phong Li struck a defiant tone at a time when the mainstream press has taken aim at the firm for its focus on accumulating Bitcoin amid its recent market downturn.

However, Saylor appeared unassuaged by criticism, stating: “Our macro strategy is to acquire and to hold Bitcoin. We’ll help explain Bitcoin to the regulators, to the public and to the media.”

“We think acquiring Bitcoin at this time is going to be a wise move. We feel like there is a land grab right now to acquire as much as we can,” he said.

Elsewhere, Saylor said he was “pleased” with the investment (to date the firm has invested over $2 billion in Bitcoin), while describing an improving economic environment for Bitcoin despite negative news catalysts that have seemingly deterred retail investors of late.

“The China exodus was a really good thing for Bitcoin. The result was a decentralization of mining throughout the world,” Saylor said. “Long term, the Westernization of Bitcoin is good for Bitcoin, the U.S. dollar and Western technology.”

Still, in the question-and-answer portion of the event, Saylor faced no shortage of questions, including whether the company would consider investing in other “crypto assets” including Ethereum.

Saylor replied, “Our strategy is to focus on Bitcoin. I can plug Bitcoin into the entire digital economy and it makes everything better. Bitcoin fixes everything.”

“The least risky, most diversified investment strategy is to simply hold Bitcoin.”

For his part, Phong Li backed Saylor’s statements arguing the investment has “generated substantial value for shareholders” and noting that the company is still in the early stages of deploying its Bitcoin strategy.

“Bitcoin is the most widely held financial asset in the history of the world, growing at the fastest rate,” Saylor said.

“If you roll back the clock twelve months it’s hard to find any publicly traded companies with Bitcoin on the balance sheet. Now you’ve got over a dozen companies with billions of dollars in Bitcoin on the balance sheets.”

On the future of MicroStragey, Saylor stated, “Going forward you can expect we will purchase additional bitcoin.”