MicroStrategy Added Nearly 9,000 BTC to Its Holdings During Q3

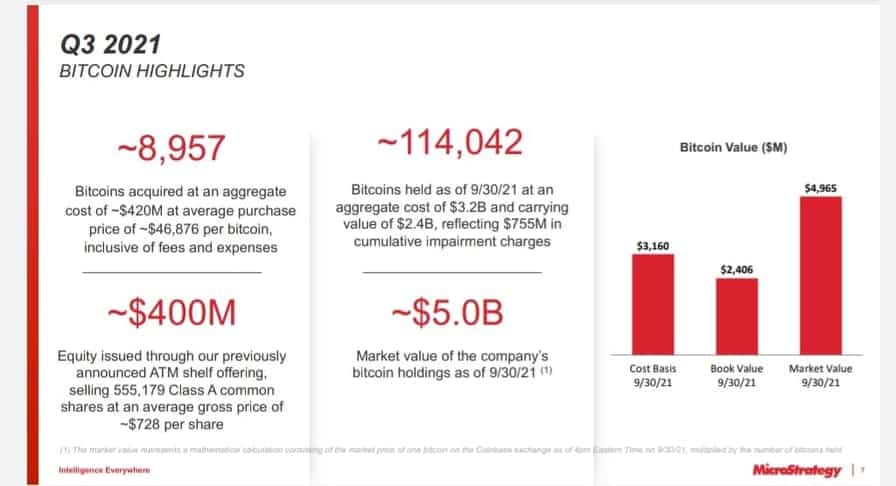

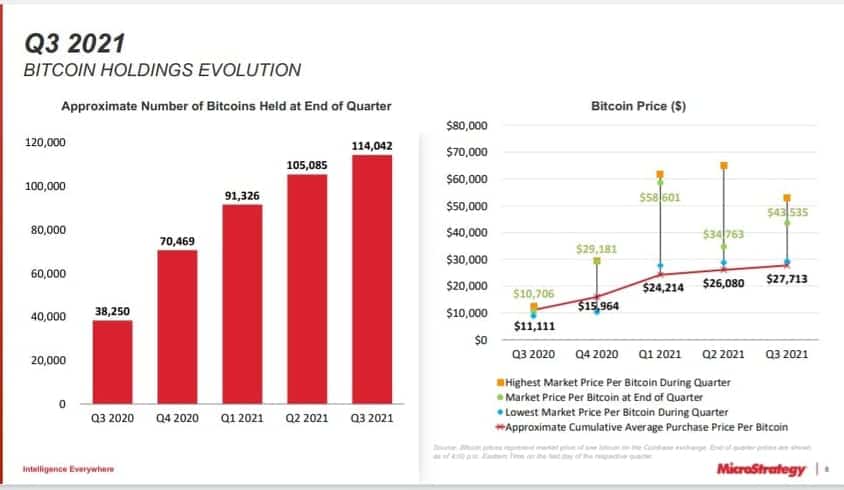

The business intelligence corporation – MicroStrategy Incorporated – doubled down on its cryptocurrency endeavors during the third quarter of 2021 by purchasing 8,957 BTC in that period. Thus, the company now holds around $7 billion worth of the primary digital asset (calculated at today’s prices).

MicroStrategy: The Bitcoin Whale

MicroStrategy announced the results in its Q3 earnings report. According to it, the firm acquired 8,957 BTC between July and October this year at an aggregate cost of $420 million, while the average price per coin was $46,876.

As such, the entire stash reached 114,042 BTC. Currently, the USD value of the leading cryptocurrency stands at around $61,000, meaning that MicroStrategy’s holdings are worth a little over $7 billion.

The software firm also announced that it had increased its BTC possessions by almost 200% since the same period in 2020.

The prominent bitcoin bull Michael Saylor – Chief Executive Officer at MicroStrategy – described his company as the “world’s largest publicly traded corporate owner” of the leading digital asset. He asserted that the organization will keep its pro-BTC stance and acquire more tokens in the future:

“We will continue to evaluate opportunities to raise additional capital to execute on our bitcoin strategy.”

In fact, “Acquire And Hold Bitcoin” is one of the main corporate goals of MicroStrategy. More specifically: purchase BTC through the use of excess cash flows and debt and equity transactions; hold the primary cryptocurrency for the long-term; and provide leadership among the community.

No BTC Price Can Make Michael Saylor Sell

MicroStrategy’s leader is, by all means, one of the biggest proponents of bitcoin. In a recent appearance, he asserted his support by saying that no force can make him sell any tokens, whether his personal ones or those belonging to the company he runs.

As a true advocate of the asset, he opposed Peter Schiff. The latter, who is a well-known critic of the cryptocurrency industry, claimed that BTC is an asset that “has an even greater potential to make you poor.” On the contrary, Saylor said, “there is a much bigger chance to become rich by buying bitcoin than buying gold.”

To prove his point, MicroStrategy’s CEO added that people can generate wealth if they invest in a “big tech dominant digital network that everybody needs, nobody understands, and nobody can stop.” It sounds like an appropriate description not only of bitcoin but also of Google, Amazon, Facebook, and Apple in their early days.