Michael Saylor’s MicroStrategy Bitcoin Bet Tops $4B in Profit

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

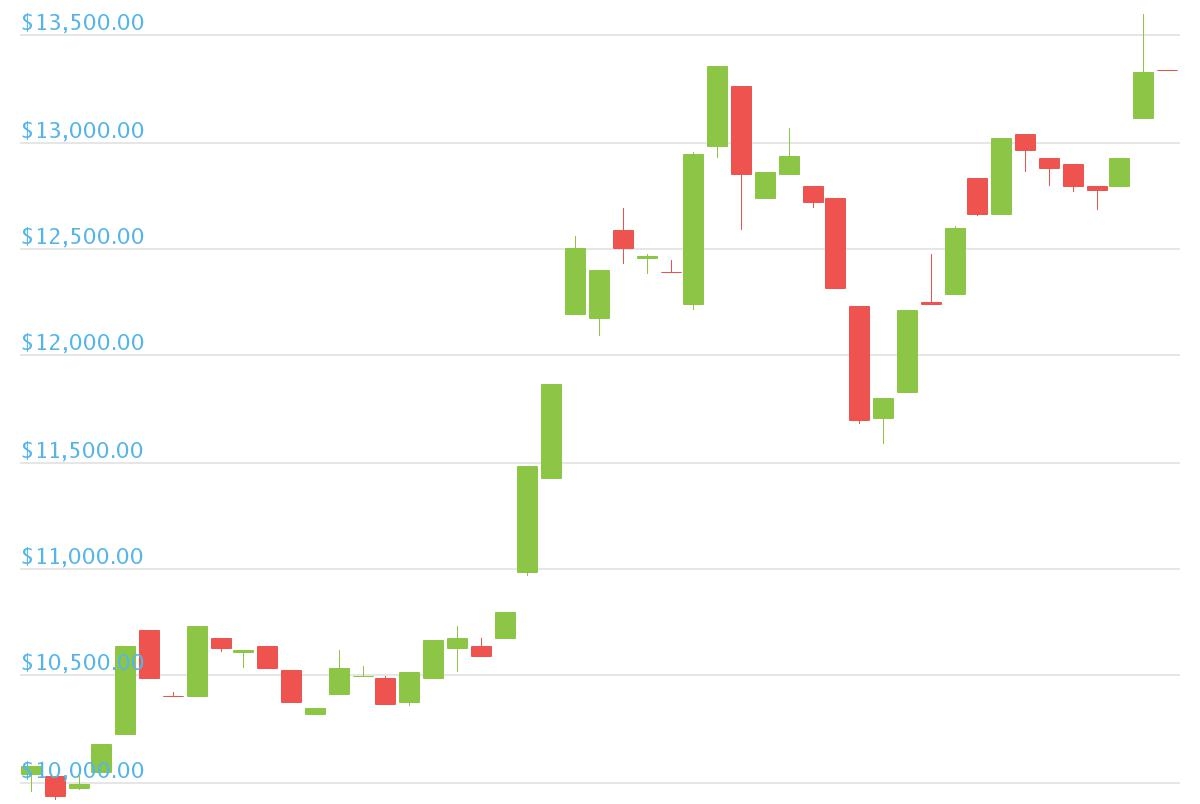

With bitcoin’s (BTC) price rise to just shy of $53,000, MicroStrategy (MSTR), the largest corporate owner of the crypto has seen its holdings move above $10 billion, amassing a profit of more than $4 billion.

According to the company’s most recent investor presentation, MicroStrategy at the end of January held 190,000 bitcoins purchased for a total of $5.93 billion, or $31,224 per coin. MicroStrategy began acquiring bitcoin in the second quarter of 2020, and has purchased additional tokens every quarter since. In December last year, the company was sitting on a profit of nearly $2 billion, but that’s since doubled thanks to bitcon’s more than 20% rally since the start of 2024.

Bitcoin rose to $52,800 early Thursday morning, bringing the value of MSTR’s holdings to just above $10 billion and its profit to more than $4 billion. The price has since pulled back somewhat, trading at $52,000 at press time.

MicroStrategy co-founder and executive chairman Michael Saylor recently said that the listing of the spot bitcoin ETFs is pushing up the token’s price as it’s brought about a massive imbalance in the supply/demand equation thanks to a decade of pent-up yearning for a retail accessible BTC product.

MSTR shares were flat in Thursday morning trade and up 21% year-to-date.

Edited by Stephen Alpher.