Michael Saylor’s Bitcoin Billions Have Rebounded Since He Exited CEO Job a Year Ago

-

A rebound in the price of bitcoin has sharply narrowed losses for MicroStrategy’s holdings of the crypto.

-

All indications are that Saylor’s company will continue adding to its bitcoin stash.

When Michael Saylor stepped down almost exactly a year ago as CEO of MicroStrategy (MSTR), the software maker he founded in 1989, to become its executive chairman with a sole focus on investing in bitcoin (BTC), his digital-asset strategy was looking pretty bleak.

He had already spent billions of dollars of MicroStrategy’s money to purchase bitcoin — and his paper loss amounted to about $1 billion. Bitcoin had sunk to below $23,000, less than MicroStrategy’s average price paid: $30,664.

The bitcoin bubble had burst and questions circulated about how painful things might get for MicroStrategy, given that it had taken on debt to buy the cryptocurrency. And things got even worse after his August 2022 job change. Crypto exchange FTX collapsed months later, taking bitcoin below $16,000 and giving Wall Street credit analysts reason to evaluate just how distressed MicroStrategy was getting.

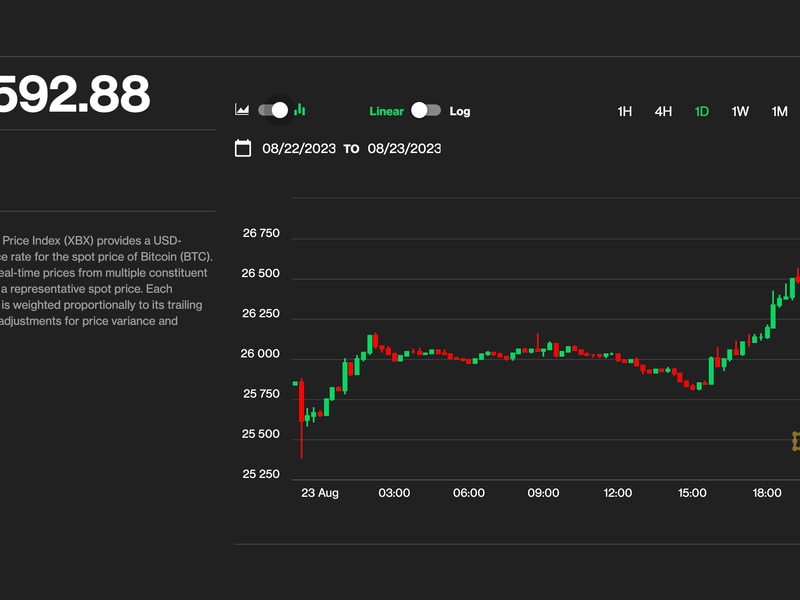

Today, though, MicroStrategy’s position looks brighter as bitcoin’s price has rebounded to above $29,000.

Saylor has bought more. MicroStrategy now owns 152,800 bitcoins, up from 129,699 when he surrendered the CEO job. Those new purchases have lowered MicroStrategy’s cost basis to $29,672.

Bottom line: MicroStrategy is nearly back in the black with bitcoin. And its stock price has recovered some, too. It’s around $390 now versus $270 a year ago (though still down from its 2021 high of nearly $1,300).

Saylor had begun purchasing bitcoin for MicroStrategy’s balance sheet in August 2020, fueling its stock rally alongside bitcoin in 2020 and 2021. Taking a wider view, Saylor this week pointed out that MicroStrategy’s share price is up 254% since he first began making bitcoin purchases, well ahead of the Nasdaq’s 31% advance and gains by individual tech stocks like Google parent Alphabet (GOOGL), Apple (AAPL) and Microsoft (MSFT), which are each higher by 60% to 76%, during that time.

Looking forward to the second anniversary of Saylor’s exit from an operational role at his company, MicroStrategy will likely own substantially more bitcoin than it does now as the company this week announced a $750 million share sale, the proceeds of which will be used in part to purchase more of the crypto.

Beyond buying more bitcoin and being one of the original cryptocurrency’s biggest evangelists, Saylor has spent some of his energy this year working to expand the adoption of the Lightning Network, a layer-2 scaling system designed to make bitcoin payments cheaper and faster.

In April, he integrated that Lightning Network into his corporate email address, allowing anyone to send the billionaire bitcoin to saylor@microstrategy.com. While he likely doesn’t need anyone’s bitcoin, the move was meant to show the ease of use of the Lightning Address protocol, which lets developers replace a standard Lightning invoice, or payment request, with an internet identifier such as an email address.

“Are you disappointed bitcoin is still at $30,000?” Saylor was asked this week on CNBC, with the interviewer noting its inability to break to higher prices even with speedy inflation, exploding government debt and apparent growing institutional acceptance. Zoom out, Saylor replied. Bitcoin was not far over $10,000 when MicroStrategy began buying three years ago. “We’re glad we adopted bitcoin.”

Edited by Nick Baker.