Michael Saylor Says Republicans Have More ‘Progressive’ View on Crypto, Democrats ‘Drifting to the Middle’

-

“There’s no doubt the Republicans have taken a very pro crypto stance,” MicroStrategy Executive Chairman Michael Saylor said Monday.

-

Appearing on CNBC, Saylor reiterated his outlook that one bitcoin will be worth $13 million over the next two decades.

1:00:39

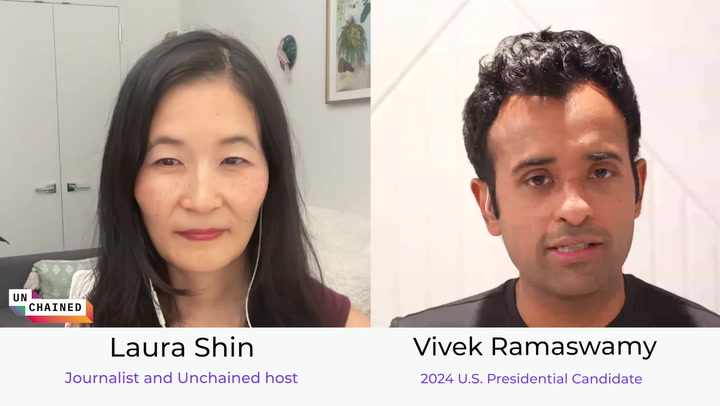

Why Presidential Candidate Vivek Ramaswamy Is So Pro-Crypto

1:02:43

Why Financial Advisors Are So Excited About a Spot Bitcoin ETF

00:37

October Was ‘Uptober’ for Bitcoin

13:53

Bitcoin’s Price Rallied 28% in October as Crypto Rally Widened

Republicans are way ahead of Democrats regarding their opinion of crypto and bitcoin (BTC), said MicroStrategy (MSTR) Executive Chairman Michael Saylor.

“There’s no doubt the Republicans have taken a very pro crypto stance […] Trump in particular.” Saylor said in a CNBC appearance on Monday when asked about the impact of the presidential election on the industry.

“At this point the Republicans have shifted to way progressive and the Democrats are drifting to the middle […] in terms of their view toward crypto and bitcoin,” he added.

Of U.S. Securities and Exchange Commission Chairman and crypto gadfly Gary Gensler’s role in a potential Harris administration, Saylor said it was above his pay grade to answer that question.

Saylor appeared unbothered by bitcoin’s recent brutal run, which saw the price tumbling to about a seven-month low below $53,000 last week. He reiterated his belief that bitcoin, which now accounts for 0.1% of global capital, will eventually rise to 7% of global capital, or a price of $13 million over the next two decades.

MicroStrategy, which recently rebranded itself to a bitcoin strategy company, now says its primary business is to securitize the world’s largest crypto. The company started purchasing bitcoin in August 2020 and currently owns roughly $8.3 billion worth of the asset at the current price.

Shares of MSTR have risen 879% since the company began buying bitcoin, though have slipped 20% over the past six months alongside the poor performance of BTC.

Edited by Stephen Alpher.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6d05e6ca-ca9b-44d0-97e6-b6bdceee3d6f.png)

Helene is a New York-based reporter covering Wall Street, the rise of the spot bitcoin ETFs and crypto exchanges. She is also the co-host of CoinDesk’s Markets Daily show. Helene is a graduate of New York University’s business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

Follow @HeleneBraunn on Twitter