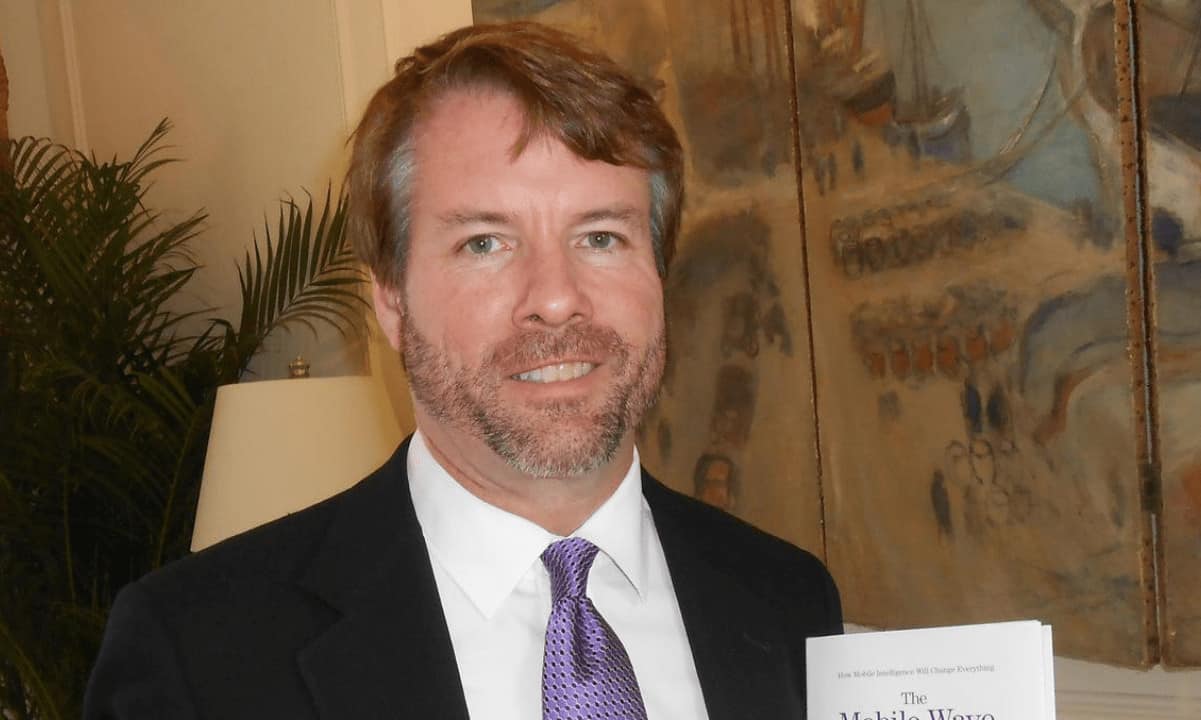

Michael Saylor: Ethereum Has its Place, Bitcoin is 50x Better Than Gold

After asserting once more that bitcoin is the better hedge than gold during these uncertain economic times, MicroStrategy’s Michael Saylor, known for his support only for BTC, also noted that Ethereum, and some other cryptocurrencies, have a place in the ecosystem.

Ethereum Has a Place Too

Ever since MicroStrategy started purchasing sizeable amounts of bitcoin, and Saylor did for himself as well, the company’s CEO has become one of the most prominent BTC maximalists. As such, he has rarely discussed any other digital assets and even more infrequently had anything positive to say.

However, he seemed significantly more optimistic about some cryptocurrencies, especially ether, in a more recent interview with CNBC’s Fast Money.

He called the network behind the second-largest cryptocurrency a “digital application” that wants to “dematerialize the JPMorgan building, the banking establishments, and all of the exchanges.”

Consequently, Saylor said, “there’s a place” for the Ethereum blockchain and its native cryptocurrency.

Similarly, he opined that stablecoins also have a spot in the ecosystem and compared them to the upcoming central bank digital currencies as they could have a somewhat identical role.

Bitcoin is Better Than Gold

Apart from his brief commendation on Ethereum and stablecoins, Saylor highlighted BTC’s merits over all other investment instruments as he has done numerous times in the past.

He justified his company’s decision to buy even more bitcoin after raising money by selling $1 billion worth of its Class A common stocks by calling BTC the most appropriate investment tool in times of increasing inflation.

“I think in the past 12 months, we have all been waiting for inflation, and I think we are seeing it now. I think investors are seeing that bitcoin is up by 330% and gold is up 7% in that period. So, bitcoin is outperforming gold as an inflation hedge by a factor of 50.

So, you are seeing Paul Tudor Jones and other early bitcoin believers thinking, ‘maybe it’s time for me to double or triple my allocation.’”

He doubled down on his belief that BTC is better than the yellow metal by saying, “I’m surprised they are not increasing their allocation by a factor of 10 because bitcoin is 50 times better.”

Despite being considered as a risky asset among some, the investment in bitcoin and the growth of the company have actually made “investors and shareholders happy,” Saylor concluded.

Featured Image Courtesy of Forbes