Michael Lewis’ SBF Biography Will Confuse People About Crypto

Brace yourself for Thanksgiving. “Going Infinite,” the new Sam Bankman-Fried biography by Michael Lewis, is about to send your aunt and uncle hurtling backwards in their understanding of what you do in crypto, and why. Though it tells a detailed and sometimes riveting story of one man’s rise and fall, when it comes to portraying the web3 community accurately, the book is a wet market of sloppy thinking that I feel compelled to address lest it spread mind viruses in the mainstream audience we fight so hard to reach with facts.

For those of us who’ve spent over a decade in this industry driven by core values – championing transparent rules, root ownership of assets, and permissionless access to finance – Sam Bankman-Fried has been poisoning the information ecology around crypto since his first trip to Washington, D.C.

Amanda Cassatt is the CEO of Serotonin.

SBF sought to invest financially in politicians in exchange for regulation that would protect FTX. The regulation he tried to buy would have created insurmountable barriers for actual decentralized finance protocols (that never custody user funds and operate transparently and permissionlessly on-chain) to achieve market share competing with FTX, whose business model, a centralized exchange, has existed intact for centuries, and that notably, did not offer customers direct ownership of any crypto assets, merely indirect access with no root ownership (obviating the actual benefit of blockchain) to the upside from them.

Cut to Michael Lewis on Monday’s “60 Minutes” on CBS describing his first meeting with SBF, the result of a friend who was considering investing in FTX asking the bestselling nonfiction author to “evaluate his character” (reminder to self: do not ask Michael Lewis for investment advice). Awestruck after a hike with SBF in the Berkeley Hills, Lewis spots an opportunity for himself to document SBF’s life. Lo and behold, SBF agrees, and after “two years speaking for countless hours,” Lewis comes in hot with a real knee slapper: How is it that in an industry where people don’t trust banks or governments, they trust FTX with all that money? That’s hilarious! Lewis and SBF casually conflate FTX with crypto, and custodial CeFi with DeFi, which was created and successfully functions today to combat this exact problem in CeFi of lack of control over one’s own assets.

Lewis does not feel responsible for ensuring his readers understand this distinction, which lawmakers from the EU to India now agree is crucial. There is no monolithic “crypto,” but rather very distinct DeFi and CeFi. Instead, in his effort to make characters “jump off the page,” Lewis presents a disturbingly sympathetic picture of the alleged fraudster as a weirdo whom nobody properly understood, a guy who must learn to simulate normal human emotions. Without saying it directly, it’s clear Lewis believes SBF suffers from autism, chalking up his subject’s shortcomings to neurodiversity, extreme youth and a sleep disorder.

Lewis is often breathless in awe of SBF. The fact that SBF made billions but doesn’t care about “worldly pleasure” fries his brain. In the Lewisean moral universe this makes SBF a moral actor like a monk. SBF is “sincere” and “even paid taxes”; his compound is “easy to steal from”; he wears T-shirts and only brings a suit to D.C.; he plays video games on calls with Anna Wintour. Lewis’s SBF doesn’t care about beauty to the point where he’s unable to judge whether other people are physically attractive, including his own romantic partners.

The moral physics of the Lewisean world are bizarre and disturbing. Who cares if a financially successful person enjoys the rewards or not? The moral question in my book is whether they scam and defraud others. If they do, it doesn’t matter if they weren’t even enjoying themself.

Lewis contrasts SBF, the ascetic, with another male character, whom he compares to “every guy in crypto,” someone who cares about sports, cars, and women. This is one of many sweeping generalizations about the motives of individuals working in the crypto industry, who, if driven by something other than lust for money, he describes as “people joined together by their fear of trust” “suspicious of big banks and governments and other forms of institutional authority.”

Lewis dog whistles his psychiatric diagnosis of the ideologically driven people in our space, implying we have a paranoid disorder that prevents us from trusting big institutions. Nowhere in the book does he suggest there is any real reason for concern about these institutions; no, Lewis is an institutional man. How Lewis portrays leaders in crypto is one hair’s breadth away from calling them “shadowy super-coders.”

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PMU6GUNKAJA4DBMYBEVK4AESUU.png)

Twin evils: simultaneously the book is an apology for SBF and his actions, and a clarion call for adult supervision of the crypto space. If you believe Lewis’s character is the real SBF, it makes perfect sense that he would be unaware of an $8 billion dollar hole in his books, because there was no org chart, there was “no one with experience” doing their job before, and SBF eschewed management. SBF is a young, dynamic character who “thought grown-ups were pointless,” but gets proven wrong. The book isn’t only an apology for SBF, but a vindication of grown-ups. In this way, Lewis himself advances the narrative about crypto that SBF and his political allies once championed in D.C.

A run on the banks, which is what brought FTX down, isn’t how a decentralized crypto project fails; if crypto projects are laid low, it’s usually by bug or hack. FTX failed in the traditional mode of the traditional institution it was, largely, it seems, as a result of perpetrating a traditional and already illegal form of mischief: financial fraud. The collapse of FTX was only circumstantially related to crypto. Moreover, it proved the need for DeFi and the limitations of CeFi. Politicians whose camp had been the beneficiary of SBF’s erstwhile generosity nonetheless rejoiced in its collapse, seizing the opportunity to willfully conflate FTX with crypto and call anew for the same regulations SBF had championed on the grounds that FTX losing its customer funds proved crypto was untrustworthy and required government to protect consumers from it. The irony!

Lewis has a knack for creating “jump off the page characters.” Indeed he finds one in SBF. I am all for supporting creators and storytellers. However, I must protest when a storyteller comes in and threatens to poison at scale perception of what we do. Perhaps unintentionally, Lewis will likely force multiply the confusion and inaccuracy clouding mainstream perception of our industry.

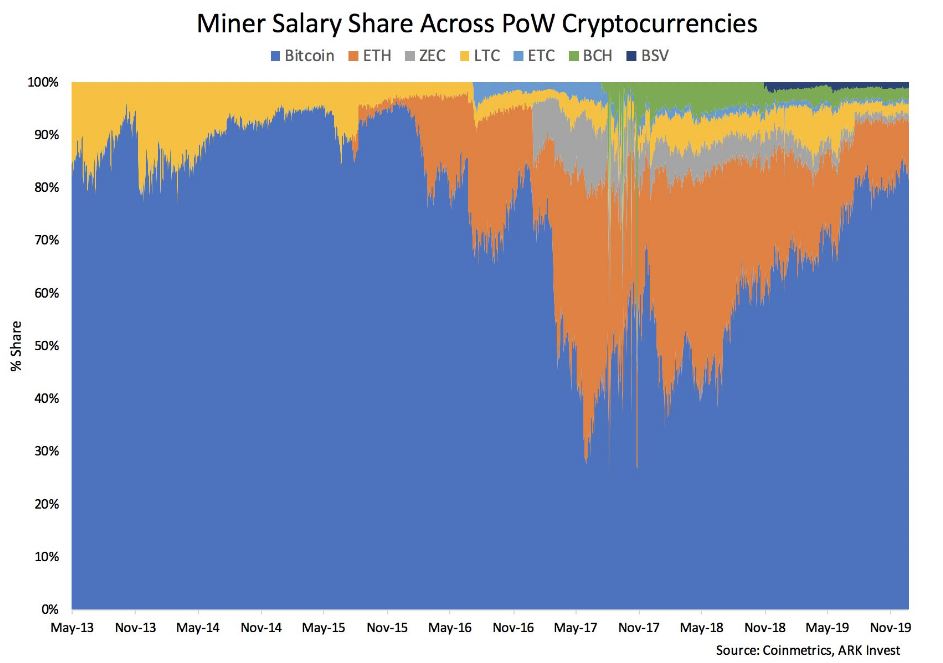

To the aunts and uncles considering crypto as a new asset class, perhaps through an ETF that allows alignment with our technology movement from the safety of institutions you trust like BlackRock and VanEck– don’t be fooled by this book into conflating FTX with crypto or SBF with the many, sometimes young, leaders in the space. Do your own research. Allow me to suggest comparing Bitcoin price performance over the full course of its history with the S&P 500.

If you want a bedtime story about a boy from a nice family who gets lost in the woods, allow me to recommend “The Lion, The Witch, and The Wardrobe,” because as far as a realistic portrayal of web3, “Going Infinite” is also in Narnia, and reading C. S. Lewis is substantially more fun.

Edited by Ben Schiller.