Metaplanet Follows MSTR’s Lead, Announces $11.3M Debt Sale for Additional Bitcoin Purchases

-

Metaplanet to issue one-year bonds to finance BTC purchases.

-

The Tokyo-listed firm holds over 1,000 BTC as of now.

01:01

Bitcoin Breaks $64K While Gold Soars

00:56

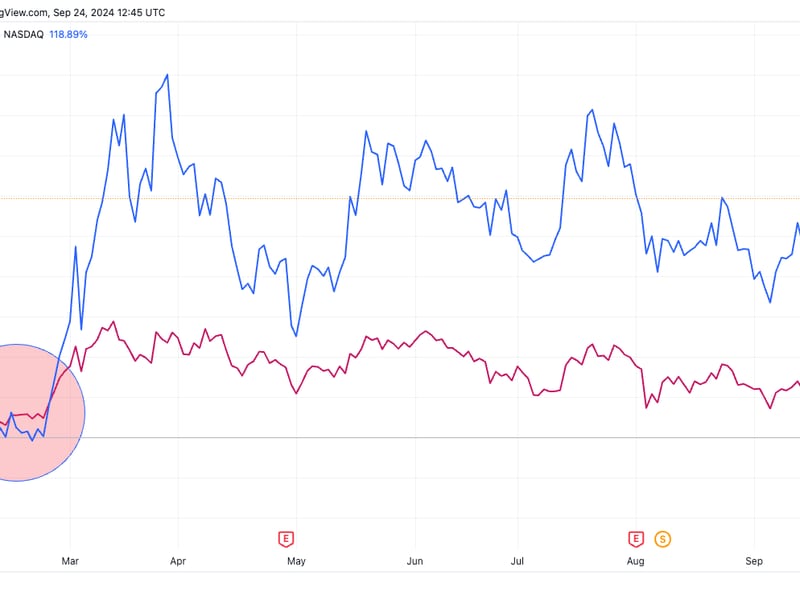

ETH/BTC Ratio Slid to Lowest Since April 2021

00:57

Is Bitcoin Losing Its Bullish Momentum?

Tokyo-listed Metaplanet has announced a debt sale to boost its bitcoin (BTC) stash, following the lead of U.S.-listed business intelligence firm MicroStrategy.

On Monday, Metaplanet announced on X that it is issuing one-year ordinary bonds with a guarantee totaling 1.75 billion yen ($11.3 million) for an annual interest rate of 0.36%. The funds raised will be used entirely to snap up BTC.

Metaplanet started buying BTC in April this year as a hedge against Japan’s debt issues and volatility in the yen. Since then, it has accumulated 1,018 BTC worth $92.33 million, according to data source Bitcoin Treasuries. The company has also used options strategies to boost its holdings.

Still, Metaplanet’s BTC balance is a far cry from MSTR’s stash of 279,420 BTC.

Edited by Parikshit Mishra.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

have been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of

editorial policies.

CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one.

:format(jpg)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/coindesk/af8d0ba0-646f-4588-abb1-85acd53eb89a.png)