Metaplanet Discloses $1.6M BTC Purchase; Shares Jump 10%

-

Metplanet bought an additional $1.6 million worth of bitcoin, bringing its total holdings up to $9.4 million.

-

Metaplanets stock jumped by 10% following the disclosure on Tuesday.

01:10

Bitcoin Extends Rally as $1B in BTC Withdrawals Suggests Bullish Mood

08:48

Binance Processes Nearly $1B in Net Outflows As CEO CZ Resigns

13:53

Bitcoin’s Price Rallied 28% in October as Crypto Rally Widened

1:14:44

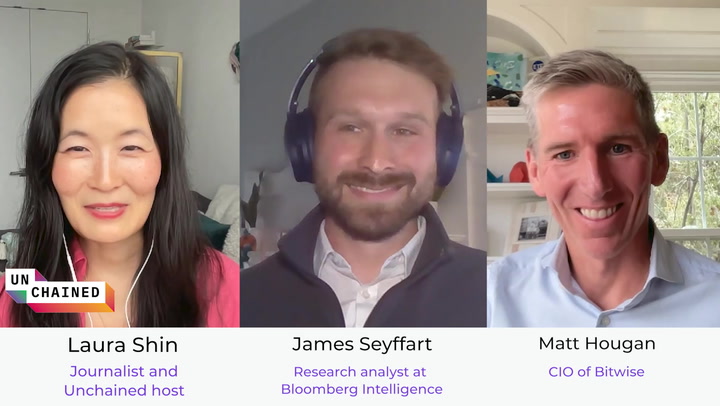

Why a Spot Bitcoin ETF Will Probably Launch No Later Than January 10

Japanese investment firm Metaplanet disclosed an additional bitcoin (BTC) purchase, worth 250 million yen ($1.6 million), taking its holdings of the largest cryptocurrency to 141 BTC, a value of about $9.4 million.

Metaplanet stock rose by 9.9% Tuesday after it made the purchase, its third since April 2024, public.

Last month, the company said it made bitcoin a reserve asset to reduce its exposure to risk arising from Japan’s debt burden and the resulting volatility in the yen. In 2023, the government’s net debt to gross domestic product ratio was the highest in the G7, about 159%, according to data on Statista. Canada had the lowest ratio, just 15%.

Metaplanet’s bitcoin strategy mirrors that of Tysons Corner, Virginia-based software developer MicroStrategy (MSTR), which has accumulated 214,400 BTC worth $14.3 billion since it started purchasing the asset in 2020 and is the largest corporate owner of the token.

Edited by Sheldon Reback.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/www.coindesk.com/resizer/fczAGHsWLFXiMV23oZZmkW19Ots=/arc-photo-coindesk/arc2-prod/public/D4HEG34XFVFVJHPXEEJAEFZ3SI.jpg)