Metaplanet Buys Additional ¥3.8 Billion Worth Of Bitcoin

Bitcoin Magazine

Metaplanet Buys Additional ¥3.8 Billion Worth Of Bitcoin

Japanese technology firm Metaplanet has acquired an additional 319 bitcoin worth approximately ¥3.78 billion ($26.3 million), continuing its aggressive bitcoin accumulation strategy amid growing U.S.-China trade tensions.

The Tokyo-listed company purchased the bitcoin at an average price of ¥11.85 million ($83,147) per coin, according to a company announcement on Monday. The latest acquisition brings Metaplanet’s total bitcoin holdings to 4,525 BTC, with an aggregate cost basis of $408.1 million at an average purchase price of $90,194 per bitcoin.

The purchase comes as bitcoin experienced a slight decline over the weekend, dropping more than 2% to $83,482 during Asian trading hours. The bitcoin and crypto market has shown sensitivity to emerging geopolitical tensions, particularly surrounding potential new U.S. trade tariffs targeting Chinese electronics.

Metaplanet often referred to as “Asia’s MicroStrategy,” has outlined ambitious plans to expand its bitcoin holdings by 470% to reach 10,000 BTC by the end of 2025 and 21,000 bitcoin by the end of 2026. The company evaluates its performance through “BTC Yield,” a metric measuring bitcoin holding growth relative to shares outstanding. For Q1 2025, Metaplanet reported a BTC yield of 95.6%, with a year-to-date figure of 6.5% as of April 14.

The company’s latest move has elevated its position to become the ninth-largest public holder of bitcoin globally. Metaplanet’s bitcoin strategy has gained additional attention following the recent appointment of Eric Trump to its Strategic Advisory Board, citing his business expertise and passion for bitcoin. The timing of the purchase coincides with complex market dynamics as investors process mixed signals from Washington regarding U.S. trade policy.

Metaplanet’s bitcoin acquisition strategy is supported by various capital market activities, including bond issuances and stock acquisition rights, designed to raise funds while minimizing shareholder dilution. The company has currently executed approximately 41.7% of its “210 million plan.”

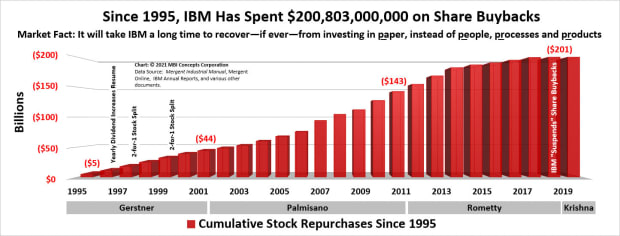

Metaplanet’s strategic pivot to bitcoin accumulation closely mirrors the playbook pioneered by Michael Saylor’s Strategy, albeit on a smaller scale. Since launching its bitcoin treasury operations, the Japanese firm has demonstrated remarkable success in implementing a similar approach of leveraging financial instruments and market opportunities to acquire bitcoin.

Like Strategy, Metaplanet has utilized a combination of convertible debt offerings and equity-linked instruments to fund its acquisitions while maintaining a healthy balance sheet. The strategy has yielded impressive results, with the company’s bitcoin holdings growing to over 4,500 BTC in just over a year.

This post Metaplanet Buys Additional ¥3.8 Billion Worth Of Bitcoin first appeared on Bitcoin Magazine and is written by Vivek Sen Bitcoin.

Japanese public company Metaplanet buys 319 #bitcoin for $26.3 million. pic.twitter.com/ZcaMg8Ae3b

Japanese public company Metaplanet buys 319 #bitcoin for $26.3 million. pic.twitter.com/ZcaMg8Ae3b