Meme Coins Like PEPE and DOGE Are Anything but a Joke

Meme coins: a term that generates both amusement and disdain within the crypto community.

The wild journey of pepecoin (PEPE), from joke to somewhat established project, perfectly encapsulates the excitement and unpredictability that come with this breed of digital assets.

Yonathan Lapchik is the CEO of Web3 company Suku and co-founder at InfiniteWorld.

It’s time we started taking meme coins more seriously. These assets, propelled by social media hype and born out of internet culture, attract a flood of newcomers to crypto. Left unchecked, meme coins can reinforce misconceptions about the broader crypto landscape.

They are both a catalyst for the mass adoption of Web3 technologies and a potential barrier that could perpetuate confusion and skepticism among outsiders, and give regulators false notions about what the industry stands for.

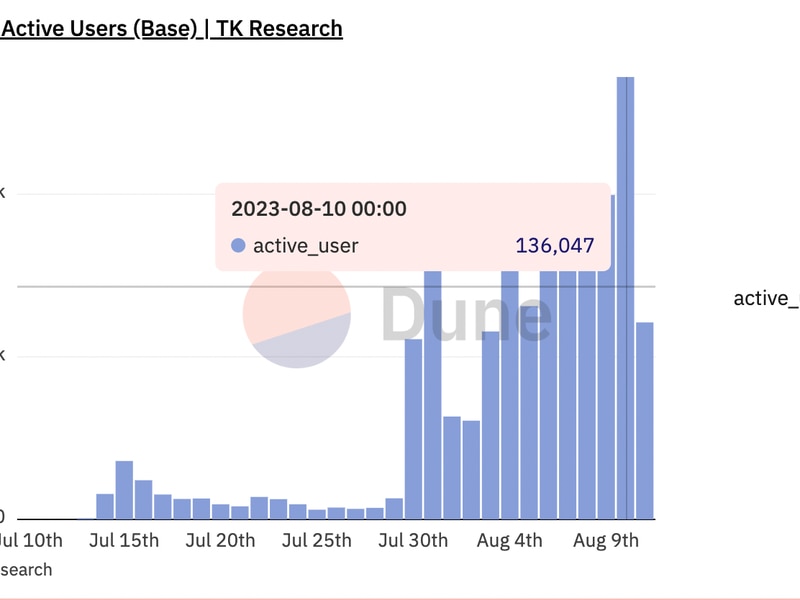

The meteoric rise of meme coins – dogecoin (DOGE), shiba inu (SHIB) and PEPE, to name a few – has been nothing short of a spectacle. These digital assets have become a fascinating gateway to the uncharted world of Web3 for a growing number of people.

Meme coins blend internet humor and gambling, which draw people in from all walks of life by promising astronomical returns. To some extent, meme coins are one of the most important drivers of mainstream Web3 adoption.

The allure of these coins extends beyond their comical origins or potential for quick profit. They effectively level the playing field in the often daunting world of cryptocurrencies, sparking intrigue among anyone who may have previously viewed this realm as the exclusive territory of tech-savvy investors and financial gurus. They give hope, too, to the many people interested in bitcoin who feel like they missed their moment to invest.

None of this is to suggest that investing in meme coins is wise. In fact, the best thing that could happen, is that a newcomer to crypto brought in by cryptodickbutt or SHIB will learn about the true innovation happening in Web3, the potentials of different decentralized applications (dapps) and the importance of self custody. It’s not wishful thinking, but a common crypto pipeline.

In many ways, meme coins have turned passive internet users into active participants in the DeFi landscape, encouraging them to explore, learn and interact with blockchain technologies firsthand. Nevertheless, this fun, democratized on-ramp has its share of tribulations.

The dark side of the meme coin

The inherent volatility and unpredictability of meme coins is a significant concern, especially when influencers spew empty promises of astronomical returns. While tales of overnight millionaires and gargantuan profits might grab headlines, the flip side is an equally abrupt potential for losses. As the saying goes, “what goes up must come down.”

Meme coins have been subject to wild price swings, driven by factors as small as a social media post or a change in sentiment within their communities when milestones in the roadmap appear to have no tangible progress.

Moreover, the fundamentals of these assets are often questionable. Unlike traditional blockchains such as Bitcoin or Ethereum, many meme coins lack intrinsic value or a concrete use-case, meaning their prices are fueled largely by hype rather than technological innovation or real-world utility.

Meme coin creators rarely try to hide this either. For instance, at the bottom of pepecoin’s landing page, it states, “The coin is completely useless and for entertainment purposes only.” This overt lack of utility raises valid concerns about the sustainability of their growth, with many in the crypto community questioning whether the meme coin boom can endure in the long term or if it’s merely a speculative bubble bound to burst.

Adding to these challenges is the potential and inevitability of market manipulation. In the absence of regulation, meme coins can be exploited in pump-and-dump schemes, where influencers or large investors artificially inflate the price before selling off their holdings, leaving average investors to bear the brunt of the crash.

Further, every massive gain comes at the expense of most people taking large losses. This is referred to as “bag holding,” where traders miss the optimal window to sell and are left holding a portfolio of devalued or, in most cases, worthless coins. This is where the term “PvP,” or player versus player, within the crypto community comes from.

The fact that it’s called playing emphasizes the competitive nature of meme coin trading and also invokes the image of a high-stakes game of chicken, where participants vie against each other, attempting to predict who will be the first to dump their tokens.

These aspects of meme coins have muddied the waters of the crypto space, often leading to misconceptions and reinforcing skeptical statements such as “all crypto is a scam.” As such, to most rational users in the space, meme coins represent significant hurdles to widespread adoption and acceptance of decentralized technologies.

Unfortunately, instead of starting from scratch, the general public now faces the challenge of unlearning their current understanding of blockchain and Web3. Only then can they truly grasp the remarkable innovations and opportunities that this new technology has to offer.

With their dynamic blend of entertainment and investment, meme coins have left an indelible mark on the crypto space and have played a crucial role in propelling Web3 recognition to mainstream audiences.

However, we must maintain a sense of focus towards the value and substance that cryptocurrency and Web3 offers. If meme coins continue to suck up much of the attention, this could play into the hands of regulators who might be looking for reasons to impose strict controls, and leave rulemakers with preconceived notions that all crypto is nonsense.

So embrace meme coins, but don’t treat them like a joke.