Meet Midas: A New Yield-Bearing Stablecoin Investing in U.S. Treasuries

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

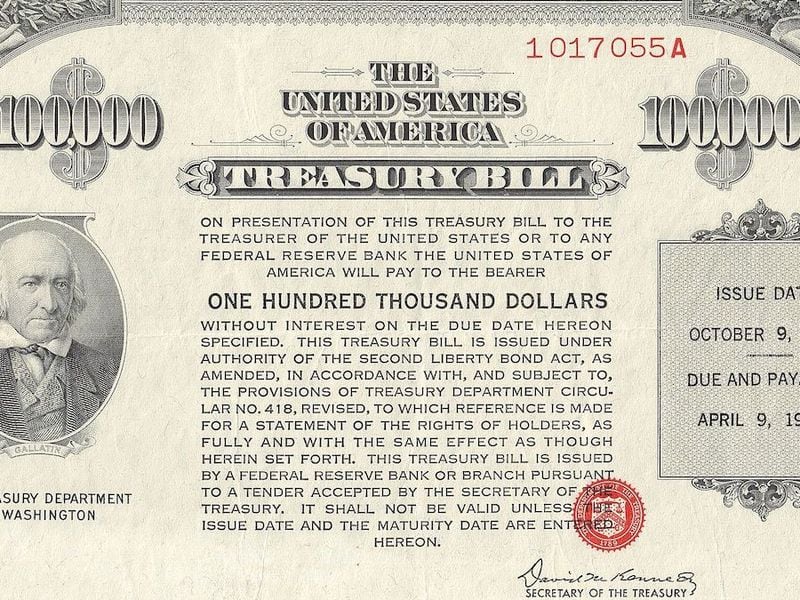

A new addition to the current convergence trend between crypto and traditional finance is Midas, a stablecoin backed by U.S. Treasuries that’s planning to unleash its stUSD token on decentralized finance (DeFi) platforms like MakerDAO, Uniswap and Aave in the coming weeks, according to a presentation deck seen by CoinDesk.

The Midas stablecoin project intends to buy Treasuries via asset manager BlackRock and use Circle Internet Financial’s USDC stablecoin as an on-ramp, according to the deck. Custody technology provider Fireblocks and blockchain analytics firm Coinfirm are also listed as institutional partners.

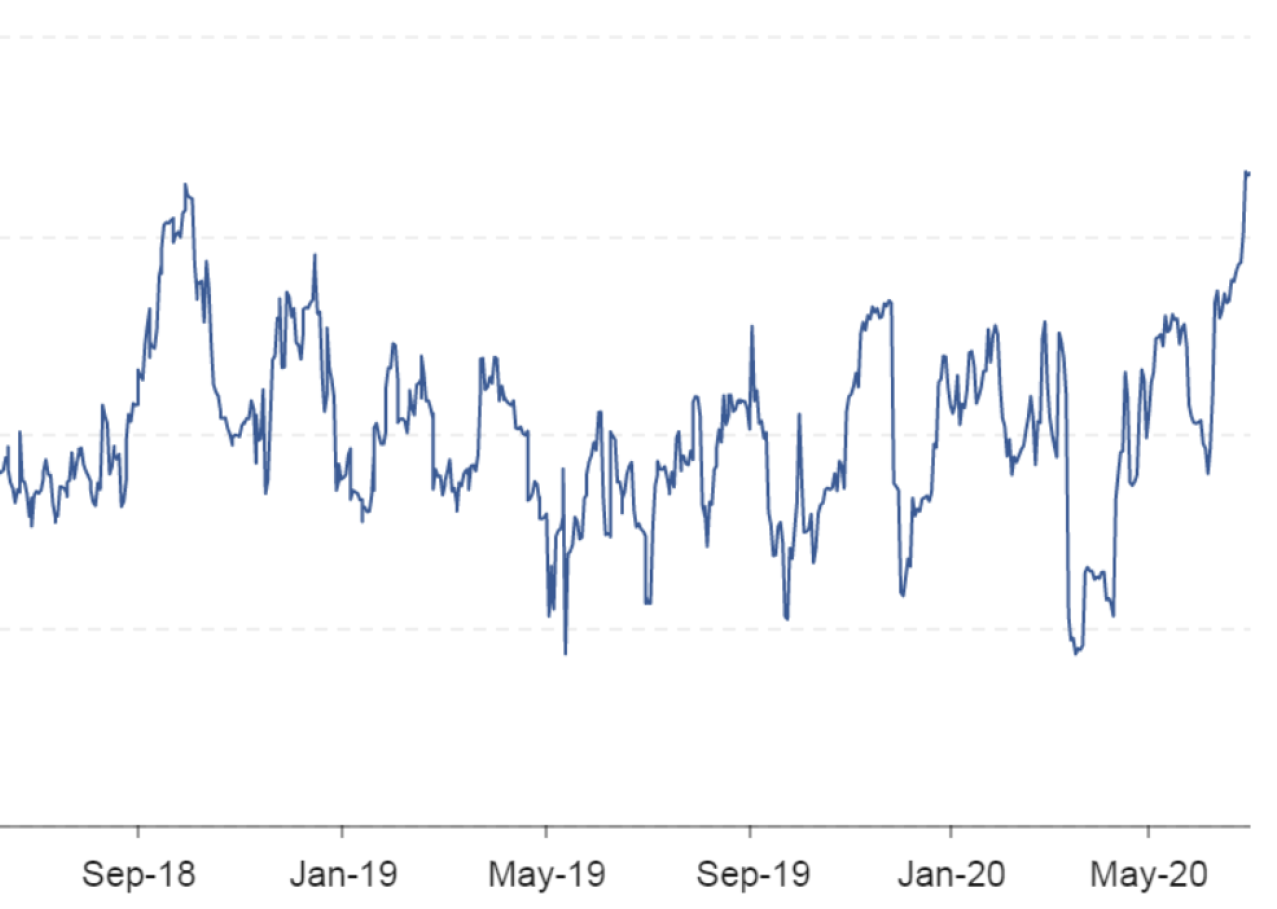

Yields offered by assets in traditional finance (TradFi) like U.S. Treasuries currently exceed yields on conventional DeFi products. The solution, as the Midas presentation deck states, is to tokenize TradFi products so they’re available in the DeFi ecosystem.

So-called tokenized real-world assets are a hot corner of the digital-asset space, drawing attention from TradFi firms that have long tried to get key parts of markets and finance onto blockchain infrastructure given the potential efficiencies. Treasuries have been an area of focus, with large growth in 2023.

The new Midas stablecoin, which aims to onboard with DeFi platforms during this quarter ahead of a retail launch early next year, joins an interesting trend in yield bearing stablecoins, such as Mountain Protocol and Ondo Finance. (The proposed Midas stUSD project is not to be confused with the now-defunct DeFi investment firm Midas.)

The Midas team includes Fabrice Grinda, founder and executive chairman of blank check company Global Technology Acquisition Corp. (GTAC); and Dennis Dinkelmeyer, who is vice president of GTAC.

The Midas stUSD token is 100% backed by U.S. Treasuries and issued as a debt security under German law, according to the deck.

“Funds are held with a regulated custodian in segregated accounts (BlackRock),” Midas said in the presentation deck. “Midas is fully compliant with European Securities Regulation and Anti-Money Laundering law. Transfer of token represents transfer of legal rights to the underlying.”

Grinda and Dinkelmeyer did not respond to requests for comment by press time.

Edited by Nick Baker.