Meet GoCopyTrade: A New Social Trading Platform

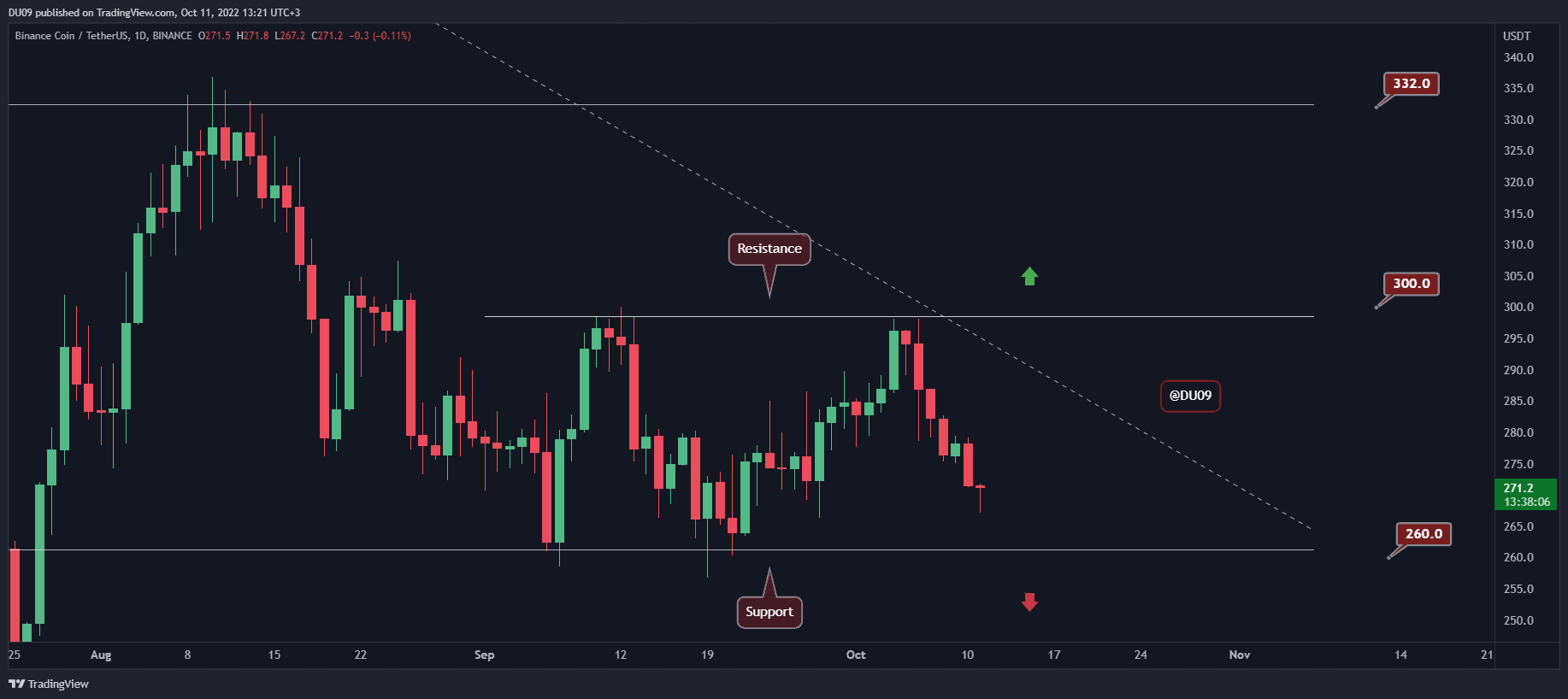

featured – Trading cryptocurrencies can be an increasingly risky endeavor, especially in a market that is highly volatile and prone to 10 to 30% price spikes and drops over a period of hours.

The crypto market is unique because it is still relatively new and mostly dominated by retail investors who are just picking up trading for the first time. The result of this demographic being introduced to trading via a volatile asset like crypto is that many people have lost money in the past year due to an inability to analyze the markets and make objective trades.

Meanwhile, those who have traded stocks or other asset classes for years have far more experience and have easily been able to profit despite the bear market conditions.

This dilemma presents a huge opportunity that Go Copy Trade is taking advantage of. GoCopyTrade is a social trading platform that allows users to copy the trades of more experienced traders in the stock, forex, gold, and cryptocurrency markets.

How it works

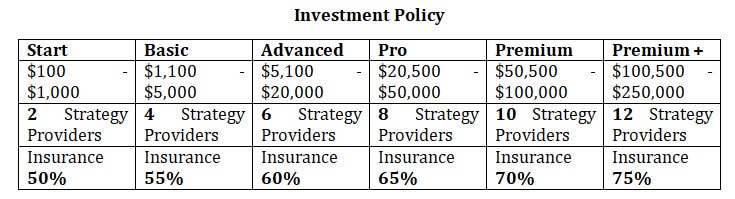

To start, simply sign up or log in to your account. Then deposit a minimum of $100.

Users can select the best trader based on whatever style or risk level is good for them. Once you select the trader (or ‘strategy provider’) you wish to follow your trades will automatically be executed in all global exchanges (Binance, Bitfinex, Oanda, TickMill, Fxpro) without needing to make direct trading orders.

100’s of strategy providers on Go Copy trade are there to help users diversify their trading strategies and generate passive income.

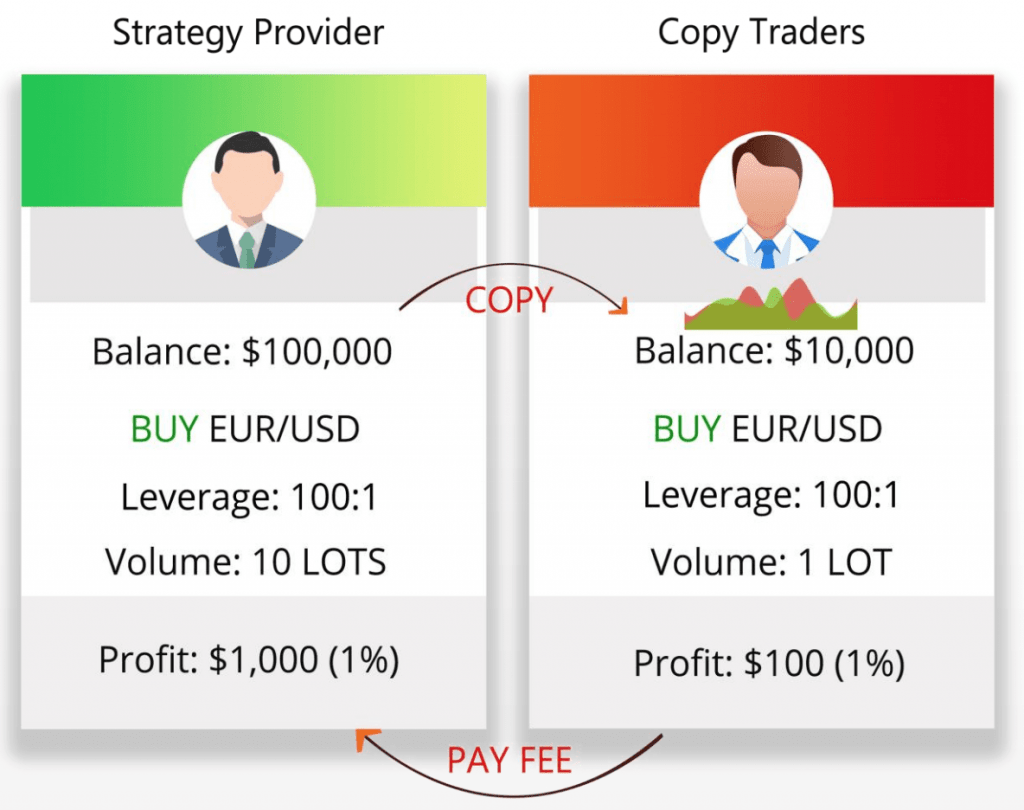

For example, a strategy provider who has an account with $100,000 could be trading the USD/GBP currency pair. You as the user may have just $10,000 in your account and choose to copy the strategy provider’s trades. GoCopyTrade will automatically execute the same buy or sell orders that the strategy provider creates for the USD/GBP trading pair. Your trades will depend on the amount of funds in your account, meaning that if the strategy provider makes a profit of $1,000 from their $100,000 trades, you will earn $100, as you have both made 1% profit from the trades that were simultaneously executed.

At the end of each trading day, you received 70% of your profits. 10 % of your profit goes to the strategy provider as a reward for allowing you to copy their strategy, and 20% is retained for Go Copy Trades ‘Risk insurance fund’, which pays you up to 50-75% of your losses for negative orders (orders in which you lose money).

Registration

GoCopyTrade provides a demo account with a balance of $10,000 to allow you to simulate real social trading and to be confident when you register a real account and deposit money to trade.

Competitors

eTORO

Etoro is a trading platform that allows influencers to set up profiles that allow others to copy their trades. However, the downside of Etoro is that the details of a trader’s position are not as transparent (for example, you can’t see the sell price that the trader sets). Etoro does not have any staking, meaning that users incur all the liability if they copy a trade that goes wrong.

Hedge.io

Hedge is a newer social trading platform that has been covered before on CryptoPotato. Similar to Go Copy Trade, Hedge provides a networking hub for financial and cryptocurrency trading experts, and for newcomers seeking trading forecasts for cryptocurrencies, stocks, options, commodities, or any other tradeable product. One of the downsides of Hedge (and something Go Copy Trade might also struggle with) is market penetration. User adoption will be a challenge for any social trading platform, especially during bear markets like the one we’re currently experiencing.

PROS & CONS

PROS

- 24-hour online transactions

- 100+ Strategy Providers

- Risk insurance fund covers 50-75% loss

CONS

- Recruiting strategy providers – the best strategy providers may not want to share their strategy, even for profit. Or they might prefer to use bigger platforms like Etoro.

- Market penetration – User adoption will be a challenge for any social trading platform, especially during bear markets like the one we’re currently experiencing.

GoCopyTrade Shares

GoCopyTrade Stock shares will be listed on five exchanges in the UK and Europe in the first quarter of 2020.

- Treasury shares:

– Volume: 5,000,000,000 shares

– Starting price: $0.1/share – All investors who have invested $10,000 or more will be awarded shares with rate 1:10 (e.g., Investment $10,000 -> Awarded 100,000 shares)

– Investors are allowed to buy and hold shares

– Public Offering: 60% (3,000,000,000 shares)

– The holders of treasury shares will receive dividends from our Risk Insurance Fund on a monthly basis and are allowed to trade the shares in the Gocopytrade community when we launch our exchange in the third quarter of 2019.

– They can also be traded on five exchanges in the UK and Europe in the first quarter of 2020.

- Corporate shares:

– Volume: 5,000,000,000 shares – Price: $0.05/share

– Public offering: 49% (2,450,000,000 shares)

– Investors are allowed to buy and hold shares, and the shares can be traded in the community from the third quarter of 2019.

– They can also be traded on five exchanges in the UK and Europe in the first quarter of 2020. Starting date of purchase: from 01/11/2018.

The post Meet GoCopyTrade: A New Social Trading Platform appeared first on CryptoPotato.