Medical Data Company OneMedNet Latest to Pursue Bitcoin Treasury Strategy After Capital Raise

-

Crypto fund Off The Chain Capital made more than a million dollar investment into medical data company OneMedNet so that it could buy bitcoin.

-

The fund hopes to outperform the price of bitcoin through its investments by buying it for a discount through allocations like this.

45:11

Bitcoin’s Price Is Way Up. And $48 Trillion in Wealth Just Got Access

1:00:39

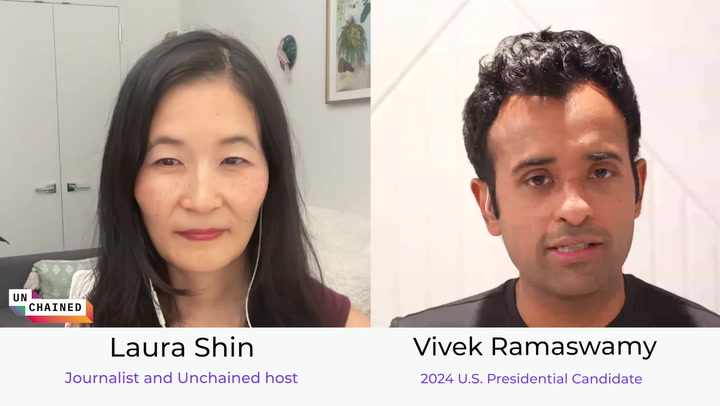

Why Presidential Candidate Vivek Ramaswamy Is So Pro-Crypto

01:10

Bitcoin Extends Rally as $1B in BTC Withdrawals Suggests Bullish Mood

1:02:43

Why Financial Advisors Are So Excited About a Spot Bitcoin ETF

OneMedNet (ONMD) late last month raised $4.6 million in a private placement and used $1.8 million of the proceeds to purchase bitcoin (BTC), according to a press release.

Among the investors was Off The Chain Capital, a crypto investment fund with ties to Bloq Chairman Matthew Roszak and Fortress founder Rob Kauffman, which purchased a combination of shares and warrants in ONMD.

OneMedNet has seen its stock price fall more than 90% since it came public via a SPAC deal late last year.

“It’s an opportunity that if it works correctly, it can outperform bitcoin’s performance,” Brian Dixon, CEO of Off The Chain Capital told CoinDesk. “From our goal as an investor, we’re looking for these discount or value opportunities and we work really hard to try to outperform bitcoin.”

Dixon believes that it is crucial for public companies to reinvest some of their cash into bitcoin, rather than real estate, stocks or bonds, in order to add the most shareholder value.

“I think more and more public companies are going to wake up to the fact that if you don’t have bitcoin on your balance sheet, you’re not being intelligent as a fiduciary to that additional cash flow you have in terms of where you allocate this part of your treasury reserve strategy,” he said.

In this, Off the Chain and OneMedNet is making a similar argument to that of Michael Saylor, whose MicroStrategy (MSTR) has seen its stock price outperform the return of bitcoin since the company began adding the crypto to its balance sheet in August 2020.

U.S.-listed Semler Scientific and Japan’s Metaplanet are among other publicly traded companies pursuing similar strategies.

Edited by Stephen Alpher.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6d05e6ca-ca9b-44d0-97e6-b6bdceee3d6f.png)

Helene is a New York-based reporter covering Wall Street, the rise of the spot bitcoin ETFs and crypto exchanges. She is also the co-host of CoinDesk’s Markets Daily show. Helene is a graduate of New York University’s business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

Follow @HeleneBraunn on Twitter