Median Bitcoin Transaction Fees Sink 78% In The Weeks Since The Halving

The cost of transacting on the Bitcoin blockchain fell by more than 78% in under two weeks, as the backlog of transactions that had been clogging the network finally subsided.

The Bitcoin mempool cleared out over 94MB worth of pending transactions in that time, driving fees down in the process. Meanwhile, the overall number of tweets mentioning Bitcoin fell by over 65% in a little over two weeks. All of this points to a marked departure in Bitcoin activity in the wake of the block reward halving event.

Bitcoin Usage Fees Drop 78%

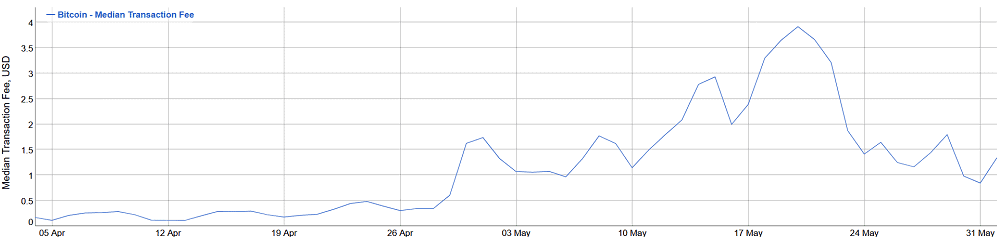

The median Bitcoin transaction fee fell by 78% from May 20 to May 31 – dropping from $3.95 to $0.84, according to data from Bitinfocharts.

Median transaction fees had previously risen 3,490% in the month, leading up to Bitcoin’s block reward halving. Blockchain fees typically rise whenever the network comes under more usage than it can process. Users are forced to increase fees to incentivize miners to include their transactions in the next block.

This race to the top, which pushed up Bitcoin fees, can be witnessed in the blockchain mempool. It’s a measure of pending BTC transactions awaiting confirmation.

Leading up to Bitcoin’s halving event on May 11, the mempool became backlogged with almost 60MB worth of pending transactions. Shortly after the halving, the congestion continued to increase – reaching a peak of 94MB on May 21.

Blockchain Congestion Subsides

Then, in less than two weeks, that backlog suddenly subsided by over 99% – dropping to just 250kB by May 31, as per data from Blockchain.com

That decrease aligns perfectly with the drop in Bitcoin fees. Along with the 78% drop in median transaction fees, average fees on the Bitcoin network also fell 66% – from $6.64 to $2.25 in that time period.

Notably, Bitcoin interest on Twitter witnessed a remarkable drop off since the Bitcoin halving event on May 11. Since then, Bitcoin mentions fell from 82,838 to 28,806 – a 65% decrease, according to data from Bitinfocharts.

Despite the drop in BTC’s average and median fees, the cost of actually getting a transaction included in the very next block is slightly higher. As recently reported by CryptoPotato, Square’s Cash App currently pays the ~$6 cost of getting their users’ $1 Bitcoin transactions in the next block.

The post Median Bitcoin Transaction Fees Sink 78% In The Weeks Since The Halving appeared first on CryptoPotato.