May Was Best Month for CME Bitcoin Futures Volume Since 2017

May was the best month for derivatives giant CME’s bitcoin futures volume since its 2017 launch, as nearly 300,000 contracts were traded in the 31-day period.

Average daily volume (ADV) reached more than 13,600 contracts, equal to $515 million notional value or 68,000 equivalent bitcoin, up 27 percent when compared to the month of April. On May 13, bitcoin futures traded a record single-day volume of 33,677 contracts (168,000 equivalent bitcoin or $1.3 billion notional value) while on May 28, BTC hit a record open interest of 5,190 contracts.

It may be a sign that institutional interest is on the rise, with 223 trading accounts added in May, the most since January 2018 according to research conducted by CME Group.

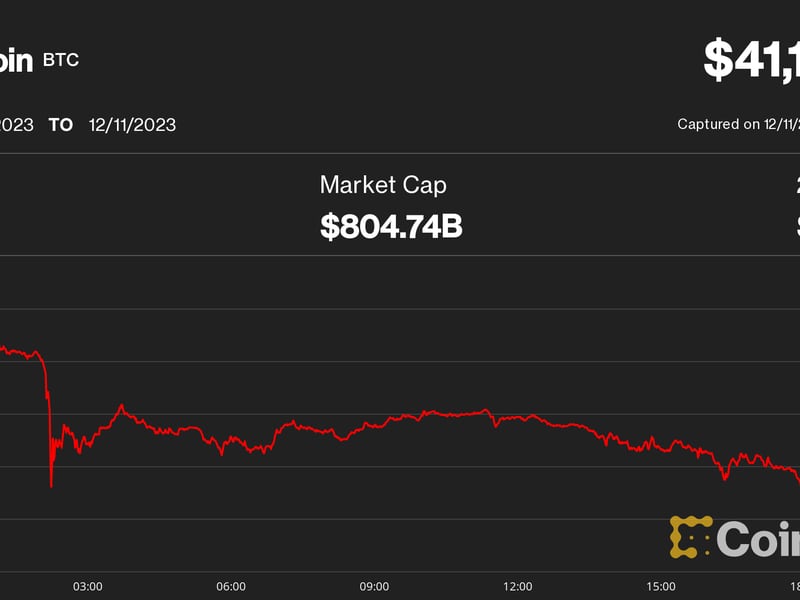

Volume month to month

As can be seen on the chart above May marked a 27 percent increase in volume on the month prior and a 73.69 percent increase on March, 2019’s volumes, hinting at gradual increasing interest in bitcoin futures.

Open interest month to month

Volume and open interest, however, are two distinctly different things.

While volume is the number of contracts traded in a day, after each session, the figure starts over at zero. Open interest, on the other hand, is the number of contracts that have been created and that are open.

As can be seen above, futures were first listed on the CME at the height of the bull market in December 2017. Futures trading activity, however, remained dull through 2018, courtesy of the crypto bear market.

Still, the data suggests interest is building, suggesting more firms are using the tool to manage risk or else speculate on the crypto markets.

Disclosure: The author holds no cryptocurrency at the time of writing

CME director of equity products Tim McCourt via Flickr