Matic Network (MTX): IEO Review and Rating Ahead of Token Sale (Binance Launchpad)

Binance Launchpad, the cryptocurrency exchange’s platform for Initial Exchange Offerings (IEOs), has been an enormous success so far. Three projects – BitTorrent, Fetch.AI, and Celer Network – have launched their IEOs on Binance’s platform with all of them hitting their hardcaps within minutes (and in some cases only seconds).

Now the cryptocurrency exchange is readying for its fourth token sale: Matic Network, just ahead of Matic’s IEO.

Matic network is a Plasma-based off-chain solution which brings advanced functions such as smart contracts on top of side chains. This improvement can have a high impact on Dapps which will utilize the Matic network solution and could help them to compete with centralized apps.

Many existing projects have already started to integrate Matic network solutions in their infrastructure such as Decentraland, Quarkchain, Ankr Network and many more. Those partnerships can be very valuable in terms of mass adoption of the new technology.

Matic is planning to conclude its fundraising rounds which included a Seed Sale round of $165K and an Early Supporter Sale of $450 K with a Public Sale (on top of Binance Launchpad) of $5 M which will account for 19% of the total tokens allocation.

Side note: Binance has recently changed the IEO participation rules for its Launchpad platform. You can take a look at the most significant changes here.

Binance Launchpad Token Sales

| Name | Hardcap | CryptoPotato Score |

|---|---|---|

Matic (Binance Launchpad) |

Hardcap $5.0 M | 8.7/10 |

Celer Network (Binance Launchpad) |

$4.0/4.0 M(100%) | 8.5/10 |

Fetch AI (Binance Launchpad) |

$21.0/21.0 M(100%) | 8.3/10 |

BitTorrent (Binance Launchpad) |

$7.2/7.2 M(100%) | 0unrated |

What is Matic Network and how does it work?

Matic Network’s goal is to enable fast, easy, and secure off-chain transactions via its layer-2 scaling platform. Matic is trying to achieve this by implementing the Plasma MVP framework, the first implementation of the Plasma Whitepaper.

So what exactly is Plasma and Plasma MVP?

Plasma is an off-chain solution for the scaling problem in public blockchains created by Vitalik Buterin (co-founder of Ethereum) and Joseph Poon (a co-author of Bitcoin’s Lightning Network whitepaper),which was published on August 11, 2017.

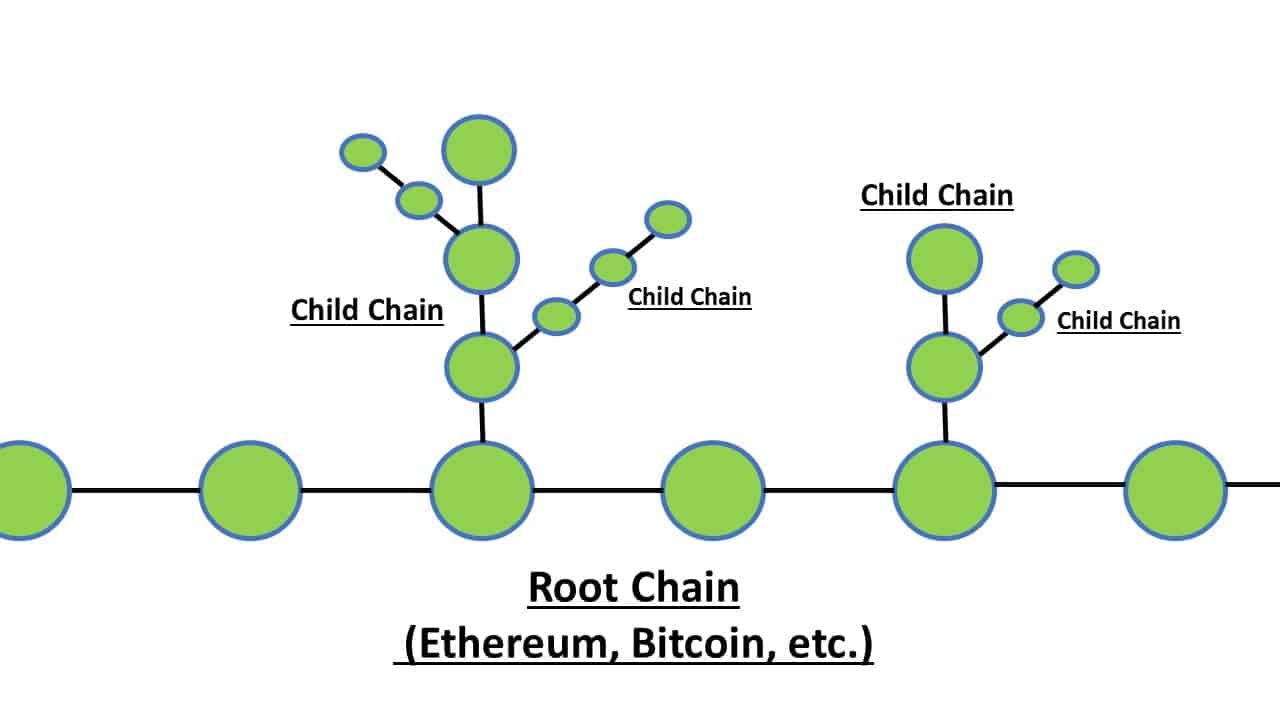

The core design of Plasma contains a series of contracts that run on top of some public root chains (e.g. Ethereum, Bitcoin, etc.) which contain a network of “child chains” (also known as side chains). Those chains are connected to the root chain in a tree-like structure. Each “child chain” handles its blockchain with its consensus mechanism, block validators and it can create more “child chains” of his own.

Like in other off-chain solutions, the great advantage of Plasma is the fact that most of the activity will happen on the “child chains.” This can almost eliminate the current bottleneck on public blockchains so only a small fraction of the transactions will be processed and validated by the main chain.

The first implementation of the Plasma solution is the Plasma MVP. The Plasma MVP is using a UTXO model and PoS consensus mechanism in the “child chains.”

Back to the Matic Network

The Matic network is a Plasma MVP implementation; the network has child chains which are almost like EVM (Ethereum Virtual Machine) based side chains. Those can handle both asset transactions like the current MVP implementation and smart contact executions.

With its first root chain being Ethereum, Matic ensures the security of the digital assets on the child chains via the Plasma framework and a decentralized network of PoS validators with the chain’s operators being stakers in the project’s PoS system.

The major difference between Matic and other existing off-chain solutions (the most famous of course being the Lightning Network) is the fact that while most of the off-chain solutions support only off-chain payment transactions, Matic is capable of processing generalized off-chain smart contracts. This fact means Matic will be a vital solution for Dapps which are looking for high scalability in terms of TX’s and smart contract executions.

Here are some other key features of the project:

- According to Matic, its network has achieved up to 10,000 transactions per second (TPS) on a single sidechain via the project’s internal testnet. To gain an even higher throughput, Matic is planning to add multiple chains for horizontal scaling.

- Matic’s child chains are public and permissionless as well as capable of supporting multiple protocols.

- Matic’s mission is to create a Plasma-influenced Layer 2 scaling solution for blockchain projects that are capable of meeting the transaction demand for the mass adoption of DApps.

Other products

- WalletConnect integration: Matic is planning to create its own wallet which will be integrated into the WalletConnect protocol. WalletConnect is an open protocol which enables desktop Dapps to connect mobile Wallets by scanning a QR code.

- Dagger: a Zapier integration that will allow developers to gather real-time Ethereum updates into Spreadsheets, Databases, Apps, etc. Today, more than 400 dApps and trackers are built using this tool.

The Matic Network token sale

Matic Network will hold its IEO on Binance Launchpad between April 24, 2019, 8:00 AM (UTC) and April 26, 2019, 2:00 PM (UTC). The project has allocated 19% of its tokens for the public sale consisting of 1.9 million MATIC. The IEO’s hardcap is at $5 million with MTX’s price determined at the date of the token sale.

Besides the public token sale the project has already conducted two private sales rounds: a Seed Sale where 2.09% of the tokens were sold for $165 K ($0.00079USD = 1 MTX) and an Early Supporters Sale where 1.71% of the tokens were sold for $450 K ($0.0026USD = 1 MTX).

In terms of vesting, all the private investor’s tokens will be 50% unlocked in the first month of TGE, and the remaining 50% will be unlocked in the seventh month. Regarding the public sale, the tokens will be released within 15 days after the end of the token sale

Token Allocation:

- Private Sale: 80% of the total supply.

- Launchpad sale: 19% of the total supply.

- Team: 16% of the total supply.

- Advisors: 4% of the total supply.

- Network Operations: 12% of the total supply.

- Foundation: 21.86% of the total supply.

- Ecosystem: 23.33% of the total supply

The Matic IEO only supports BNB, so if you’d like to participate, be sure to hold Binance Coins in your exchange wallet. Also, as mentioned before, the participation of the Matic token sale will be different than the other IEOs on Binance Launchpad, so it is essential to check out Binance’s new rules before the token sale.

Token Use Cases:

Staking tokens for the Proof Of Stake consensus mechanism: Matic child chains are using a PoS algorithm to secure their blockchain. To become a validator, one must stake Matic tokens.

Transactions Fees: transaction fees in the Matic child chains are being paid in Matic tokens.

Support other Eco-system projects: Matic intends to allocate some of the block rewards in the child chains to support the development of new features and dApps that will contribute to the network.

Team, advisors, and partnerships

Matic’s team consists of 12 members, including three co-founders, six developers, two marketing specialists as well as a product manager. We’ve decided to cover the three co-founders’ backgrounds more thoroughly below:

Jaynti Kanani: Kanani is the co-founder and CEO of Matic. With a Bachelor of Engineering at the Dharmsinh Desai Institute of Technology as well as experience working as a data scientist at Housing.com, the Matic CEO is one of the core contributors of the first Plasma MVP implementation. He also worked on the first Node implementation of the original Walletconnect protocol and contributed to Web3 and developer ecosystem tools like sol-trace.

Sandeep Nailwal: A former Deloitte consultant and ex-CTO of the e-commerce division of Welspun Group, Nailwal is the co-founder and COO of Matic. He has an MBA from one of the top business schools in India and is the co-founder and CEO of another blockchain project, ScopeWeaver.com.

Anurag Arjun: The co-founder and CPO of Matic, Arjun has previously been the AVP of Iris Business as well as a serial entrepreneur involved in multiple projects. He completed his BA at the Nirma Institute of Technology in 2006.

Matic has three advisors: Esteban Ordano, the founder & CTO at Decentraland; Pete Kim, Head of Engineering for Wallet at Coinbase; and Ari Meilich who is Project Lead at Decentraland.

In terms of partnerships, Matic had created some very important partnerships:

- Decentraland: Decentraland is a virtual reality platform that is built on top of Ethereum (with a current $64 M marketcap), where the user can create and transfer digital assets. Matic has partnered with Decentraland to scale its financial activities inside the virtual universe of Decentraland.

- QuarkChain: QuarkChain is a permissionless blockchain architecture that plans to provide a secure, decentralized, and scalable blockchain solution using sharding technology. Quarkchain and Matic are planning to develop a plasma chain solution on the top of the Quarkchain blockchain.

Matic has also partnered with Ankr Network, Portis, MakerDAO, and Ripio Credit Network.

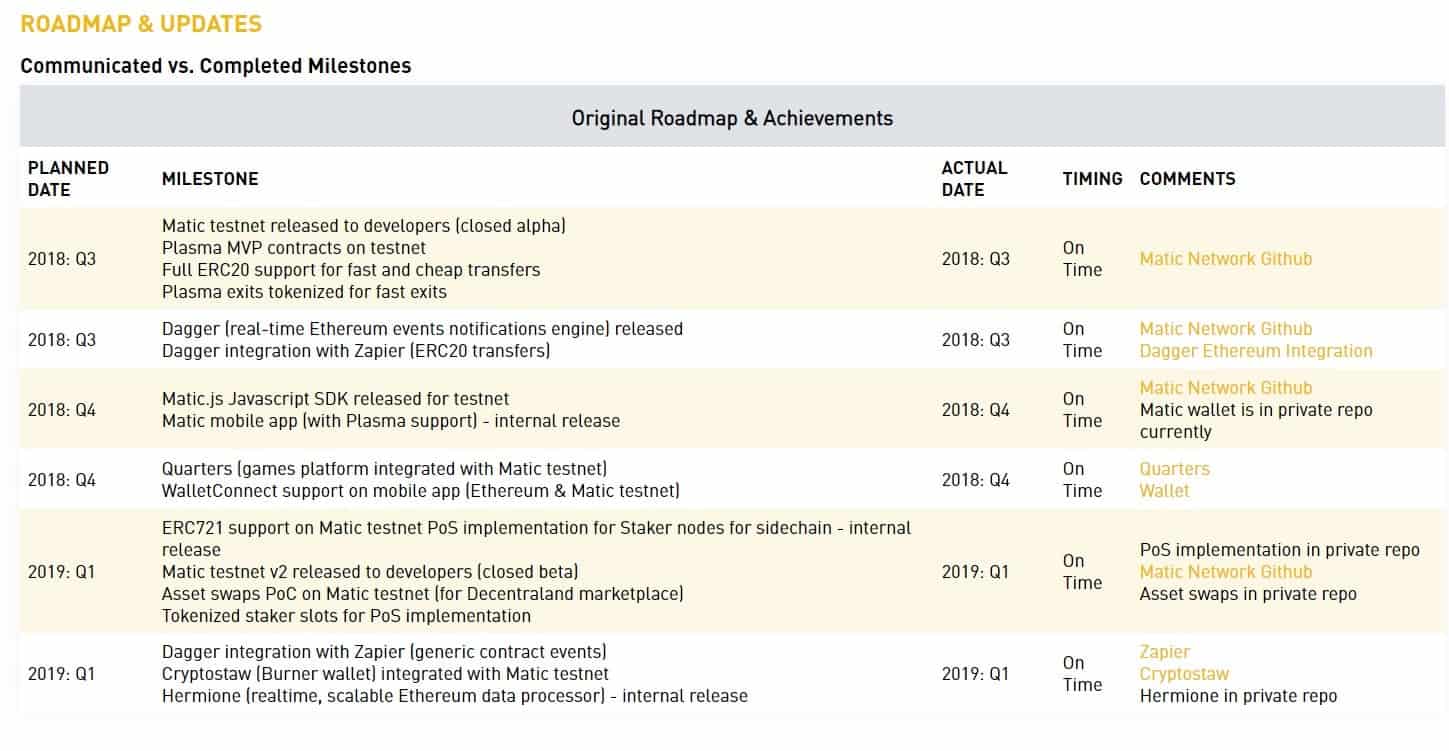

Roadmap

Matic has achieved substantial progress with its roadmap:

By Q1 2019, the team expects to have the following built on top of Matic:

- A Burner wallet

- An upcoming games platform

- A marketplace for NFT assets

- A VR game

- And an advertisement exchange

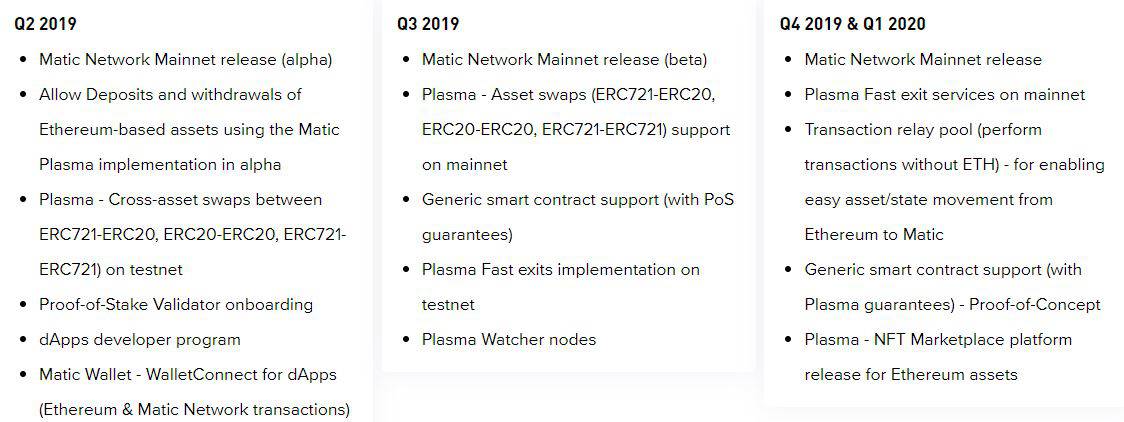

Here are the project’s roadmap updates for Q2 2019:

Matic Review and Rating

Pros

- Market penetration: Solid partnerships with multiple organizations in the blockchain space. Some of the partnerships, specially Decentraland, and Quarkchain can have a significant effect in terms of mass adoption.

- Binance Launchpad sale: The Matic Network sale will be conducted on the top of the Binance Launchpad; this has already proven itself to be a significant advantage with the latest token sales of Celer Network, Fetch.AI, and BitTorrent.

- Use-case: Matic’s Layer 2 scaling solution not only supports payments but smart contracts too. This along with Matic’s compatibility with other blockchain systems has a great potential for the project’s use-cases.

Cons

- Competition: Multiple off-chain scaling solutions are present in the crypto space, including the Lightning Network.

- Team and Advisory Board: Even though the CEO of the project has the right experience and skills (he is a Core contributor to Plasma MVP implementation) most of the team doesn’t have blockchain background and abilities. Regarding the advisors, we don’t see any real technical advisors who can have a significant contribution to the project.

Team & Advisory board: A small sized team which consists of twelve members. The CEO has some serious blockchain background. The advisory board is composed of three members, two of them are from the management team of Decentraland, the last one is Head of Engineering for Wallet at Coinbase. The advisory board lacks technical and legal expertise. Score: 7.7

Stage of the project: Matic testnet v2 has already launched. According to company records their private GitHub accounts are very active with almost 2,400 commits. Score: 8.4

Project Potential: Considering this ICO is being launched on Binance Launchpad the short-term potential is excellent, long-term this is also very interesting, eventually working off-chain solutions seem like the cornerstone of the future of Blockchain technology. If they will be able to fulfill their goal they could have tremendous long term potential. Score: 9.1

Community: 9.2K users on Telegram and 2.3K on Twitter. Also, this project has enjoyed a lot of PR since it is being launched on top of Binance Launchpad, and the Binance user base is, in a sense, the community. Score: 8.8

Token Use: We have seen other solutions that don’t require the existence of native tokens (LN), on the other hand, the Plasma solution which requires native tokens has some serious advantages for creating endless child chain structures which can help Dapps to compete with non-decentralized solutions. Score: 8.5

Token Sale Terms: In total, 22.89% of the tokens will be sold during the three sale rounds for a cap of $5.615 M. Only $615,000 was raised privately and just $165,000 worth of them were sold at a discount. Vesting time for the private investors of one month for 50% of the tokens and the rest will be unlocked in the seventh month. Score: 9.2

White Paper: Well written, very technical and detailed. Score: 8.4

Technology and Code: Active. Most of the code is currently placed in their private GitHub, which according to the company statements has a lot of activity (~2,400 commits). The technology itself seems very relevant to Dapps that would like to adjust themselves to mass activity. Score: 8.8

The post Matic Network (MTX): IEO Review and Rating Ahead of Token Sale (Binance Launchpad) appeared first on CryptoPotato.