Mastering the Mind In Crypto Trading: Following The Herd

Trading cryptocurrency (or any market for that matter), goes against natural human emotions and psychology. It often takes years to train your body and mind to act in ways that promote profit. Many times, the best move is the one that goes against one’s comfort zone. Whether it’s as an outlier or learning to control emotion, successful trading often requires mastery of the mind.

It’s been stated that a mere 6% of people make it as professional traders. This is due to many different factors. However, many of these factors often boil down to psychology. One important aspect of trading psychology is “herd mentality”.

Following the Herd

Herd mentality is defined as “the tendency for people’s behaviour or beliefs to conform to those of the group to which they belong”. Herd mentality can be seen in many aspects of life. Fads are born because “everyone is doing it”. People want to be involved.

The same is true of trading in crypto markets. One reason the most recent crypto bull market exploded in such a dramatic fashion, was due to the perpetuation of ideas. People told their friends about crypto, and how it was “the next big thing”, with tales of their profits. This led to classic examples of Fear of Missing out (FOMO).

This is a fantastic example of herd mentality and a lesson in how to address it. During the recent crypto bull run (November – December 2017), experienced traders probably traded or invested with caution, whereas many other inexperienced people bought what tended to be at the top of the market without calculating or planning their decisions.

For example, when Bitcoin was at $15 – $19k, human emotion probably led people to feel “safe” about taking trades because “everyone was doing it”, and making a significant profit. However, in this type of scenario, it may be unwise to listen to emotions that tell you to blindly and overconfidently dive into trades without proper risk management. There is something strange about human emotions that lead people to feel much better about decisions when many of their peers are doing the same thing and where they are leading to positive outcomes.

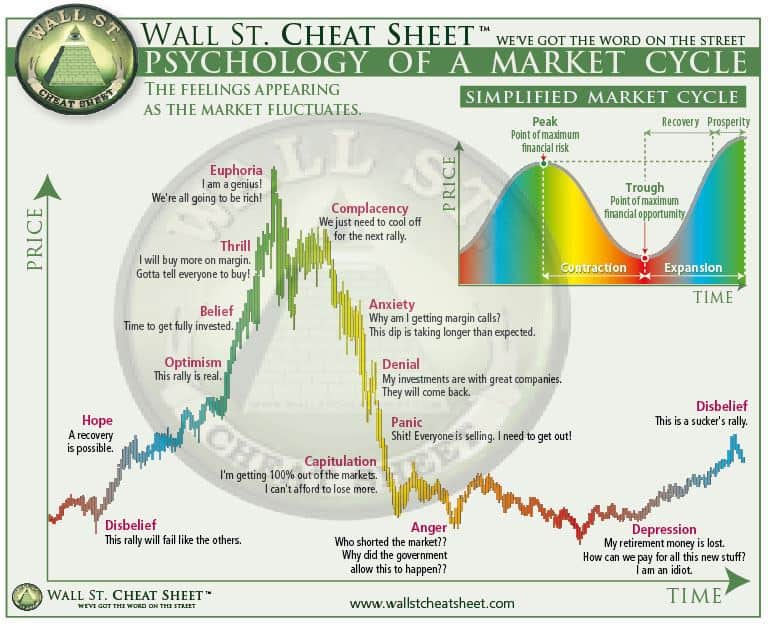

The above might be an example of euphoria, a stage of investor emotion that “marks the point of maximum financial risk. Having seen every decision result in quick, easy profits, we begin to ignore risk and expect every trade to be profitable”.

When trading, emotions are powerful, and can sometimes be of good use. But keeping one’s emotions in check and using your established strategy and calculating the upside and downside risk in every situation is essential.

The post Mastering the Mind In Crypto Trading: Following The Herd appeared first on CryptoPotato.