MassMutual’s $100M Bitcoin Investment Marks Adoption Milestone: JPMorgan

MassMutual’s $100M Bitcoin Investment Marks Adoption Milestone: JPMorgan

JPMorgan analysts have said the recent recent bitcoin purchases by Massachusetts Mutual Life Insurance Co. are a sign of growing mainstream acceptance for the cryptocurrency.

- “MassMutual’s bitcoin purchases represent another milestone in the bitcoin adoption by institutional investors,” JPMorgan’s strategists said, according to Bloomberg on Monday.

- “One can see the potential demand that could arise over the coming years as other insurance companies and pension funds follow MassMutual’s example,” they added.

- On Thursday, the 169-year old insurance firm announced bitcoin purchases worth $100 million, as well as a $5 million equity stake in NYDIG – a financial services firm focused on bitcoin with $2.3 billion in the asset under management.

- MassMutual’s move suggests insurance firms and pension funds are beginning to look at bitcoin as an investment/reserve asset alongside increased demand from wealthy investors and family offices.

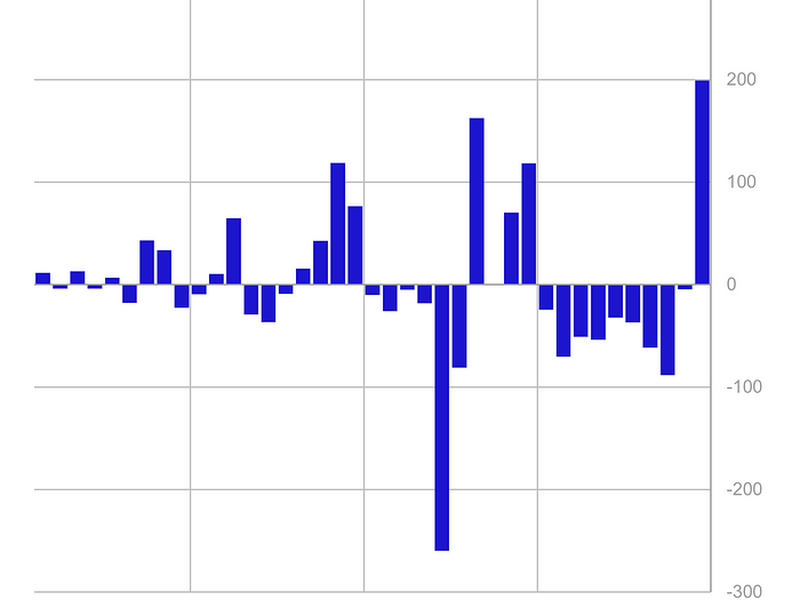

- According to JPMorgan, bitcoin may find an additional demand of $600 billion if pensions insurance firms in the U.S., EU, U.K. and Japan allocate 1% of assets to the top cryptocurrency.

- Regulatory hurdles, however, may complicate matters for such firms, limiting their participation in the bitcoin market, the strategists said.