Market Wrap: Short Seller Liquidations Help Push Bitcoin Beyond $9,500

Source: CoinDesk Bitcoin Price Index

Market Wrap: Short Seller Liquidations Help Push Bitcoin Beyond $9,500

Bitcoin broke through $9,500 Thursday and those short sellers betting on lower prices got liquidated by some crypto derivatives exchanges. That also helped push the world’s oldest cryptocurrency higher.

As of 20:50 UTC (4:50 p.m. ET), bitcoin (BTC) was trading at $9,447, up 2.9% over the previous 24 hours. Trading seems to support a higher upward climb with a large session of buying around 12:00 UTC (8 a.m. ET) briefly pushing price to as high as $9,526 on exchanges including Coinbase. Bitcoin’s price continued its rising trend from Wednesday, well above its 10-day and 50-day moving averages, a technical analysis signal of bullish sentiment.

“A breakout above $10,055 would be a catalyst for significant upside in our work, and support is now defined by the 200-day moving average, which is now at $8,377,” said Katie Stockton, an analyst that covers global markets at Fairfield Strategies.

Stockton doesn’t see the buying momentum for bitcoin slowing down anytime soon. “We think intermediate-term trend-following indicators are pointing higher,” she told CoinDesk.

Large price movements in the bitcoin spot market can often be attributed to the crypto derivatives markets. The derivatives exchange BitMEX, for example, automatically liquidates both long and short seller positions when price begins to quickly move. Bitcoin’s upward trend is being helped in this instance by short sellers getting squeezed out, which triggers automatic buy orders that help move prices higher.

“There are definitely topside liquidations on BitMEX, and more than on average,” said Vishal Shah, an options trader and founder of derivatives exchange startup Alpha5. Over the past 24 hours, buy liquidations are at $39 million on BitMEX, and have far outpaced the $4 million in sell liquidations.

Since May 25, sell liquidations (shown in red in the above chart) have started to abate as buy liquidations grow (shown in blue).

The influence of BitMEX on the markets has been controversial as the exchange’s $700 million in liquidations during March’s precipitous price drop was considered a huge factor in downward selling pressure at the time.

However, Shah says BitMEX’s influence, while still important, is not what it was prior to March. After hitting a high of $1.1 billion in open interest in February, it has not recovered since the March 12 crash and now stands around $630 million. “I do think BitMEX is turning more into a fractal of the market than the anchor. Open interest is definitely in osmosis.”

Along with short squeezes, it’s obvious more people looking to buy bitcoin are helping the price appreciation, according to Rupert Douglas, head of institutional sales for cryptocurrency asset manager Koine. Douglas senses spot exchanges could continue to be heavy on buy orders for bitcoin. “I think the big rally is about to start. I don’t think we are going to trade below $9,000 again,” he said.

However, not everyone is bullish as some traders are planning for downside price action in bitcoin to return at some point. A consistent price increase simply isn’t the dynamics of a market, and crypto is no different, said Josh Rager, a bitcoin trader and founder of educational platform Blackroots.

“What we’re seeing with bitcoin is a two-month run-up with a potential pullback right now, reversion to the mean and price heading back down to $7,000 to $8,000 wouldn’t be out of the question,” Rager said. “In fact, it would be healthy after running up in a two month period.”

Other markets

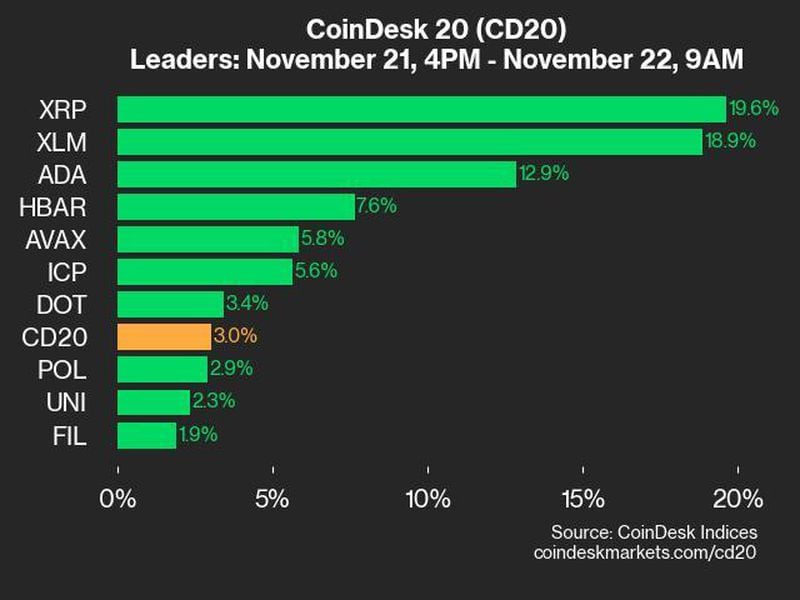

Digital assets on CoinDesk’s big board are all in the green Thursday. Ether (ETH), the second-largest cryptocurrency by market capitalization, gained 3.8% in 24 hours as of 20:50 UTC (4:50 p.m. ET).

Cryptocurrency winners on the day include cardano (ADA) bouncing a healthy 14%, qtum (QTUM) climbing 2.8% and neo (NEO) in the green 2.4%. All price changes were as of 20:50 UTC (4:50 p.m. ET) Thursday.

In the commodities sector, oil is making major gains, climbing 4.3% with a barrel of crude at $33.62 as of press time.

Gold traded flat on the day, with the yellow metal gaining less than a percent and closing at $1,718 at the end of New York trading.

The equities markets had a good day as the negative impact of coronavirus on the economy seems to be decreasing, at least in investors’ eyes. In the United States, the S&P 500 index ended trading flat, down less than a percent. In Europe, the FTSE Eurotop 100 index ended trading up 1.5%. Japan’s Nikkei 225 of large companies ended the day up 2.3%, with the Asian index hitting its highest close since February 27.

U.S. Treasury bonds were mixed on the day. Yields, which move in the opposite direction as price, were down most on the two-year bond, in the red 8%.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.