Market Wrap: Oil Rebounds As Crypto Makes Gains, Especially Ether

The oil markets rebounded somewhat from the stunning, historic lows that started the week. Prices for a barrel of West Texas Intermediate (WTI) have remained generally above $10 Wednesday, with trading up 9 percent as of 20:30 UTC (4:30 p.m. EDT).

European markets saw gains, with the FTSE Eurotop 100 index closing in the green 1.9 percent, driven by oil-related stocks.

The S&P 500 index also ended the day on the plus side, up 2.2 percent. Meanwhile, U.S. Treasury bonds sold off slightly as traders were willing to take on a little bit more risk in the equities market. Yields on the two-year, the 10-year and the 30-year Treasury bonds all rose (bond yields rise as prices fall). The yield on the 10-year climbed highest, to 6 percent at 20:30 UTC (4:30 p.m. EDT) Wednesday.

Despite Wednesday’s uptick, crude is not out of the woods. “Although OPEC production cuts are expected to kick off in May, weak demand and high global inventory mean that oil prices remain under pressure,” said Nemo Qin, senior analyst for multi-asset brokerage eToro.

Crypto markets

The price of bitcoin climbed 3.4 percent over the past 24 hours, according to CoinDesk’s Bitcoin Price Index as of 20:30 UTC (4:30 p.m. EDT) Wednesday.

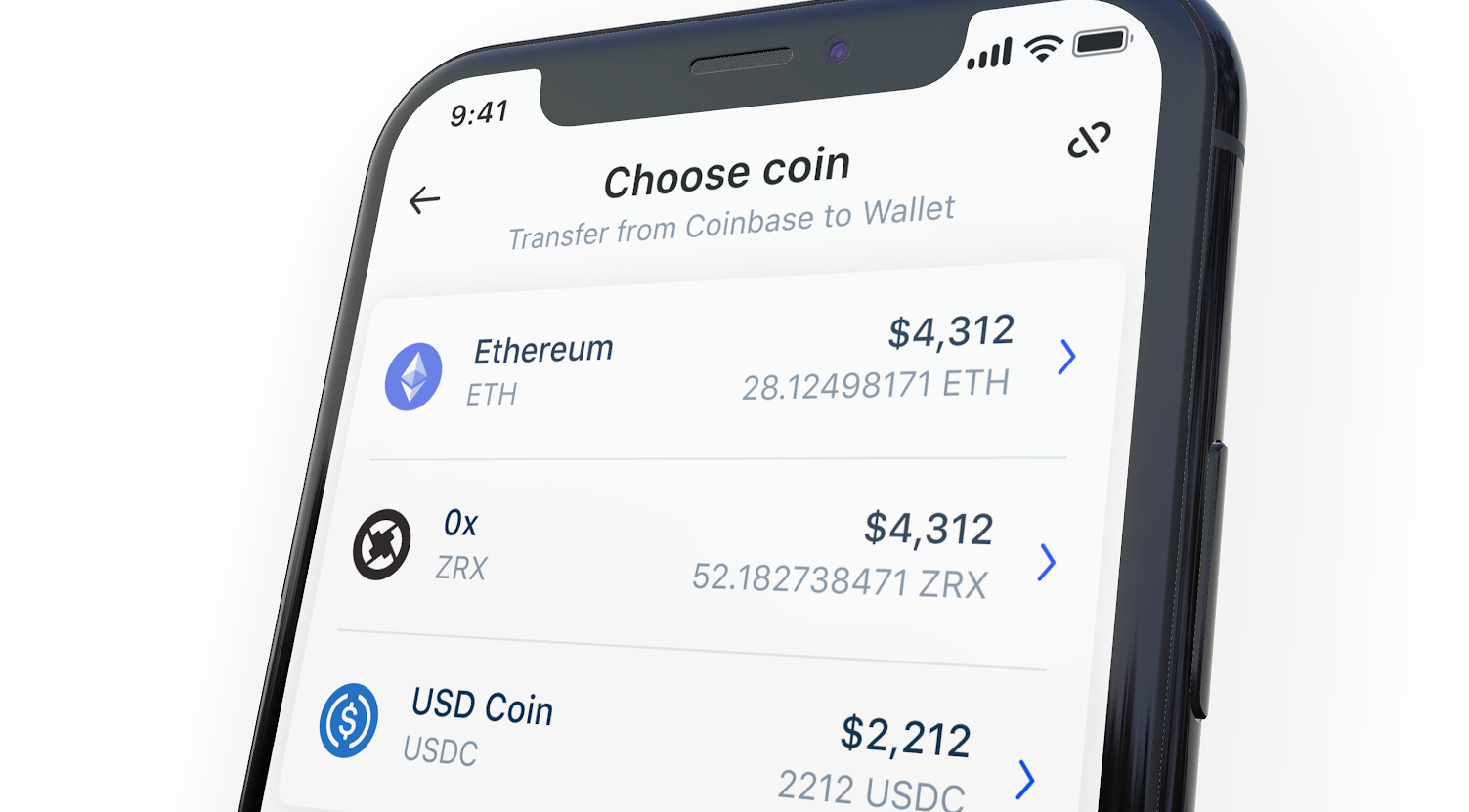

After starting at midnight UTC around $6,800, bitcoin saw some buying on spot exchanges like Coinbase. That pushed its prices above $7,000, breaking higher than its 10-day and 50-day moving averages, a bullish signal for those who follow technical analysis.

It’s just about more buyers but perhaps fewer sellers in the cryptocurrency ahead of the expected May halving event.

“With the bitcoin halving fast approaching, where miners will see the amount of bitcoin mined from each node reduced by 50 percent, it could be that investors are choosing not to sell their holdings as we might expect,” said Simon Peters, another analyst at eToro. “Instead, they are staying in bitcoin so as not to miss out on the anticipated gains in the months following the halving.”

Digital assets are up on CoinDesk’s big board for the day. Ether (ETH) climbed 6 percent. The biggest winners today include dash (DASH) up 7.6 percent, stellar (XLM) gaining 6.9 percent and cardano (ADA) in the green 5 percent. All price changes are as of 20:45 UTC (4:45 p.m. EDT) Wednesday.

Ether beats bitcoin

Despite security concerns in the Ethereum-backed decentralized finance (DeFi) ecosystem, the price of ether continues to perform well, trouncing bitcoin since the beginning of the year, according to data from aggregator Coin Metrics. Year to date, bitcoin is flat while ether has seen 30 percent gains.

While ether’s prices have done remarkably well, Ethereum’s DeFi ecosystem has been hit with smart contract security problems. That includes the bZx “flash loans” hack in February, when a hacker was able to drain $350,000 from the Fulcrum lending platform. In addition, more recently, the dForce protocol saw $25 million in crypto drained from the Lendf.me lending platform which was 99 percent of its total balance, although that attacker soon returned most of the funds.

It’s hard to place blame on protocols, says Jason Wu, CEO of Definer.org, a network for digital asset savings, loans, and payments. “The latest news on DeFi’s security flaws have to do with the construction of the architecture on top of Ethereum, and not to do with the Ethereum protocol itself. As such, I do not expect the flaws of a limited number of DeFi projects to affect the price of ETH,” Wu said.

“The so-called security flaws are merely structural decisions that DeFi companies are making and not indicative of Ethereum itself,” said Neeraj Khandelwal, Co-founder of India-based exchange CoinDCX.

Companies, not protocols, are causing problems with DeFi, Khandelwal added. He made a comparison to the critical web protocol HTTP – it has been hacked as well, usually due to bad security practices by organizations that cause issues. “Just like how we wouldn’t dismiss the entire HTTP protocol due to the hacking of a single website, it will be misplaced to deem Ethereum unsafe and insecure simply based on the flaws of DeFi companies.”

Ethereum as a cryptocurrency computing platform isn’t the only one suffering from hacks. The Factom protocol, a smaller rival to Ethereum, this week fell victim to a $11 million hack of stablecoin platform PegNet. Insiders have said the Factom PegNet hack looks similar to the Ethereum-based dForce attack, a sign hackers can be protocol agnostic with their tactics.

DeFi’s travails most likely doesn’t have an affect on ether’s price performance. Liquidity on exchanges, and not protocol fundamentals, could be ether’s key feature for traders.

“Ether and bitcoin have many similar attributes: easily accessible and tradable on global exchanges everywhere, used heavily for trading pairs, very little friction with cross-border trading, deemed not equities by the SEC,” said Definer.org’s Wu. Their values — and in turn, their prices — aren’t necessarily tied to their technical attributes.”

Other markets

Gold also bounced higher Wednesday, with buying volume of the yellow metal keeping its price above $1,700.

“Gold prices are expected to be pushed higher due to investors flocking toward safe-haven assets,” said Nemo Qin, Senior Analyst eToro. “We can expect to see gold and gold-backed investments to continue to grow in 2020.”

In Asia the Nikkei 225 dropped, although only less than a percent, in daily trading as Tokyo’s transportation and real estate sectors were hit with big losses on Wednesday.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.