Market Wrap: Bitcoin Sticks to $10.7K; DeFi Site dForce Doubles TVL in 24 Hours

Market Wrap: Bitcoin Sticks to $10.7K; DeFi Site dForce Doubles TVL in 24 Hours

Buying volume is pushing bitcoin higher. Meanwhile, DeFi investors continue to seek places to park crypto for steady yield.

- Bitcoin (BTC) is trading around $10,730 as of 20:30 UTC (4:30 p.m. EDT). Gaining 0.50% over the previous 24 hours.

- Bitcoin’s 24-hour range: $10,550-$10,795

- BTC above its 10-day and 50-day moving averages, a bullish signal for market technicians.

Bitcoin’s price was able to cling to $10,700 territory, rebounding from a bit of a dip after the cryptocurrency rallied on Thursday. It was changing hands around $10,730 as of press time Friday

Guy Hirsch, managing director and U.S. head for multi-asset broker eToro, points to fundamentals for a bullish bitcoin case.

He cites bitcoin’s mining hashrate and difficulty hitting all-time highs, along with heightened economic uncertainty in the face of rising COVID-19. “$11,000 is the only barrier to a parabolic run towards $12,000 or higher,” Hirsch told CoinDesk.

Neil Van Huis, head of institutional trading at liquidity provider Blockfills, said he is just happy bitcoin has been able to stay over $10,000, which he contends feels is a key price point.

“I think we’ve seen that test of $10,000 hold which keeps me a level-headed bull,” he said.

The last time bitcoin dipped below $10,000 was Sept. 9.

“Below $10,000 makes me worried about a pullback to $9,000,” Van Huis added.

The weekend should be relatively calm for crypto, according to Jason Lau, chief operating officer for cryptocurrency exchange OKCoin.

He pointed to open interest in the futures market as the source of that assessment. “BTC aggregate open interest is still flat despite bitcoin’s overnight price gain – nobody is opening new positions at this price level,” Lau noted.

Another indicator of expected calm is bitcoin swaps funding, which remains in negative or near zero territory – a signal derivatives traders are still hesitant to place bullish bets.

Lau said there would need to be positive funding rates in the derivatives market before another big price pop.

“Until funding goes positive again, it’s hard to see us going much higher – for me that’s the best indicator of where we are at the moment,” said Lau. “Longs are being paid to open positions, so it confirms that there’s still a lot of hesitation at current price levels.”

Investors hunting for yield plow into dForce

The second-largest cryptocurrency by market capitalization, ether (ETH), was up Thursday, trading around $355 and climbing 2.7% in 24 hours as of 20:30 UTC (4:30 p.m. EDT).

DeFi project dForce, a decentralized exchange, has seen its total value locked (TVL) almost double over the past 24 hours, from $58 million Thursday to over $108 million as of press time.

Jean-Marc Bonnefous, managing partner of Tellurian Capital, which invests in the DeFi ecosystem, says some investors should be wary of trendy projects cropping up in the ecosystem.

“There’s a great pace of innovation, but in some cases, project releases are not even a minimum viable product,” he said. “So the chances for breaking are pretty high which implies a huge risk premium and high volatility for the tokens as we have seen over the last few weeks.”

It’s possible, then, that crypto traders like dForce for parking assets while waiting for more exciting opportunities. According to the project’s website, dForce users are currently getting a 7% annual yield on the dai (DAI) stablecoin.

Other markets

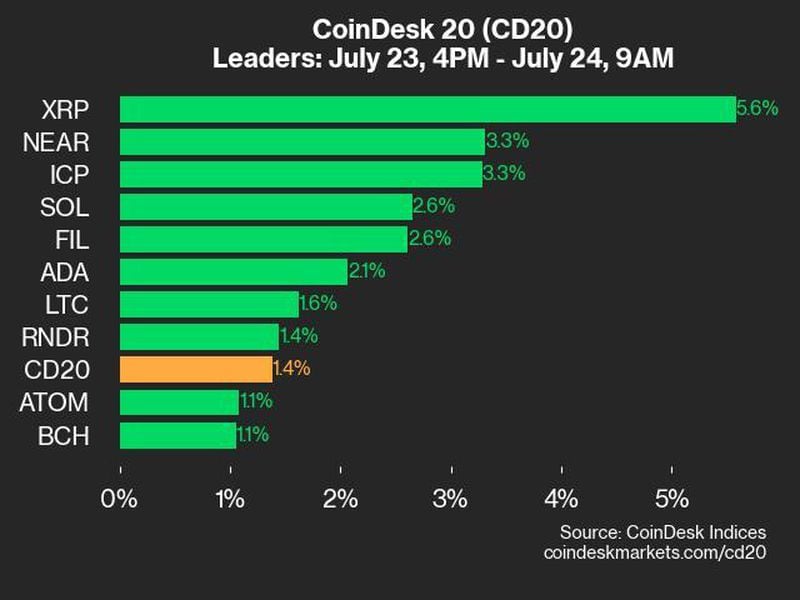

Digital assets on the CoinDesk 20 are mostly green Friday. Notable winners as of 20:30 UTC (4:30 p.m. EDT):

- chainlink (LINK) + 10.6%

- stellar (XLM) + 7.1%

- 0x (ZRX) + 6%

Notable losers as of 20:00 UTC (4:30 p.m. EDT):

- ethereum classic (ETC) – 1.2%

- bitcoin sv (BSV) – 0.61%

Equities:

Commodities:

- Oil was down 0.22%. Price per barrel of West Texas Intermediate crude: $40.05.

- Gold was in the red 0.24% and at $1,862 as of press time.

Treasurys:

- U.S. Treasury bond yields all fell Friday. Yields, which move in the opposite direction as price, were down most on the 2-year, dipping to 0.129 and in the red 8.3%.