Market Wrap: Bitcoin Sinks to $11.6K as Ether’s Gas Keeps Rising

CoinDesk 20 Bitcoin Price Index

Market Wrap: Bitcoin Sinks to $11.6K as Ether’s Gas Keeps Rising

Bitcoin traders are hitting the sell button. On Ethereum, DeFi is boosting fees again.

- Bitcoin (BTC) trading around $11,658 as of 20:00 UTC (4 p.m. ET). Slipping 2.6% over the previous 24 hours.

- Bitcoin’s 24-hour range: $11,613-$12,100

- BTC below its 10-day and 50-day moving averages, a bearish signal for market technicians.

Bitcoin traded as low as $11,613 Tuesday. Traders continued selling the world’s oldest cryptocurrency after it hit a 2020 high of $12,485 on Monday. For the time being, it may struggle to break much higher from that.

“Too much resistance at $12,000,” said over-the-counter crypto trader Alessandro Andreotti. “So it’s just going to go sideways for a while.”

Katie Stockton, analyst for Fairlead Strategies, expects a weaker bitcoin market ahead. “There are signs of short-term upside exhaustion supporting continuation of today’s pullback over the next week or two,” said Stockton. Traders In the bitcoin options market don’t expect too drastic a pullback, however, as most strikes are well over $10,000.

Many traders remain bullish despite the recent price drop, seeing the decline as a bit of a respite before rising. “Last year’s high was $13,852,” noted Rupert Douglas of institutional crypto broker Koine. “We are going to test that, but whether we have a significant pullback to around $10,000 first is a tough call,“ Douglas added.

First it must get over that $12,000 hurdle, and traders like Andreotti see that level as all that stands in the way of a return to bullish territory. “I believe that in the next attempt at breaking $12,000 we could have the next major support as high as $13,500,” added Andreotti.

Ethereum’s gas pain

The second-largest cryptocurrency by market capitalization, ether (ETH), was down Wednesday, trading around $398 and slipping 5.8% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

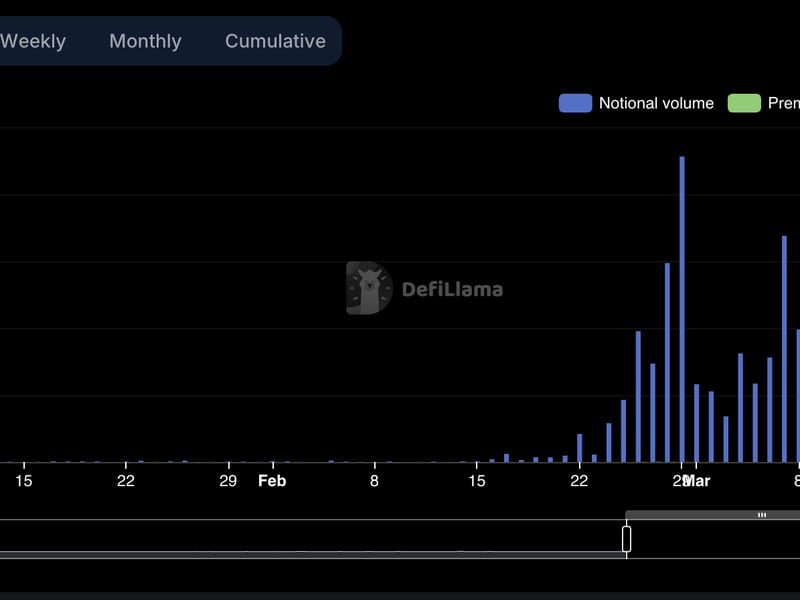

After jumping to an average all-time high of $6.68 on Aug. 13, Ethereum fees dropped briefly below $3. However, they are now rising again, currently at $3.59, according to data from aggregator Glassnode. The fees are required to make transactions on the network, including trading on decentralized exchanges, or DEXs.

Ethereum network average fees the past month.

Peter Chan, a trader at firm OneBit Quant, says the network’s fee costs, also known as gas, are problematic for Ethereum’s DeFi market. “Everyone in DeFi was all over the place, including us, the last couple of days due to the insane gas cost,” he said. The bearish market trend, in addition to the fees, are problematic for the ecosystem’s cryptocurrencies, Chan told CoinDesk. “DeFi coins are going downhill now.”

Other markets

Digital assets on the CoinDesk 20 are mostly in the red Wednesday. One notable winner as of 20:00 UTC (4:00 p.m. ET):

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- tron (TRX) – 10%

- litecoin (LTC) – 9.9%

- eos (EOS) – 9.6%

Equities:

Commodities:

- Oil is up 0.66%. Price per barrel of West Texas Intermediate crude: $42.80.

- Gold was in the red 3% and at $1,940 as of press time.

Treasurys:

- U.S. Treasury bonds were mixed Wednesday. Yields, which move in the opposite direction as price, were down most on the two-year, in the red 2.6%.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.