Market Wrap: Bitcoin Flat at $15.2K; Crypto Locked in DeFi at All-Time High

Market Wrap: Bitcoin Flat at $15.3K; Crypto Locked in DeFi at All-Time High

Bitcoin is sideways Tuesday, with little price action. However, traders seem to be jumping into decentralized finance to maximize their crypto yield.

- Bitcoin (BTC) trading around $15,345 as of 21:00 UTC (4 p.m. ET). Slipping 0.30% over the previous 24 hours.

- Bitcoin’s 24-hour range: $15,092-$15,471.

- BTC close to its 10-day and 50-day moving averages, a flat or sideways signal for market technicians.

Bitcoin’s price was flat Tuesday, sticking to a $15,000-$15,400 range and at $15,345 as of press time. It was a bit of a respite after Monday’s $1,000 price move in a span of hours.

Funding rates have ticked up on major derivatives venues, a sign more traders are looking for long leverage.

“It is likely that the sharp bounces in BTC price yesterday and on Saturday were retail led – with the perpetual swap funding spiking for the first time since September,” quantitative trading firm QCP Capital wrote in its Tuesday investor note. “One reason for the overall strength and stickiness of the rally in the last two months has been the absence of retail over-leverage, as evidenced by the flat funding up till now.”

Mostafa Al-Mashita, executive vice president of trading for Global Digital Assets, is keeping an eye on bitcoin’s correlation with the S&P 500 index as a way to gauge fundamental market news affecting the crypto market.

“We saw positive momentum from the Pfizer announcement, with a loss of S&P 500 correlation to bitcoin price action,” Al-Mashita said. “Support will be established over the next couple of days before rebounding to continue the bullish trend.”

After a slight dip last week, bitcoin’s correlation to the key U.S. index cropped back up on Monday.

“The last month has been extremely bullish for digital assets,” said Brian Mosoff, chief executive officer of investment firm Ether Capital. “Various institutions are committing to new products and R&D and giving a new set of investors more comfort that the space is maturing.”

Year-to-date, bitcoin has more than doubled and over the past month, the world’s oldest cryptocurrency is up over 35%.

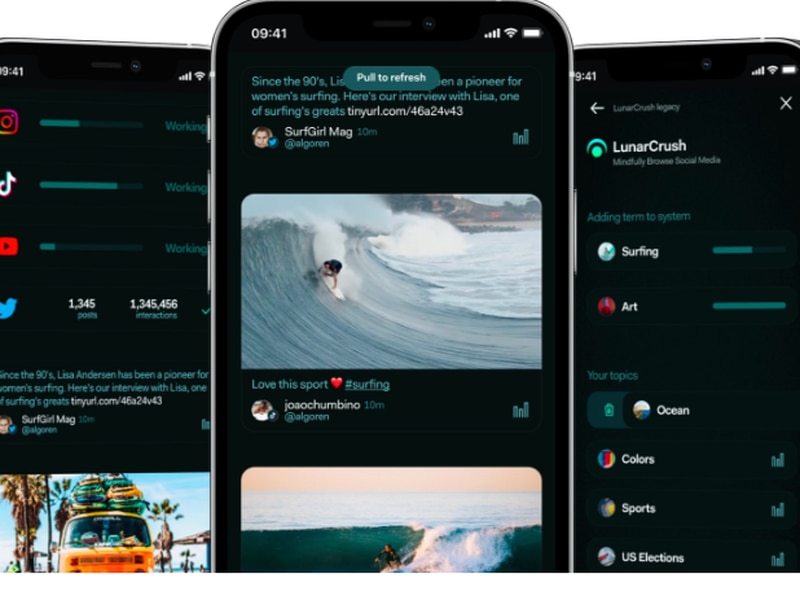

With the sideways price performance Tuesday, a number of traders appear to be moving crypto into decentralized finance, or DeFi, for yield-generating opportunities. According to DeFi Pulse, 168,111 BTC, worth $2.5 billion as of press time, is generating yield in various Ethereum-based protocols.

“BTC is digesting the recent confusing macro and political events and consolidating before its next move,” said Jean-Marc Bonnefous, managing partner of investment firm Tellurian Capital. “We are seeing the rotation from BTC to DeFi in full swing now, which is typical of traders redeploying capital to higher yielding assets.”

DeFi value locked at a high

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up Tuesday trading around $450 and climbing 0.70% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

The amount of cryptocurrency “locked” or held in Ethereum-based DeFi protocols is at a record Tuesday. Over $12.8 billion is currently being held in DeFi, the highest it has ever been according to data aggregator DeFi Pulse.

Ether Capital’s Mosoff says many investors have profited from rising crypto prices and are looking to find additional gains in the DeFi market.

“Total value locked in DeFi is hitting all-time highs likely due to the price increase across all crypto assets and the continued positive sentiment in the space alongside more certainty in the political arena,” Mosoff told CoinDesk.

Other markets

Digital assets on the CoinDesk 20 are mixed Tuesday. Notable losers as of 21:00 UTC (4:00 p.m. ET):

- algorand (ALGO) + 8.2%

- 0x (ZRX) + 7.7%

- chainlink (LINK) + 4%

Notable losers:

- bitcoin cash (BCH) – 3.1%

- litecoin (LTC) – 1.7%

- cosmos (ATOM) – 1.2%

Equities:

Commodities:

- Oil was up 3.8%. Price per barrel of West Texas Intermediate crude: $41.34.

- Gold was in the green 0.58% and at $1,872 as of press time.

Treasurys:

- U.S. Treasury bond yields all climbed Tuesday. Yields, which move in the opposite direction as price, were up most on the 2-year, jumping to 0.183 and in the green 3.4%.