Market Wrap: Bitcoin Edges Up to $7.7K as Mining Power Rebounds

Market Wrap: Bitcoin Edges Up to $7.7K as Mining Power Rebounds

Bitcoin’s price is on the upswing, and so is the amount of computing power securing the network as a once-in-four-years event known as the halving approaches.

The world’s oldest cryptocurrency is up 12% over the past five days, and less than a percent over the last 24 hours, trading in $7,600-$7,700 territory Tuesday.

The price for one BTC has been above the technical indicator 10-day and 50-day moving averages, indicating bullish sentiment.

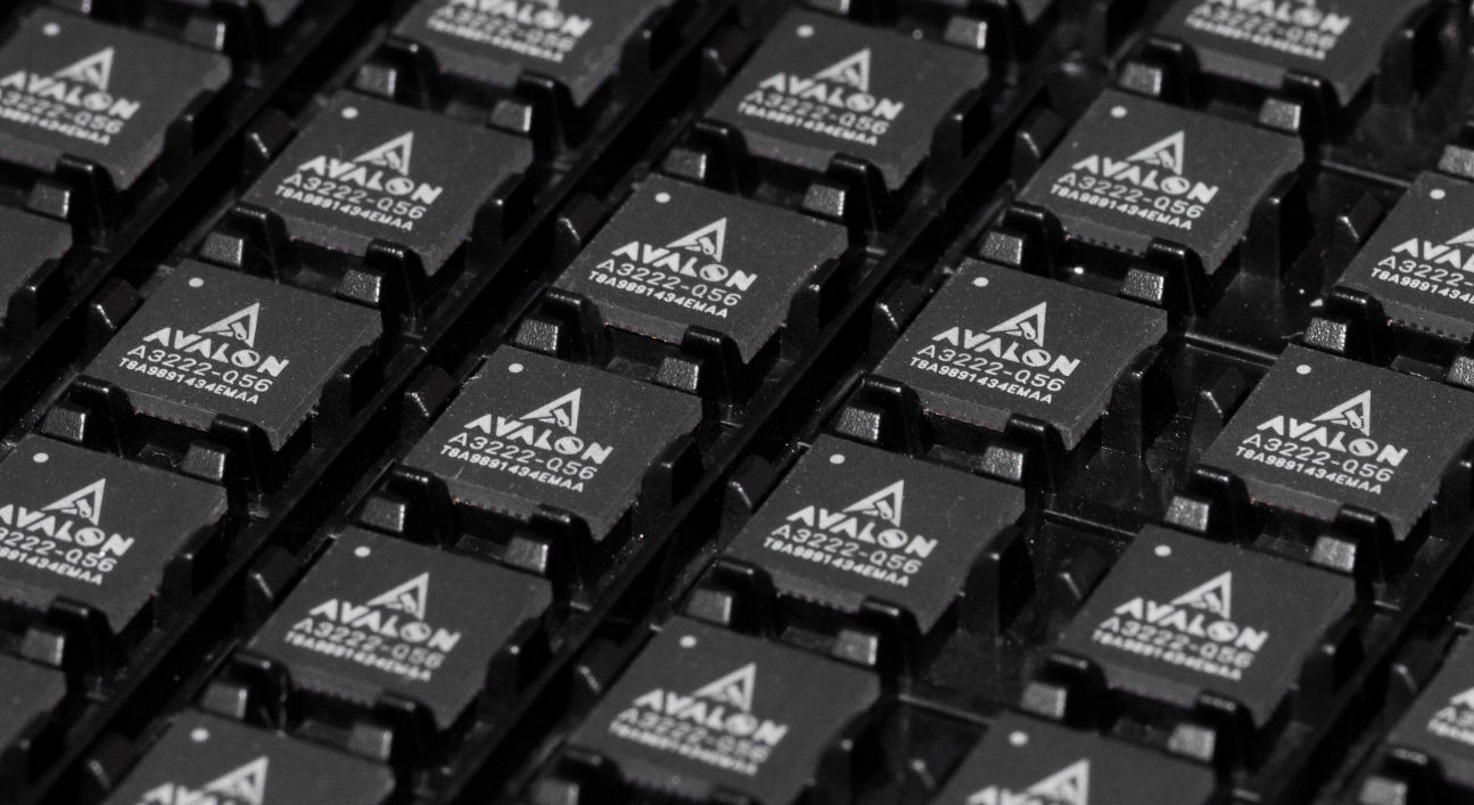

Meanwhile, mining power is making a comeback from March lows. After a high of 121 exahashes, or millions of terahashes, per second (EH/s) in early March, the network dropped to 95 EH/s by March 19. The hashrate is now trending up again ahead of the halving.

Bitcoin’s March price bloodbath, with over $700 million in BitMEX liquidations triggered, likely contributed some to the March mining power dip as some machines became less profitable. However, bitcoin’s 19% gain over the past month certainly doesn’t hurt miners now.

Despite the recent increase, network power will likely recede over time, according to John Lee Quigley, an analyst for MinerUpdate.

“Hashrate is expected to decline post-halving with industry professionals estimating decreases in the range of 13% to 60%,” Quigley wrote in an April report.

Vishal Shah, an options trader and founder of derivatives exchange Alpha5, sees inflows to cryptocurrencies broadly as one reason for bitcoin’s recent price appreciation.

“The past week at least appears to be spot-led and is indicative of some unlevered capital funneling into crypto in general,” he said.

Yet, as bitcoin’s price continues its rebound from March lows below $4,000, the real pop may not come until summer or fall.

“The real climb around halvings occurs months later,” post-halving, according to Henrik Kugelberg, a Sweden-based over-the-counter crypto trader. “I see no reason that will not happen again.”

The rationale for bullishness, while hotly debated, is that once the amount of supply entering the system every 10 minutes or so drops from 12.5 BTC to 6.25, unchanged demand should drive the price up.

“Both previous halvings had a very positive impact on bitcoin’s price, since they compress the supply and drive greater demand,” said Sebastian Serrano, CEO at Argentina-based crypto payments company Ripio.

Other markets

Digital assets on CoinDesk’s big board performed well Tuesday with nearly everything in the green. The second-largest coin by market cap, ether (ETH), gained 1% as of 20:25 UTC (4:25 p.m. EDT).

Big gainers included lisk (LSK) gaining 11.5%, stellar (XLM) climbing by 8.7% and xrp (XRP) jumping 8.4%. All price changes are as of 20:25 UTC (4:25 p.m. EDT).

Oil remains in turmoil, although only down 1.8% as of 20:25 UTC (4:25 p.m. EDT) However, the 30-day historical volatility of oil has been higher than bitcoin’s this month.

“The oil market implosion just reminds us that there are many skeletons in the traditional market closet, and a lot fewer in digital assets than many believe,” digital asset investment firm Arca wrote in its Monday letter this week.

Gold traded flat Tuesday and closed the New York trading session at $1,708.

“Gold has shied away from marking new highs with all the optimism going around,” said Mati Greenspan, founder of Quantum Economics, in an investor update, referring to gold’s role as a store of value in bleak times.

The S&P 500 index slipped less than a percent – down 10% year-to-date. U.S. Treasury bonds slipped – yields, which move in the opposite direction as price, were down with yields on the 2-year down 13.8%.

Europe’s FTSE Eurotop 100 index of largest companies in Europe ended its trading day in the green 1.6% amid positive news of pandemic lockdown easing.

In Asia, the Nikkei 225 index of Japanese stocks closed almost flat with losses in the transportation and real estate sectors.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.