Market Wrap: Bitcoin Briefly Pops Above $9,400 as Global Stocks Rally

Source: CoinDesk 20 Bitcoin Price Index

Market Wrap: Bitcoin Briefly Pops Above $9,400 as Global Stocks Rally

Bitcoin hit its highest price point in almost two weeks as stocks climbed.

- Bitcoin (BTC) trading around $9,371 as of 20:00 UTC (4 p.m. EDT). Gaining 2.2% over the previous 24 hours.

- Bitcoin’s 24-hour range: $9,149-$9,439

- BTC above 10-day and 50-day moving average, a bullish signal for market technicians.

Bitcoin stakeholders were delighted to see green flashes on their screens next to the world’s oldest cryptocurrency Tuesday.

Prices on the world’s most valuable cryptocurrency went as high as $9,439 around 7:00 UTC (3 a.m. EDT), a price not seen since July 9.

“Bitcoin might be waking up,” said Rupert Douglas, head of institutional sales at London-based crypto brokerage Koine. “A close above $9,600 would be a strong sign.”

Some are just happy to see prices go up in the bitcoin market, which has lacked activity for much of July.

“Nice to finally see a bit of movement,” said Douglas Bilyk, a director at New York-based crypto brokerage Copper. “With lower volumes, it doesn’t take as much to push it, and looks like the initial move was up. Now we just need to see some follow-through.”

Major global equities are also showing positive gains today:

Gains in the equity markets appear to have been the catalyst for bitcoin’s positive trading day. “Bitcoin seems pretty correlated to equities at the moment,” Koine’s Douglas told CoinDesk. “The test will be whether BTC can hold up if equities sell off.”

Stock indices have been outperforming bitcoin in July. However, Vishal Shah, an options trader and founder of derivatives exchange Alpha5, points out that flat markets for the oldest cryptocurrency sometimes can occur.

“This lull isn’t uncharacteristic of bitcoin; it spent most of Q1 2019 in a sideways market,” he said.

“Expectations are always running high for performance. And though it’s a well-run narrative by now, bitcoin has a tendency to exhibit a high volatility; things will move again,” Shah added.

Curve DEX volumes up

The second-largest cryptocurrency by market capitalization, ether (ETH), was up Tuesday, trading around $245 and and climbing 4.4% in 24 hours as of 20:00 UTC (4:00 p.m. EDT).

Ethereum-powered decentralized exchange (DEX) Curve Finance is seeing huge growth in volumes this past week. Curve, at $70 million in volume over the past 24 hours, has overtaken bellwether DEX Uniswap as decentralized finance (DeFi) heats up.

“It is probably a bit of interest picking up in non-bitcoin assets that are becoming multifunctional or yield-enhancing,” said Neil Van Huis, director of institutional trading for Chicago-based liquidity provider Blockfills.

Jake Brukhman, managing partner for New York-based crypto asset manager CoinFund, said Curve’s specialization in swapping stablecoins gives the DEX an edge in execution.

When DeFi traders seeking opportunities need to arbitrage stable assets, Curve’s volume increases.

“They are using a mathematical equation which makes slippage very low,” Brukhman said.

Other markets

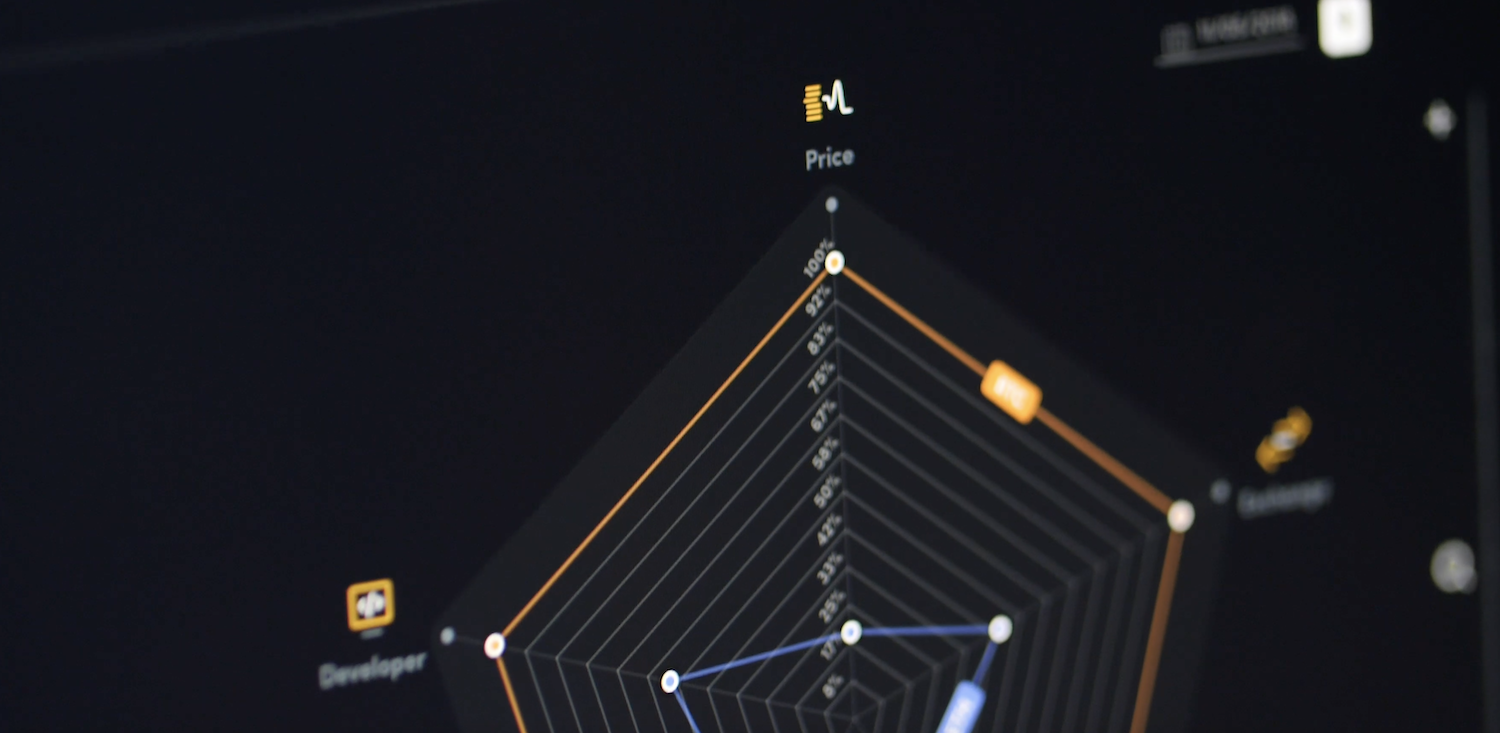

Digital assets on the CoinDesk 20 are mostly green Tuesday. Notable winners as of 20:00 UTC (4:00 p.m. EDT):

- zcash (ZEC) + 7.7%

- tezos (XTZ) + 7.3%

- neo (NEO) + 6.5%

Notable losers as of 20:00 UTC (4:00 p.m. EDT):

Commodities:

- Oil is in the green 2.5%. Price per barrel of West Texas Intermediate crude: $41.80

- Gold is up 1.2% Tuesday, at $1,840 per ounce

Treasurys:

- U.S. Treasury bonds all slipped Tuesday. Yields, which move in the opposite direction as price, were down most on the 10-year, in the red 1.8%.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.