Market Wrap: Bitcoin Briefly Drops Below $18K While ETH Uncouples From BTC

Market Wrap: Bitcoin Briefly Drops Below $18K While ETH Uncouples From BTC

Bitcoin dipped below $18,000 before recovering on higher-than-average spot volume. Meanwhile, ether’s price performance is showing a divergence from bitcoin.

- Bitcoin (BTC) trading around $18,374 as of 21:00 UTC (4 p.m. ET). Slipping 0.85% over the previous 24 hours.

- Bitcoin’s 24-hour range: $17,990-$18,752 (CoinDesk 20)

- BTC below its 10-day and 50-day moving averages, a bearish signal for market technicians.

Bitcoin’s price was all over the place Monday, dipping below $18,000 then hitting as high as $18,752 before settling at $18,374 as of press time.

It appeared that more traders were hitting the sell button given the world’s oldest cryptocurrency’s volatility Monday.

“Most likely, we will touch the $19,000 mark before the start of a correction,” noted Constantin Kogan, managing partner at Wave Financial.

Another week has begun with higher-than-normal USD/BTC spot volumes, a factor that led to bitcoin’s bullish run last week. As of press time, daily volume hit $907 million, much higher than the past month’s daily average of $489 million.

“A pullback just below the all-time high is not unexpected and it will be even healthy,” said David Lifchitz, chief investment officer at quant trading firm ExoAlpha. ”We could see bitcoin moving sideways from here in a $18,000-$19,000 range or perhaps even pull back to $16,000 before trying a new reach at the all-time high.”

Bitcoin’s record high price is $19,783 set on Nov. 4, 2017, according to CoinDesk 20 data.

Analysts are keeping an eye on China-based crypto flows to help indicate where price might be heading. China-focused exchange OKEx, for example, has had no outflows since Oct. 16 following the halting of withdrawals. Since then, bitcoin’s price has soared to over $18,000 from $11,500 while OKEx users have not been able to withdraw any crypto from the exchange.

Darius Sit, managing partner of quaint firm QCP Capital. said OXEx “possibly contributed” to the price rise, but a bigger problem has been cropping up on the mainland. “It’s not just OKEx but across the board – difficulties with getting fiat” out of China, Sit added.

“The OKEx story is just weird,” said George Clayton, managing partner of investment firm Cryptanalysis Capital. OKEx is “huge, but with all of the institutional flow around crypto, I don’t think the status of any single exchange is enough to affect prices beyond typical daily volatility.”

Indeed, it is possible that institutional investors, who have been piling in, may help absorb any problems China-based crypto businesses may have. The derivatives market is a sign of this, as bitcoin futures hit $7 billion in open interest Sunday, with institutional venue CME at $1 billion.

“It’s important to remember there’s a large chunk of institutional money moving in and not as much retail,” noted Chris Thomas, head of digital assets for Swissquote Bank. “So we’re seeing a more structured move higher here, which should continue for a while yet.”

BTC, ETH correlation breaking

The second-largest cryptocurrency by market capitalization, ether (ETH), was up Monday trading around $595 and climbing 5.3% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

Since Nov. 20, the price of bitcoin has been relatively stagnate, up only 3% as of press time.

The price of ether is up over 25% during the same time period.

According to data from CoinDesk Research, returns of bitcoin and ether were highly correlated in March, April and May on a 90-day rolling basis – even before the early March sell-off that took its toll on assets across the board. However, since June, correlations have mostly been lower.

Some investors attribute the recent ether price run separate from bitcoin to the Ethereum network’s plan to shift to “2.0”. Ether holders must “stake” at least 32 ETH in the new network’s smart contract, which is currently around 65% of the over 524,000 ETH balance required to launch.

“This current run I largely attribute to the excitement around the pending launch of Ethereum 2.0, the much-anticipated Ethereum network upgrade,” said Brian Mosoff, chief executive officer of investment firm Ether Capital. “It’s been years in development, and I think a lot of the discounted price was a reflection of the market’s uncertainty if Ethereum 2.0 would ever launch or if a competitor smart contract platform would steal mindshare.”

Other markets

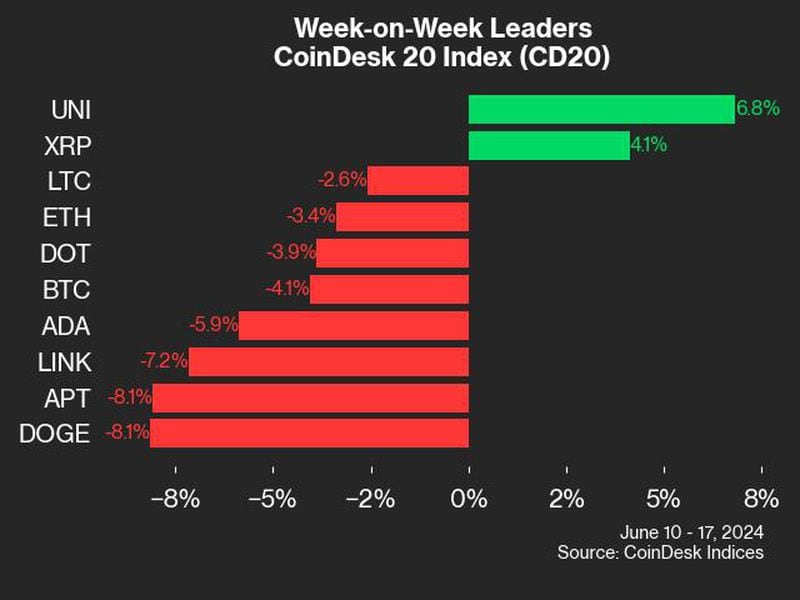

Digital assets on the CoinDesk 20 are all green Monday. Notable winners as of 21:00 UTC (4:00 p.m. ET):

- orchid (OXT) + 26.8%

- xrp (XRP) + 16.3%

- tezos (XTZ) + 10.6%

Equities:

Commodities:

- Oil was up 1%. Price per barrel of West Texas Intermediate crude: $42.88.

- Gold was in the red 1.8% and at $1,835 as of press time.

Treasurys:

- The 10-year U.S. Treasury bond yield climbed Monday, jumping to 0.854 and in the green 3.1%.