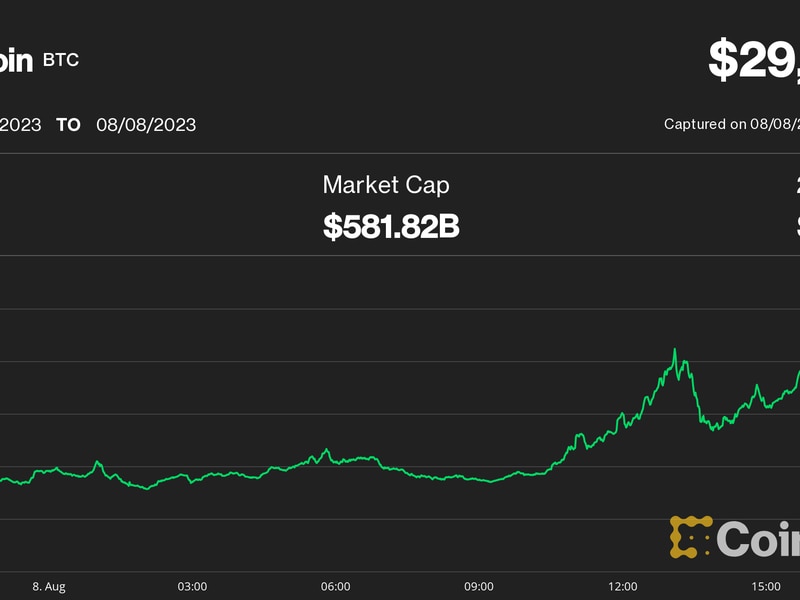

Market Wrap: As Stocks Rally, Bitcoin Trades Above $9.3K for the First Time in 10 Days

CoinDesk Bitcoin Price Index

Market Wrap: As Stocks Rally, Bitcoin Trades Above $9.3K for the First Time in 10 Days

A rising tide in equities is lifting all boats – including in the bitcoin market.

- Bitcoin (BTC) is trading around $9,295 as of 20:00 UTC (4 p.m. ET), gaining 2.7% over the previous 24 hours.

- Bitcoin’s 24-hour range: $8,938 – $9,345

- BTC above 10-day and 50-day moving average, bullish signal for market technicians.

Market participants are pointing to global stock markets as reasons for bitcoin’s rise in price, with the world’s oldest cryptocurrency in a narrow range just above $9,000 since July 3.

“Equity markets are up across the board and so you see a spike in bitcoin’s price,” said Michael Rabkin, head of institutional sales at Chicago crypto trading firm DV Chain.

Indeed, stock indexes globally are flashing green. In Asia, the Nikkei 225 index of companies ended the day up 1.8%. Despite a rising number of coronavirus cases in Japan, gains were made in industrial stocks including conglomerate Mitsubishi. Europe’s FTSE 100 index closed up 1.5%. Optimism on fresh government stimulus across the continent contributed to leading the index higher. The U.S. S&P 500 index gained 1.6%. Record highs for tech stocks Netflix and Amazon led the way.

Since the start of June, the major stock indexes are actually beating bitcoin.

Despite some excitement in crypto price action Monday, traders point out volatility has been absent in the bitcoin markets, said Elie Le Rest, a partner at Paris-based cryptocurrency trading firm ExoAlpha, “Since the bitcoin halving on May 12, the digital asset markets have gone nowhere for six weeks in a row,” said Le Rest. “Volatility has collapsed abruptly and bitcoin remains stuck between $8,200 and $10,500.”

Bitcoin’s one-month at-the-money (ATM) implied volatility, reflecting the market’s future expectation of volatility and calculated by using options with a strike price nearest to the spot price, has dipped. In the past month, ATM implied volatility for bitcoin has dropped from as high as 70% on June 11 to 43% on July 3, though it is creeping back up. This is something derivatives traders are following closely as they make option bets on future price action.

To be sure, the bitcoin price pop on Monday has stakeholders ready for a bigger price move, hopefully up, said Mostafa Al-Mashita, an executive at Toronto-based crypto liquidity provider Secure Digital Markets. “Bitcoin is poised for a big move as it’s held a tight range for a couple of weeks now,” he told CoinDesk.

A dip in DEX

The second-largest cryptocurrency by market capitalization, ether (ETH), was up Thursday, trading around $238 and climbing 5.7% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

Ethereum-based decentralized exchanges, or DEX, have seen volumes decrease over the past few weeks. DEX week-over-week volume growth has dropped 19%, according to data from aggregator Dune Analytics.

Nevertheless, decentralized finance (DeFi) traders seem to be finding creative ways to profit that don’t necessarily require DEX. “DeFi has been killing it,” said Karl Samson, director of strategy for crypto merchant services firm Global Digital Assets Despite the drop in volumes.

Samson pointed to at least one new play that might be contributing to a dip in DEX: Yield farming, where crypto stakeholders leverage lenders such as Compound to gain a profit on Ethereum-based tokens.

Other markets

Digital assets on CoinDesk’s big board are mostly in the green Monday. Notable gainers (as of 20:00 UTC (4:00 p.m. ET):

- bitcoin SV (BSV) + 23%

- dogecoin (DOGE) + 9%

- tron (TRX) + 7%.

Commodities

- Oil is up 0.86%. Price per barrel of West Texas Intermediate crude: $40.58

- Gold is up 0.69% at $1,786 per ounce

U.S. Treasury bonds all climbed Monday. Yields, which move in the opposite direction as price, were up most on the two-year, in the green 2.65%.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.