Market Watch: XRP and ETH Steal The Show As Bitcoin Retracing $700

After almost touching $19,000 for the second time, Bitcoin has calmed and retraced below $18,500 (as of writing these lines). At the same time, most alternative coins have doubled-down on their recent gains. Ripple’s 60% weekly spike has helped the asset overcome Tether as the third-largest cryptocurrency by market cap.

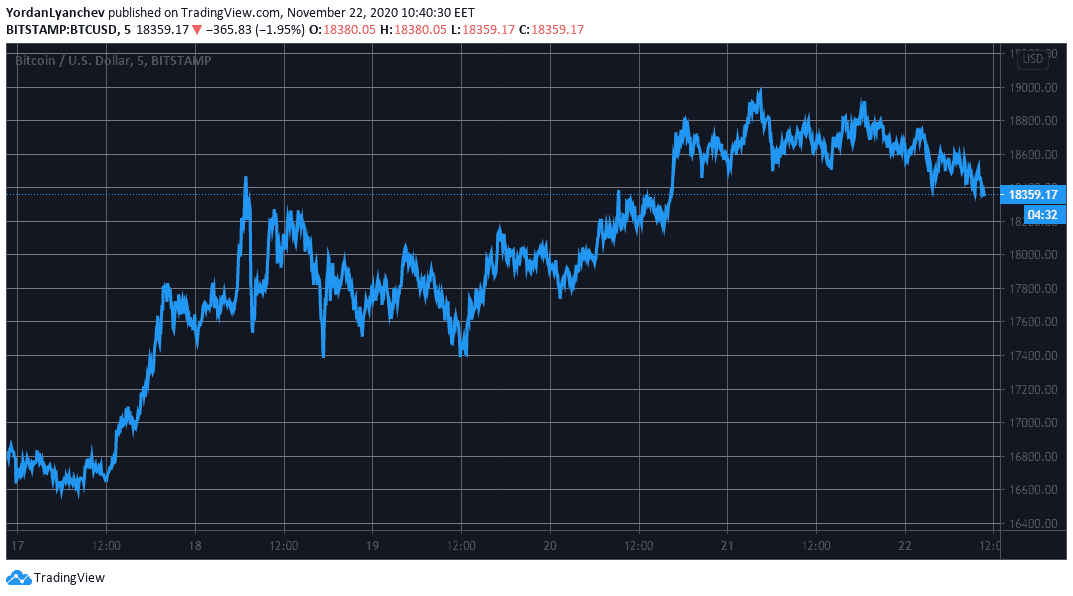

Bitcoin Slows Down After Doule-Top At $19K

BTC’s latest impressive price developments led to a notable leg up yesterday and yet another fresh yearly high. This time, the asset charted a price tag of nearly $19,000.

Although Bitcoin began gradually retracing in the following hours, it made another attempt to overcome the coveted price level but to no avail. Since then, the price had retraced a few hundreds of dollars. Was it a bearish double-top formation, or just a break before setting a new ATH for Bitcoin?

From a technical point of view, resistance lines lie at $18,800, $18,950, $19,400, and $19,660 (all-time high). On the other hand, the closest support lines lie at $18,200, and $18,000 could stop Bitcoin if another correction arrives.

Ripple Soars To The Top 3

The altcoin explosion that began recently has only intensified in the past 24 hours. Ethereum marked a fresh yearly high of over $560, however, it retraced back to the $540 price area (as of now). Just on November 20th, ETH was trading below $470 – meaning a 20% increase in just two days.

Ripple (XRP) has stolen the show once again. XRP sat at $0.28 on November 19th but exploded to almost $0,50. Although XRP has retraced to $0,44, its market capitalization has exceeded that of Tether to occupy the third spot.

Bitcoin Cash and Cardano have surged by a similar percentage of about 6.5%. As a result, BCH has neared $290, while ADA is above $0.13.

Binance Coin (3%), Chainlink (1.5%), Polkadot (1%), and Litecoin (0.5%) are also in the green.

Further gains are evident from Nano (20%), Aragon (19%), Status (17%), VeChain (11%), and Stellar (10%).

The red side as of today was the leading DeFi-related tokens, which have retraced heavily. Yearn.Finance (YFI) saw an 18% price decline. Reserve Rights (-12%), Aave (-12%), SushiSwap (-11%), and Quant (-10%) follow.