Market Watch: Was This Bitcoin’s Final Correction Before New All-Time High?

After a few days of stagnation beneath $19,000, Bitcoin broke above that coveted level to mark a new yearly high of nearly $19,500. In contrast, most large-cap alternative coins have slowed down after the recent gains.

Bitcoin To New Yearly Highs

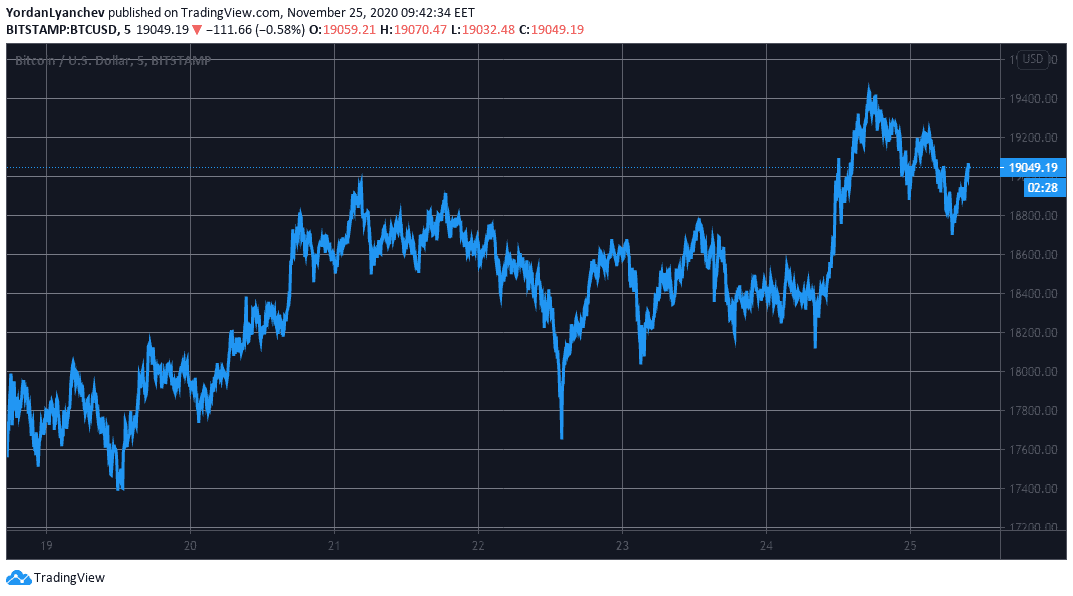

The primary cryptocurrency reached $19,000 on Saturday after an impressive leg up. As the community began speculating on a possible break for $20,000, BTC started to retrace.

In the following days, the asset headed south and even touched $17,400 after a massive price drop. The alternative coins took advantage and reduced Bitcoin’s dominance by 8% in a few days.

However, BTC decided to act yesterday. While the cryptocurrency was struggling at $18,000, it went on a roll that resulted in breaking above $19,000 for the first time in nearly three years. Ultimately, BTC jumped to its new yearly high of $19,450 (on Bitstamp).

Nevertheless, Bitcoin went through a steep red candle that touched $18,640 but as it’s almost always the case in the last few weeks, it managed to recover almost immediately and it’s now above $19,000 again.

The technical indicators suggest that BTC needs to overcome the key resistance lines at $19,400 and $19,550 to potentially challenge the all-time high at almost $20,000.

Alternatively, the support levels at $18,950, $18,830, and $18,650 could assist in case of a price breakdown.

Altcoins Slow Down

The alternative coins enjoyed the past few days with some remarkable gains.

Ripple was among the most impressive performers with consecutive double-digit price increases that took XRP to a high of almost $0.90.XRP has started to retrace and has lost over 7% of value on a 24-hour scale. Nevertheless, it still holds the third position in terms of market cap after surpassing Tether earlier.

Ethereum pumped to a new yearly high of $620 during the rally. ETH has also dived since then and currently struggles beneath $600.

Chainlink (-2%), Polkadot (-6%), Cardano (-3%), and Litecoin (-2%) are also in the red.

The lower and mid-cap altcoins continue with massive fluctuations. Verge leads the race with a 32% surge in the past 24 hours. XVG’s weekly gains have now entered triple-digit territory as it trades at $0.009.

Stellar has also doubled-down on its recent performance with a 25% surge. XLM is up by more than 140% in the past seven days to $0.20.

On a 24-hour scale, Ziliqa (19%), NEM (13%), Horizen (15%), DigiByte (15%), Golem (15%), Dash (15%), Siacoin (13%), ICON (12%), and Nano (11%) have also increased by double-digits.

On the other hand, Bitcoin Gold (-16%), Aave (-10%), NXM (-10%), and Synthetix (-9%) have lost the most value.